External risks and lack of confidence of shareholders causing stagnation in the stock market

According to the economic reporter of Fars news agency, the stock market ended its work in a week that did not follow a particular trend, in the same situation as at the beginning of the week, to show the impact of external risks on the stock market more than in the past. In other words, at the end of the third week of February, the total index remained around the level of last week and the equal weight index fell for the third week in a row. This week, the market was affected by the shock of car conflicts.

According to many capital market experts, the risks that are injected into the stock market from outside the market will eventually lead to a decrease in the distrust of the shareholders in the stock market.

In the third week of February, the stock market was in a situation where no particular trend was seen in the stock market, and this caused a drop in the value of transactions and small transactions in the stock market. It seems that the stagnation in the stock market was due to the fear of shareholders of events outside the stock market.

In the last 2 weeks, the supply of cars in the stock market was stopped due to the opposition of the competition council, and the directives of the council at the beginning of the week could not solve the problem. However, the approval of the Consolidation Commission and the decision of the Supreme Council of the Stock Exchange in the context of its offering on the Stock Exchange reduced some of the concerns about the Stock Exchange.

The acceptance of Tara, Fidelity 5 and 7 seater cars and Respect for the first time in the stock market next week can reduce some of the risks in the stock market.

* Lack of confidence in the stock market is the cause of the stock market fall

Capital market expert Mojtaba Danshi said in an interview with Fars news agency’s economic reporter: Once and for all, unreasonable decisions for the capital market should be taken by the Stock Exchange Organization and the Supreme Council of the Stock Exchange.

He continued: As long as every organization and institution allows itself to play with the fate of millions of stock market shareholders, we should not expect equilibrium trends to form in the capital market.

This capital market expert emphasized: In the last 2 years, the capital market has been seriously damaged by the lack of confidence of shareholders. This issue was only due to non-expert comments outside of the stock market.

Referring to the positive actions of the Supreme Council of the Stock Exchange regarding the defense of shareholders’ rights, Daneshi added: “The Supreme Council of the Stock Exchange has never been so active in the field of defending the rights of shareholders, and this issue should be taken as a good omen.”

* Growth of 837 units of the total index in one week

In the third week of February, the total stock market index fell by 17 thousand 55 points on Sunday and 2 thousand 330 points on Monday. On Tuesday, the index rose and grew by 18,666 points. On the last trading day of the week, the index increased by only 1,556 units.

On the last working day of the week, the total index reached 1 million 558 thousand 81 units and was 837 units higher than the last trading day of the previous week, and the weekly return of the stock exchange index was positive by 10 percent.

* The drop of the total homogenous index in the week of stock market stagnation

The total homogenous index also dropped by 7 thousand 390 units on Sunday and decreased by 3 thousand 917 units on Monday. But on Tuesday, it changed direction and grew by 8,218 units, and on the last day of the week, it stood higher by 1,970 units.

At the end of the week, the total weighted index was 1,992 points lower than the previous week and recorded a negative return of 41 percent. This index was at the level of 485,565 units at the end of the third week of February.

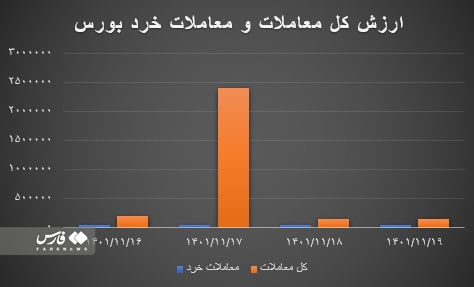

* Decrease in the value of stock market transactions

Last week, the average value of capital market transactions reached 72,553 billion tomans with a growth of 14%.

In this week, the average value of small transactions of the stock exchange was 4 thousand 778 billion tomans, which has decreased by 28% compared to the previous week’s figure of 6 thousand 709 billion.

* The continuation of real capital withdrawal from the capital market

In the last week, we saw the continuation of the withdrawal of real money from the market, so that real capital was withdrawn from the market on all trading days of this week. On Sunday, the net value of real ownership change was 115 billion tomans and on Monday 396 billion tomans of real money was withdrawn. On Tuesday, 187 billion Tomans were withdrawn, and on Wednesday, real capital was withdrawn for the fourteenth day in a row. The value of real currency output on Wednesday was 380 billion tomans.

In total, 2 thousand and 78 billion Tomans of real money were withdrawn from the stock market during the whole week, and the average daily withdrawal of real money was 519 billion Tomans.

end of message/

You can edit this article

Suggest this article for the first page