Forecast of the stock market in the second half of the year / conditional growth of the stock market in the shadow of economic policies

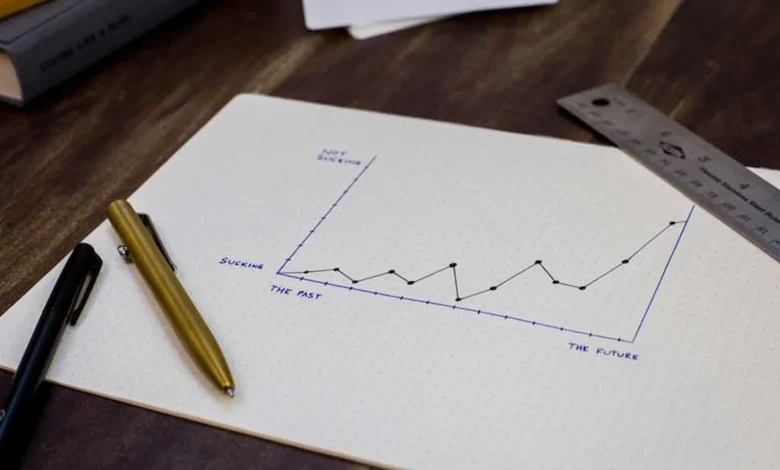

According to Tejarat News, the stock market won the title of the most profitable market in the first 6 months of the year ahead of the gold and coin, dollar, car and real estate markets. However, under the skin of superior performance in the spring and summer season, there were many ups and downs.

The stock market experienced many ups and downs during the first half of this year. From the golden days of the first half of spring to the upward trend of the market, which was interrupted in the middle of May, then from the rapid downward trend of the market, which during 73 working days reduced 23.94%, equivalent to more than 610 thousand points from the height of the total index, to the recession days of September. All in all, in the first 6 months of this year, there were bitter and sweet days for the shareholders.

The market decline is far from expected

Hossein Meridsadat, a stock market expert, said in an interview with Tejarat News: If we want to talk about the current conditions, the market will not go anywhere with 50 thousand tomans. The only risk of the market is the same issue, which suppresses prices in different ways such as news therapy or other methods.

Regarding the scenarios facing the stock market, Meridsadat said: According to the 6-month financial statements of the companies, we envision a balanced and upward growth for the market. He emphasized: On the other hand, the drop in the market value is far from expected because the risk does not threaten the size of the market.

government and central bank control policies; market stoppage factor

Helen Esmet Panah, another stock market expert, told Tejarat News about the second 6 months forecast of the stock market: For the second 6 months, if we look at the stock market from the point of view of economic components, the atmosphere of this market is in a situation where the government is trying to use It should have its own tool i.e. interest rate control, dollar rate control policy and inflation reduction in its strategy. Currently, the government’s intention is based on this, but it is not clear how long it will have this tool and be able to continue this policy.

He added: On the other hand, companies grow along with inflation and the dollar, because currently the situation of companies and their production boom is so bad that production and sales have fallen. Therefore, we do not have the sales volume of the companies in high conditions, and everything that has been created so far was due to inflation, which means that the sales rate of the company has increased.

This stock market expert admitted: From now on, the two driving engines of the market, i.e. the dollar and inflation, are not going to have a special effect on the market. Therefore, the market enters the challenge. But what is the right strategy at the current stage?

Winning shares in the second 6 months of the year

He continued: Shareholders should go to companies that produce according to their nominal capacity, which means that they have good production and global prices affect it. This means that these stocks grow on the weight of global components. The global prices of commodities such as oil, urea, etc. were in good condition during the past months. If these have upward conditions, they can have a positive impact on the market.

Esmat Panah said regarding the important criteria in stock selection: From the other side, the atmosphere and the market trend are such that money goes to stocks that have a high cash flow. Currently, money does not pay much attention to the intrinsic value of the symbol, good reports of companies or positive news such as Iran-US negotiations. The space is moving more towards stocks that are moving their big bucks.

A condition for smoothing the way up the Tehran Stock Exchange

He continued: The market has also experienced many fluctuations due to the insecurity and uncertainty caused by the decisions of Khalq al-Saa’ in various industries such as the petrochemical, automobile, cement and steel industries, along with the margins of confirmation and denial, agreement and opposition. On the other hand, the value of transactions originates from the increase in liquidity and the increase in demand. When liquidity is faced with fear, it decreases and consequently loses its dynamic trading value.

This stock market expert added: Therefore, the market is in a situation where shareholders should have a realistic view because the market is facing many challenges. We are waiting for 6 months reports; Probably the 6-month reports are in good condition. Because it operationalizes the works of some news that were only news, and we see its impact in the reports. On the other hand, it digests some problems created in the first half of the year. Therefore, the atmosphere of the second half of the year can improve slightly compared to the first half of the year.

Esmet Panah stressed: But the main problem of the country’s economy is the budget deficit. If the discussions that are happening such as the agreements that Iran had with China, Saudi Arabia and the United States, the blocked money that was released and things like that, control the budget deficit conditions, liquidity can slowly return to the market. So now the market needs a new stimulus. It is worth noting that the main driver is rebuilding trust!

Predictable growth of the stock market at the end of 1402

He stated: There is another possibility that with the passage of time towards the end of the year, approaching the parliamentary elections and the tradition of increasing the value of the dollar, it may have a positive effect on the market. However, these types of effects are all short-term. On the other hand, the value of the transactions should be at least above 10 thousand billion tomans so that the market gets a new life.

Esmet Panah added: It should also be taken into account that there are some single shares in the market that are both in good conditions and have moved regardless of the general conditions of the market. For example, there are good single stocks in agricultural industries or basic metals, which are among the least risky industries in the market. Subsistence industries such as pharmaceuticals, sugar and food are suitable for the short term.

Read more reports on the capital market page.