Following the rise in the price of digital currencies, the total value of funds locked in Difai projects also increased.

The digital currency market has started its upward trend. At the same time, the total value of funds locked in Decentralized Finance Protocols (DEFI) and the increase in decentralized application revenue (dApp) also promise to revitalize the DIFI domain.

To Report Kevin Telegraph, the last month in terms of digital currency market situation should be divided into two different halves. While the price of digital currencies has been declining since the beginning of the new year, the downward trend in prices slowed down in the second half of this month. Bitcoin’s strong break above the $ 40,000 level was able to bring hope back to the markets. Defy project tokens also followed an upward trend.

Data from Messari, a digital currency markets data analytics firm, shows that tokens for most of Difai’s top assets last month recorded double-digit gains. At the top of them is THORChain, whose token for the RUNE project has risen 199.81% compared to last month. Also, the price of Aave has increased by 53.95% during the same period.

Also read: Sharp growth in the inflow of money into digital currency funds; Most purchases since the beginning of 2022

In the following, we will briefly review the status of Difai projects and their recent upward trend.

The value of locked funds in defy projects is increasing

The return and re-acceptance of investors from DIFA projects can be identified by examining the total value of locked funds (TVL) in different areas of DIFA. According to DeFi Llama, the TVL index is currently worth $ 228.05 billion.

Although many DIFA project tokens cost less than their all-time high, TVL DIFA project tokens are only $ 28 billion less than their record $ 256.62 billion. This indicates that the Difai ecosystem has expanded and attracted investors by launching new Chinese blockchain protocols and networks over the past few months.

Also read: Which divisions have good investment opportunities?

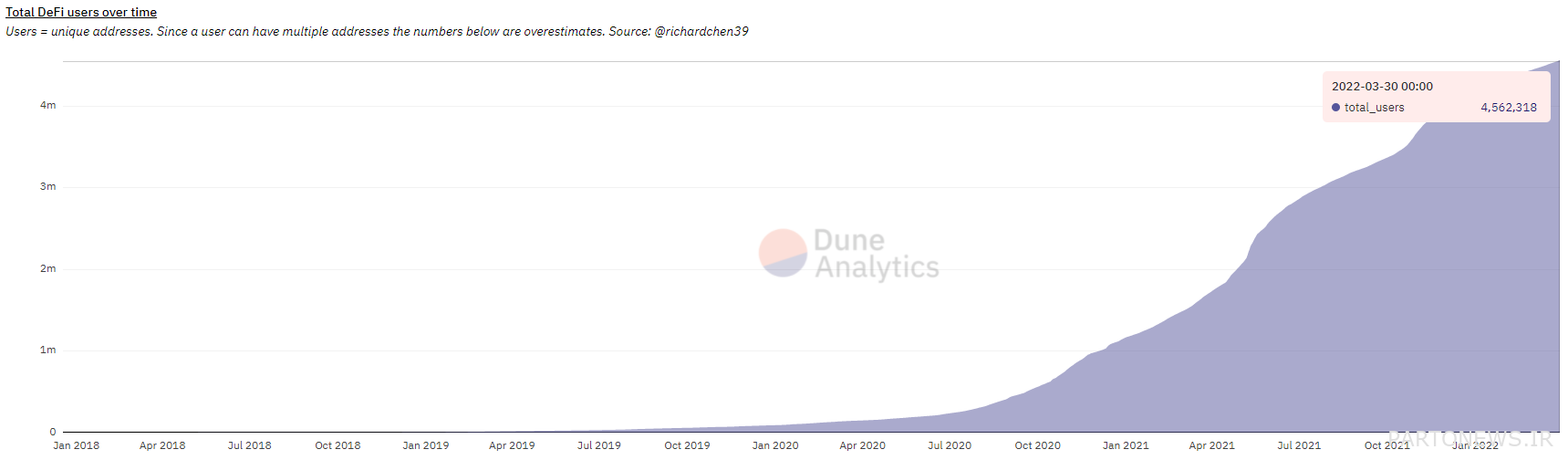

Dune Analytics data show that the total number of DIFA users has steadily increased over the new year and now stands at a record 4,562,318 unique wallet addresses.

