Ethereum Inflation Rises After FTX Crash; Will the ether be inflated again?

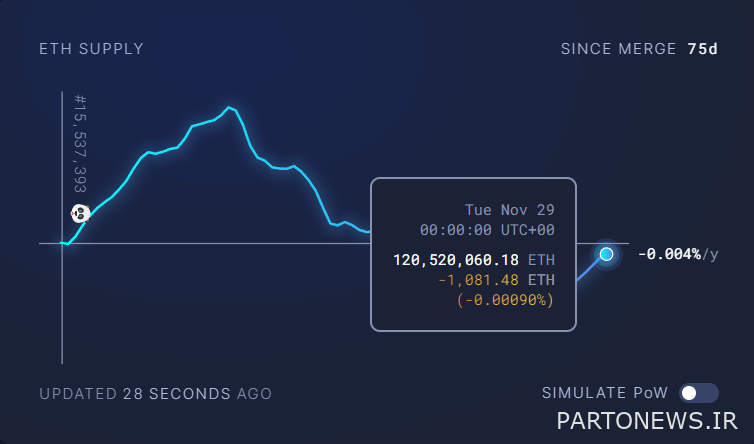

Ethereum officially became an anti-inflationary asset less than 2 months after Marj’s update; But a review of new data shows that Ethereum’s deflation trend has reversed a few days after FTX’s bankruptcy filing.

To Report CryptoSlit, in the midst of the fall of the FTX exchange, the daily inflation rate of Ethereum reached negative 0.00514% so that this digital currency witnessed the most anti-inflationary situation in its history. However, since November 17 (November 26), we have seen Ethereum’s negative inflation decrease.

The inflation rate of Ethereum today is in the negative range of 0.0009%. A decrease in Ethereum deflation rate means an increase (positive correction) of 80% of Ethereum inflation.

Additionally, the total amount of Ethereum burned through the EIP-1559 token burning mechanism is now near its all-time low.

The number of addresses with balances of 32 Ethereum or more has reached an all-time high, despite Ethereum’s annual inflation increasing and the volume of tokens burned reaching an all-time low.