Dr. Fazel: The capital increase will be done in the next two months and we will increase 1850 billion tomans to 4 companies

The symbol of Vagghdir was released in the largest initial offering of 1401

The CEO of Ghadir Mining and Industrial Development International Holding said: “Today we were able to offer Ghadir in the stock market and we are trying to open a production line of one million tons of small reed steel ingots by the end of April.”

According to the specialized correspondent of the Bursa Times, The ritual of the initial public offering of Ghadir International Industries and Mines Development Company, with the symbol “Vakghadir”, today, Tuesday, March 23, 1401, in the presence of Dr. Seyed Abu Tarab Fazel, CEO of Ghadir International Industries and Mines Development Holding, managers of Tehran Stock Exchange and a group of It was held at the place of Tehran Stock Exchange and Securities Company.

Dr. Abutrab Fazel, CEO of Ghadir Industries and Mines Development International Holding

Dr. Fazel, during the initial offering of shares of this company with the symbol “Vakghdir” in the capital and securities market, said: “We were able to offer Vakghdir in the stock market today, and we are trying to launch a production line of one million tons of small steel ingots by the end of April.” to open

He added: the current capital of the Ghadir International Mining and Industries Development Company is 1,850 billion tomans, which was accepted in the stock exchange with a base price of 1,550 tomans.

The CEO of Ghadir International Holding for the Development of Industries and Mines continued: In the next two months, the capital increase will be done and we will bring 1850 billion tomans to 4 companies.

Dr. Fazel continued: Ghadir Holding has all the steel chains in the steel industry and 80% of this company’s portfolio is steel.

At the end of his speech, the CEO of Ghadir International Holding for the Development of Industries and Mines said: Almost two years ago, we entered other chains, including copper, gold, nickel, etc., and we will enter zinc mines next year as well.

