Fundamental analysis and export / Saderat Bank’s income generation from granted facilities – Tejaratnews

According to Tejarat News, Bank Saderat Iran was registered in September 1331 with the original name Bank Saderat va Maaden. Later, in 1958, according to the law of nationalization of banks, its name was changed to Bank Saderat Iran.

Where did it start from?

The shares of this bank were offered for the first time in Tehran Stock Exchange in June 2018 at a price of 100 Tomans. It should be noted that the capital of this bank at the time of the initial offering was about 1,680 billion tomans, which reached 17,535 billion tomans after several stages of capital increase.

Currently, the most important threat to the country’s banking system are sanctions, which will be discussed in the rest of this report.

Sanctions cut off the banks’ breath

Iran’s economy has been struggling with severe inflation since 1997 due to international sanctions. So that the heavy economic recessions along with the inflation rate of more than 40% in these years have affected the economic stability of the country.

During this period, in addition to the deadlock of the JCPOA, Iran’s economy has experienced a jump in the exchange rate due to the heavy accumulation of liquidity. This has caused an increase in the cost of domestically produced goods.

On the other side of the story, the foreign investor cannot transfer the desired funds for investment into Iran through the banking channel. As a result, money from abroad is not injected into Iran’s economy, and the only way for oil export money to enter is in crude form!

It should be noted that the sanctions hinder the possibility of money transfers between the central bank and other banks abroad. Therefore, foreign banks have stopped their brokerage relations with Iranian banks.

Also, the restriction on access to the SWIFT financial messaging system (World Bank Interbank Financial Communication) was one of the other restrictions created by these sanctions.

All these restrictions have come together to overshadow the performance of Iranian banks, including stock market banks. These pressures sometimes show themselves in the banking group’s stock transactions.

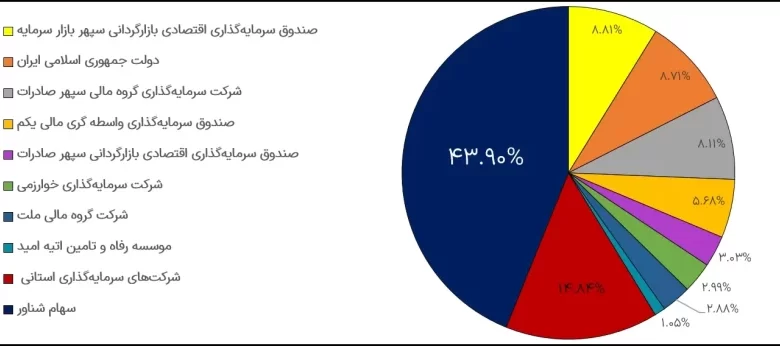

Composition of shareholders

Looking at the information section of the shareholders of Saderat Bank on the website of the Tehran Stock Exchange Technology Management Company, we find that Sepehr Bazar Sarmayeh Economic Investment Fund is the largest major shareholder by taking over 8.81% of the shares of Saderat Bank, which is worth approximately 2,400 billion tomans. This is considered a bank.

The government of the Islamic Republic of Iran and the investment company of Sepehr Saderat Financial Group are considered as the other major shareholders of Saderat Bank, each of them owning 8.71% and 8.11% of the bank’s shares.

As can be seen in the graph below, about 44% of Bank Saderat’s shares are held by small shareholders.

Comparing yield and output with the total index

In the past years, banking stocks did not show acceptable performance due to sanctions and the impasse of the JCPOA. The following table clearly shows that, in the medium and long term, Bank Saderat shares and the banking index are completely behind the stock market index.

For example, in the period of 6 months, Bank Saderat’s shares decreased by more than 10%. Meanwhile, the total index recorded only 2.89% decrease.

Also, in the last three years, while the total index has experienced a growth of about 322%, the yield of stocks and bonds has not reached 150%.

Financial Statements

As can be seen in the graph, Saderat Bank’s income from the loans it gives to its customers (granted facilities) has been increasing in the past years. So that this income grew by 50% and 33% in 1998 and 1999, respectively, and reached 21,304 billion tomans and 28,445 billion tomans.

Also, the financial statements of 1400 Bank Saderat also show that this year the bank has managed to increase its income by 44% from the granted facilities.

But the remarkable thing is the strange drop of 97% in the net profit of this bank in the mentioned year. So that this profit has reached 364 billion tomans from 11 thousand 585 billion tomans in 2019.

A major part of this decrease in profitability includes a 35% increase in the interest paid by this bank to its depositors, a 105% increase in financial costs and a decrease in the profit from investments and deposits of this bank.

The 6-month financial statements of this bank also report a decrease in the profitability of this active bank in the Tehran Stock Exchange. Although this news is not an alarm bell for Saderat Bank at the moment, it sends a message that if it continues with the same order, it may incur losses in the coming years.

Read more reports on the Kodal page.