NFT markets outperform decentralized exchanges

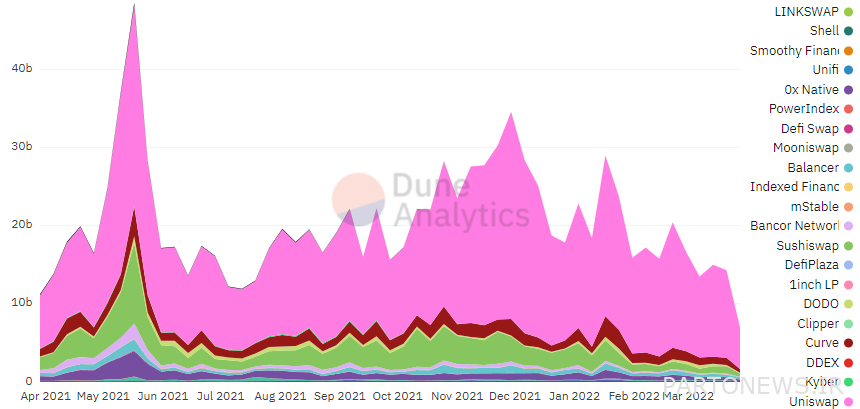

Decentralized exchanges (DEX) is one of the sub-segments of the defa market in which there has been no change in the downtrend. The trend of activity in decentralized exchanges is currently at its lowest level since July 2021 (July 1400).

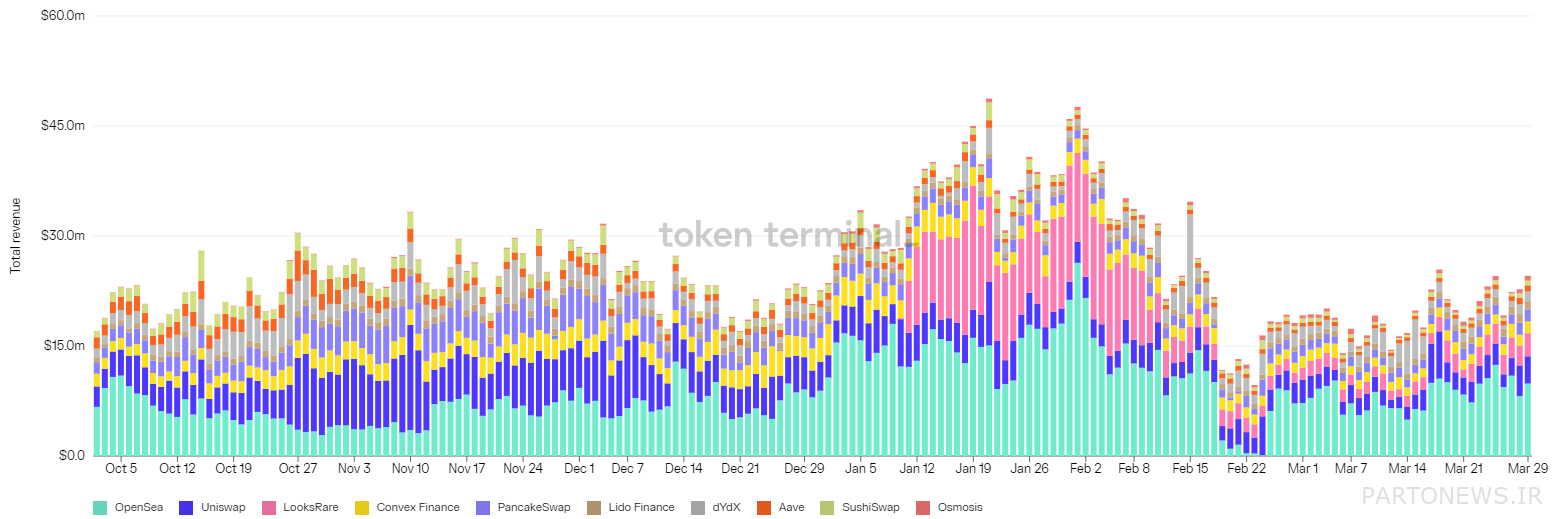

While the evidence suggests that traders are reluctant to participate in this segment, Token Terminal data suggests that other areas of defa are in a different position. The revenue of the top decentralized applications has been on an upward trend since the market downturn in February.

The NFTs marketplace, such as OpenSex and LooksRare, has had the best revenue-generating performance of decentralized applications in recent months. They were followed by Convex Finance, Uniswap and PancakeSwap.

The total market value of digital currencies currently stands at $ 2.151 trillion, and the bitcoin dominance rate is 41.7%.