Ethereum price reached the highest level since Marj update; what is the reason?

Yesterday, the price of Ethereum reached the highest level since the historical update of The Merge at $1,525. As it can be seen, several positive factors have contributed to the formation of this upward jump in the Ethereum market.

To Report Crypto Briefing Ethereum is currently trading above $1,500, up more than 11% in the last 24 hours. Before this, Ethereum was stuck in the range between $1,240 and $1,405 for more than a month. While it is too early to confirm Ethereum’s continued breakout from this volatile range, this is the first time since Marj’s update that the price of the cryptocurrency has experienced these price levels.

Yesterday’s jump in Ethereum was probably partially influenced by the conditions of other financial markets. The S&P500, Nasdaq and Dow Jones are all in the green for the third day in a row and have experienced growth of 1.32%, 1.86% and 0.86% respectively. The digital currency market has been closely related to the US stock market for most of the year. In mid-October, however, while all three major US stock indexes fell to their lowest levels of 2022, digital currencies showed more resilience, and Bitcoin and Ethereum did not break out of their swing ranges of recent months.

Most importantly, the dollar index, which compares the value of the US dollar to a basket of major world currencies, has been correcting over the past few days. After reaching its peak of 114.6 units on September 27 (5 Mehr), this index is now at the level of 110.5 units, and signs of its movement trend reversal can be seen on the chart.

The increase in the strength of the dollar in the world markets during 2022, put a lot of pressure on the stock market, digital currencies, as well as other prominent national currencies of the world, such as the euro, the British pound, and the Japanese yen. Now it is possible to reduce the pressure of all that the dollar has created in the world markets; Because it seems that compared to the past, the Central Bank of America is more inclined to lower the rate of interest rate increase in this country.

However, macro factors are not the only things that have driven Ethereum forward during this period. The volume of open trading positions in Ethereum futures markets has grown significantly in recent hours. According to the analysis platform Delphi Digital, last day and in just one hour, about 500 million dollars of Ethereum Perpetual futures contract was bought on the Coinbase exchange and immediately after this big purchase, the price of Ethereum went from 1,350 dollars to 1 It has increased by $380.

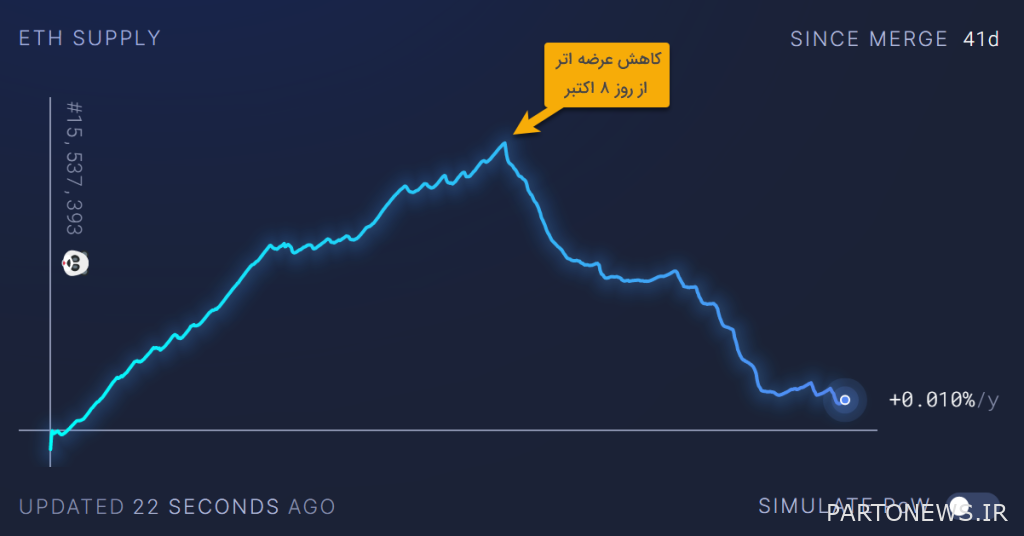

The next factor could be the decrease in Ethereum circulation in recent days. According to website data ultrasound.money, even after changing the Ethereum network mechanism to proof of stake, the supply of this digital currency was increasing for a while; So that since the update of Marj until October 8 (16 Mehr), 13,086 new Ethereum units were added to the circulating supply of this digital currency. However, from October 8 onwards, as the volume of Ethereum-related intra-chain activity increased, the blockchain’s monetary policy took on an anti-inflationary form and the supply of Ether began to decrease. It should be noted that the circulating supply of Ethereum is currently reduced to near the same levels as it was recorded on the day of Marj’s update.

Also read: An unknown project has turned Ethereum into an anti-inflation asset! What is the story of the XEN token?