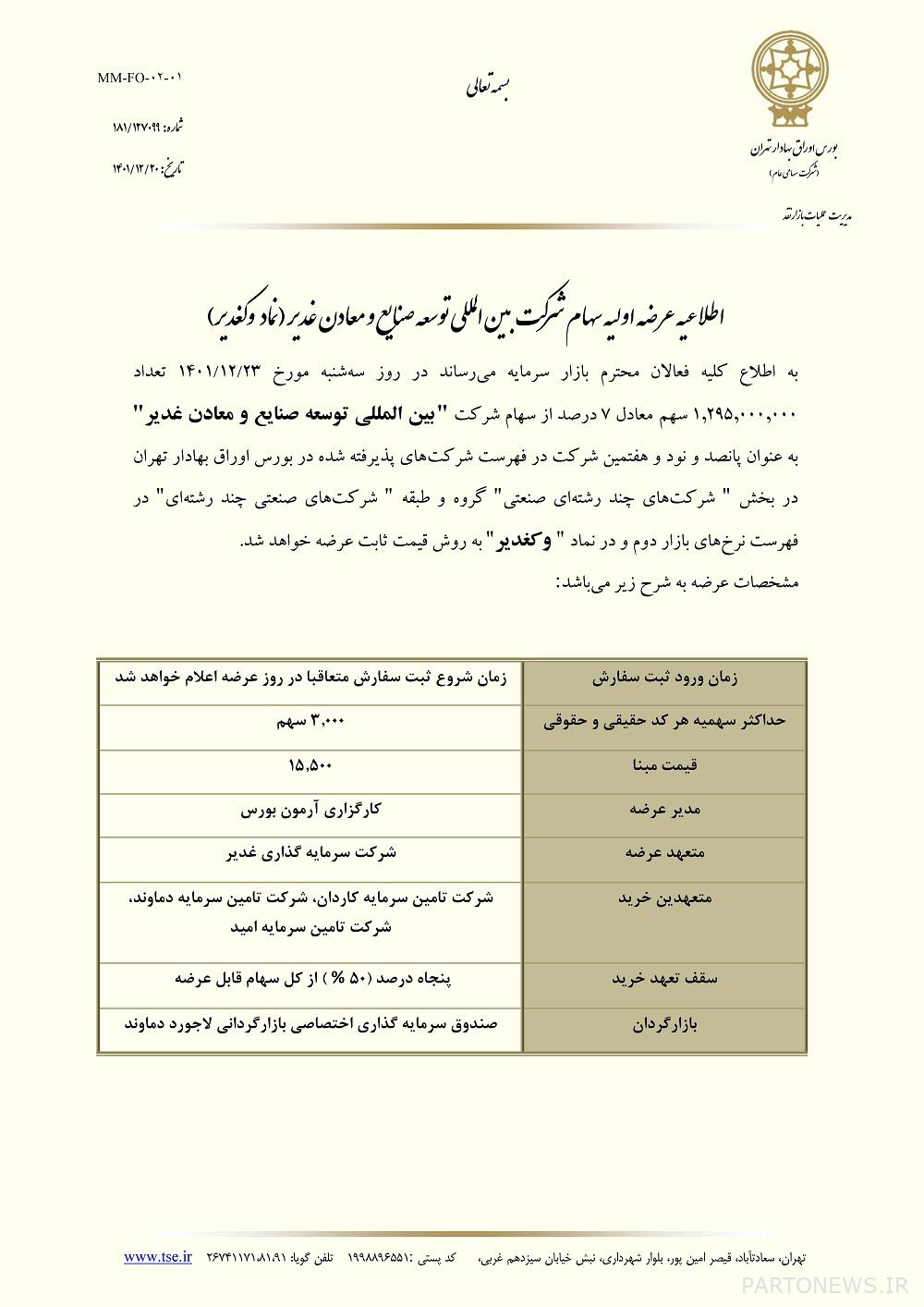

According to this report, on Tuesday, March 23, 1401, one billion and 295 million shares equal to 7% of Ghadir International Industries and Mines Development Company in the sector of multi-discipline industrial companies and in the list of second market rates and with the symbol Vagdir by price method Thabit was initially offered in the capital and securities market of Tehran Stock Exchange.

The base price and maximum share of each code was 1,550 Tomans and the maximum share of each real and legal code was 3,000 shares.

The maximum liquidity required to participate in this offering was estimated at 4,650,000 Tomans.

Introducing Ghadir Industries and Mines Development International Holding

Ghadir Mining and Industries Development International Holding is the investment arm of Ghadir Holding in the field of mines and metals. This company has invested in companies in the field of mineral industries (ferrous, non-ferrous and non-metallic), mines (extraction and processing), exploration zones (domestic and foreign) and non-mineral industries (electromotor and related industries). The shares of this holding are supposed to be initially offered in the capital market. It has been announced to be among the top five listed companies in the country’s mining and related industries in terms of market value.

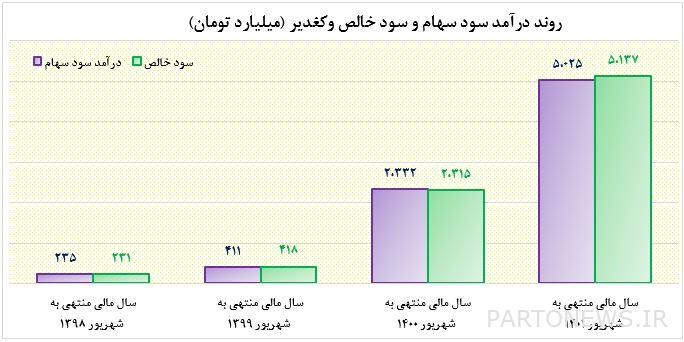

Examining the performance trend of Vagdir indicates the growth of the company’s performance indicators. One of the most important parameters in examining the state of investment holdings is the growth of the dividend income trend because it is from the place of operation of investable companies and is mostly stable. Surveys show that due to the growth of the profitability of the shares of the subsidiary companies, the dividend income of Vagghdir has jumped at an increasing rate in the last two years. According to the company’s financial statements, the company’s dividend income has reached 2332 billion Tomans in the year ending September 1400 and more than 5 thousand billion Tomans in the year ending September this year. This is despite the fact that Vagghdir’s dividends in previous years were less than 500 billion tomans.

Due to the nature of the holding company and low other income and expenses of the company compared to the dividend income, the mentioned jump regarding the company’s dividend income is fully reflected in the net profit. While the net profit of Ghadir was only 418 billion tomans in the year ending in September 2019, in the years ending in September 1400 and 1401, this number increased to about 2.3 thousand billion tomans and 5.1 thousand billion tomans, respectively. it is arrived. A review of the performance of companies admitted to the capital market shows that such a jump in the profitability of listed companies is rare (or even unique).

