Fresh data: Bitcoin whales are selling their holdings in droves

Typically, massive selling of Bitcoin by whales causes the price to drop, creating panic and volatility in the market. However, studying their behavior can help traders and small investors find opportunities to enter or exit the market.

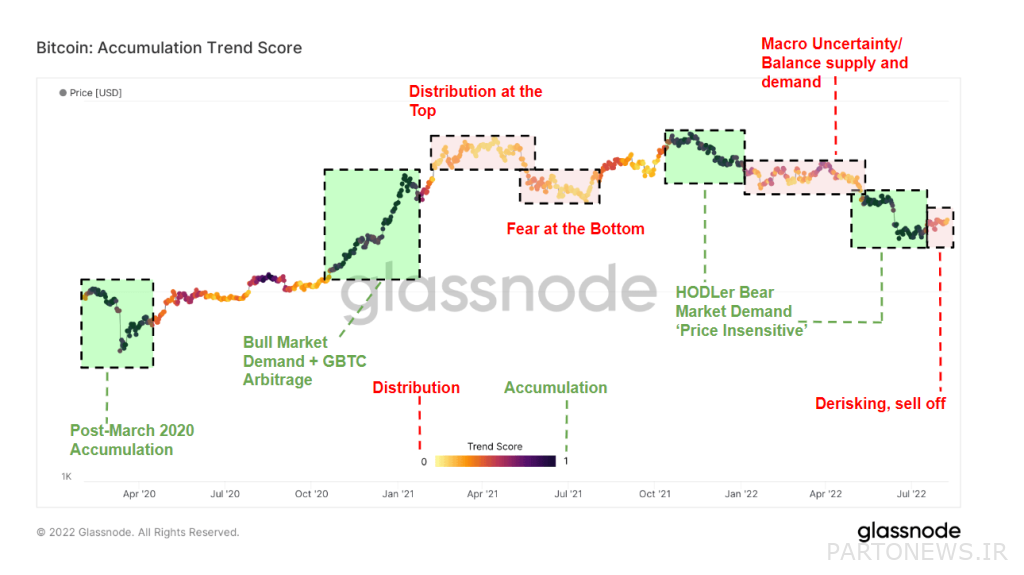

To Report According to the data of CryptoSlit, the Bitcoin Whale Accumulation Trend Index has reached the zero range. This indicates that they have stopped buying more bitcoins and are quickly selling their holdings.

Examining the Bitcoin accumulation trend index data between April 2020 and August 2022 (April 99 to August 1401) shows that Bitcoin accumulation by whales has decreased drastically this month. This means that they are massively selling off their Bitcoin holdings.

According to the available data, the price of Bitcoin in August was mostly traded in the range of 20,000 to 25,000 dollars. It has already been seen that whales have bought and accumulated bitcoins in the last 2 years and in 4 different periods.

It should be noted that whales are wallets with more than 1,000 bitcoins in stock and are usually known as representatives of large investors (holders).

Bitcoin accumulation trend indicator

The Bitcoin Accumulation Trend Index is a measure that identifies the current buyers of Bitcoin. This index is used to analyze market sentiments, especially among different groups of investors.

This index is measured based on two factors: first, the participation score of an institution, which is the same amount of tokens at their disposal, and second, the balance changes (wallet), which is determined based on the difference in the amount of assets in a period, usually one month.

The value of the Bitcoin Accumulation Index will be a number between zero and one. If this value is close to zero, it indicates the distribution of coins among different investors. A value close to one also indicates the strong presence of large investors in the network.

Also read: Who is the Bitcoin whale and how does it trade?

Accumulation of small bitcoin holders has decreased

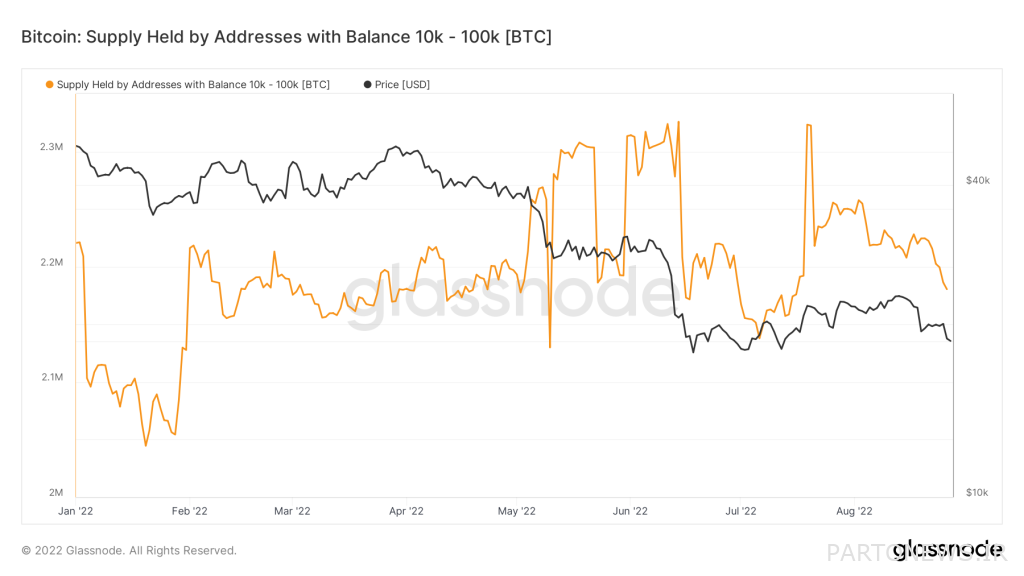

At the same time, whales have stopped accumulating bitcoins and even started selling their assets, and the amount of bitcoin accumulation of shrimps (small investors) has also decreased.

According to Glassnode data, this year the balance of the shrimp wallet has fluctuated between 2 and 2.3 million bitcoins. However, this index has been on a downward trend since July.

It should be noted that shrimps are investors who have less than one bitcoin in their wallet.

With shrimp buying 60,000 bitcoins in July, we saw the highest level of monthly accumulation by small investors since 2018.

The difference in the way these two groups react to the same market conditions shows how each group perceives this situation.

Uncertain market conditions have forced Bitcoin whales to sell their holdings; Especially after the latest speech by Federal Reserve Chairman Jerome Powell, who hinted at more pressure on the US economy.

However, shrimpers have identified Bitcoin’s attempt to break through the $20,000-$25,000 range as the best entry point.