Fundamental analysis has a low / lag of 60% of the intrinsic value – Tejaratnews

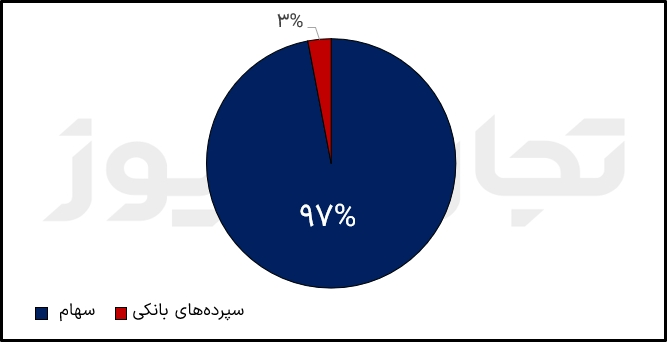

According to Tejarat News, the financial statements for the 6 months ending in September 1401 indicate that most of the assets of this fund are stock market. So that 97% of the assets of this fund are the shares of “Banks and Credit Institutions” and “Insurance and Pension Fund except for Social Security” group.

It should be mentioned that three percent of the assets of the first refining fund include bank deposits.

What companies make up the portfolio?

The portfolio report of Daraekam investment fund in December 1401 indicates that Daraekam’s stock market portfolio includes the shares of Amin Reinsurance, Alborz Insurance, Mellat Banks, Trade and Export. The number and price of each is given in the table below.

By multiplying the current closing price of each share by its number, the daily value of the stock market assets of the low-income fund is obtained. By dividing this number by the total number of investment units with investors, which is about 577 million and 61 thousand units (577,061,888), the stock market value of each unit is determined.

These calculations indicate that the value of each low-income unit, excluding other assets of this fund (bank deposits), is equal to 15,530 Tomans. This is despite the fact that the low-income fund has not crossed the price barrier of 10,000 tomans despite its growth of more than 22% in the last two months. It should be noted that this fund was subscribed with a discount of 10 thousand tomans.

Losing despite a profitable portfolio

Examining the financial statements of 6 months ending in September 1401 indicates that the main income of this fund comes from the profits of the shares in its portfolio.

This financial statement reports a 61% increase in the income of this fund from dividends in the first half of this year compared to the same period last year. Therefore, despite this significant increase, this fund has earned only 163 billion tomans in the current half year.

It should be mentioned that the loss due to the non-realization of the holding of the securities of this fund has also decreased in this period. In spite of all these, Darakm is still unprofitable as in the first half of 1400 and suffered a loss of 1,367 billion tomans in the first half of this year.

However, it is not possible to expect the support of this fund from the people.

There was little left from his portfolio

Basically, the purpose of investment funds is to reduce the risk of buying and selling shares for investors who do not have enough knowledge to invest in the stock market.

But by looking at the yield of bank shares in different time frames and comparing it with the yield of low assets, it is clear that risk reduction in Iran’s inflationary market is nothing more than an excuse.

For example, a recent month, the whole market experienced a good increase following the growth of the total index. The shares of the low-income portfolio also behaved in line with the overall index and grew by 19% on average. But as can be seen in the table below, the yield of the low-income did not even reach 6%.

The following graph shows that the low-income investment fund recorded a lower return than the average of its shares in all time periods.

This graph shows that Dariqam had a weaker return than the average of his portfolio in the monthly, quarterly, 6-month and annual periods, respectively, by 2.05, 13.22, 15.54, 6.29 and 25%.

In the last year, while the shares of Webmelet, Alborz and Atcom grew by 34.43, 36.16 and 16.78% respectively, the two shares of Vebasadr and Vetjarat decreased by 11.21 and 15.88.

It should be mentioned that Dariqam followed the shares of two Saderat and Trade Banks and recorded a price decrease of about 10.13 during this period.

Examining this chart shows that if a person had invested in all five stocks of this fund’s portfolio on average, instead of buying low-value stocks, he would have received much more profit.

Read the latest analysis about stock market symbols every day on the Kodal TejaratNews page.