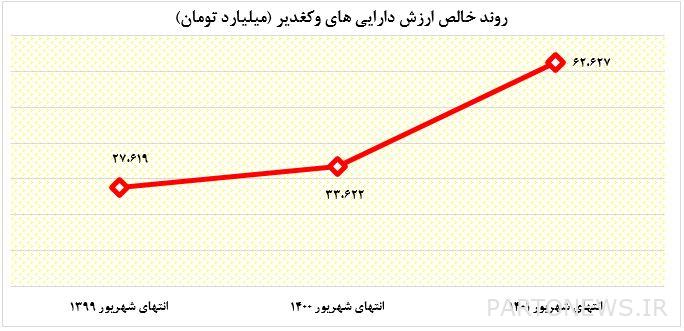

The jump in the profitability of subsidiary companies over the last three years has also had its effects on the net value of the main holding’s assets. According to the company’s announcement, at the end of September 1401, the net value of Vaghdir’s assets was 62.6 thousand billion, which is almost twice as much as compared to the same date in the previous year, and compared to the end of September 1399, with a growth of about 2. It has been added 5 times. The growth of nearly two times of net assets in Vaghdeer happened during the mentioned period when the stock market index (as a comprehensive measure of the profitability of companies) dropped by 15% during this period. This issue shows two things. First of all, because of the very strong foundation of the subsidiary companies of Vagghdir, they are safe from the strong impulses of the market, and therefore it can be said that they have a very low level of risk in terms of investment. The second thing to be mentioned in this case is that Vaghdeer has supported the stocks of his portfolio during the falling market in this two-year period. Another very commendable action in Vaghdeer in the last two years is the extensive investments made and the existence of numerous development projects in the subsidiary companies. A review of the list of investments made in Ghadir companies shows that these plans include a wide range of activities related to mines and metals. On the one hand, due to the backwardness of the country’s mining industry in the field of exploration and extraction, as well as entering the field of non-ferrous and precious metals, including gold and copper, and rare metals, such as lithium and sodium, the holding has bought or explored mines in the field of many metals. Northern anomaly iron ore, Nanja gold and copper, etc. are among these. On the other hand, it has expanded intermediate rings (such as concentrate, pellet and sponge iron) and final rings (such as the coil project in Folage Company).

Another very commendable action in Vaghdeer in the last two years is the extensive investments made and the existence of numerous development projects in the subsidiary companies. A review of the list of investments made in Ghadir companies shows that these plans include a wide range of activities related to mines and metals. On the one hand, due to the backwardness of the country’s mining industry in the field of exploration and extraction, as well as entering the field of non-ferrous and precious metals, including gold and copper, and rare metals, such as lithium and sodium, the holding has bought or explored mines in the field of many metals. Northern anomaly iron ore, Nanja gold and copper, etc. are among these. On the other hand, it has expanded intermediate rings (such as concentrate, pellet and sponge iron) and final rings (such as the coil project in Folage Company).

Offering the shares of subsidiary companies such as Ghadir Iranian Iron and Steel and Shahroud Steel, as well as accepting and including the symbol of the main holding company (Vaghdir) has been one of the most important actions of the company’s management in the direction of transparency and of course in partnership with the public in the capital market.

What can be seen from the review of the performance trend of Wagghdir in recent years is that Wagghdir has turned from a small investment company in recent years to a large specialized investment holding. The current trend, the investments made and the number of development plans in the subsidiary companies show that the rapid growth will continue in the coming months and years. With this trend, it seems that the vision drawn regarding being among the top five listed companies in the country’s mining and related industries in terms of market value is a completely achievable vision. Therefore, it seems that the new guest of the capital market is going to offer investors a stable, low-risk, yet high-yield investment.

It should be noted that Ghadir International Industries and Mines Development Company, with the symbol “Vakghadir” as one of the holdings of the Ghadir investment sub-group, with a capital of 1.3 thousand billion tomans, was listed in the second market of the stock exchange in December 1400, and according to the introduction meeting of this In November of this year, the icon was close to its initial release.

Media reporter: Fatemeh Dadashi