Fundamental analysis of camel symbol / Tehran oil refining was left behind by competitors – Tejaratnews

According to Tejarat News, the main activity of Tehran Oil Refining Company includes the construction, operation and operation of industrial factories for the purpose of producing, marketing, selling and exporting various types of petroleum and chemical products.

The capital of this company at the time of establishment was about 10 million tomans, which reached 17 thousand billion tomans after 11 stages of capital increase. The last capital increase of Shatran is related to Azar 1400, by which the capital of the company increased by 126% from the accumulated profit.

It should be mentioned that Shatran is the third largest company of the group with a market value of 105 thousand and 77 billion tomans “Petroleum products, coke and nuclear fuel» is considered.

Saderat Bank of Iran and Tejarat Bank are the largest major shareholders of this company, each owning 5.25 and 4.76 percent of Tehran Oil Refining shares. It should be mentioned that the approximate value of this amount of shares is 5 thousand 515 and 5 thousand billion respectively.

Also, 50.25% of the company’s shares are floating and in the hands of small shareholders.

Return of camel stocks in different periods of time

As shown in the table, the camel stocks have remained behind their group in most of the time frames. So that only in the last 6 months, shares of Tehran Oil Refining Company managed to register a better return than its group.

Of course, this table clearly shows that Shatran has performed much better in the medium term compared to the overall index.

For example, in a recent year, while the total index grew by only 16%, the price of camel shares increased by more than 56% during this period and reached 381 Tomans.

It should be mentioned that in the period of three years, the shares of this company have grown by 312% and were able to approach the yield of the total index.

Decreased production with the cold weather!

The problem of access to gas due to the increase in consumption in the domestic heating sector and the food crisis may be considered as one of the reasons for the decrease in the production of companies in the cold seasons of the year.

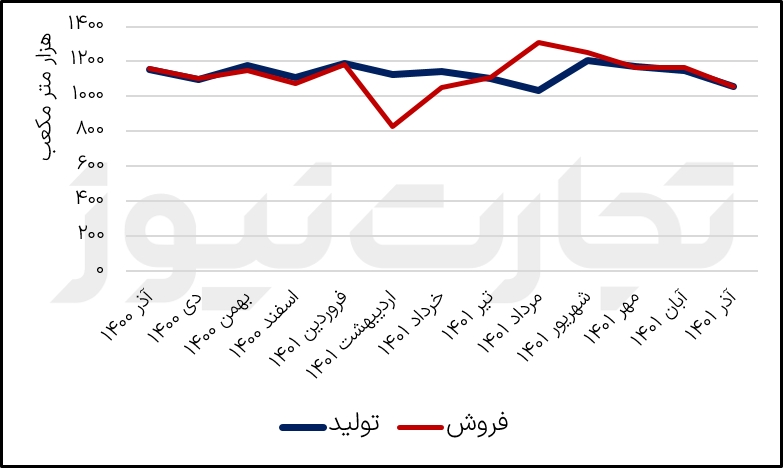

The activity report of one month ending in Azar 1401 Shatran shows that the production of this company in Azar this year compared to the previous month has decreased by eight percent.

Therefore, the amount of production in Azar month of Chetran in this report is about one million and 53 thousand cubic meters. Meanwhile, Tehran oil refinery managed to produce 91 thousand 684 cubic meters more than Azar in November of this year.

Also, the production of this company in December of this year has decreased by 9% compared to the same period last year. Based on this, Tehran Oil Refining Company does not get a good score in its Azar productions.

On the other hand, this report shows that the sales amount of this company also decreased with the cold weather. So that this company sold 112 thousand and 322 cubic meters less than November of this year in December of this year.

In this way, the sales amount of this company in December of this year has been recorded in its monthly performance report of about 1 million 55 thousand cubic meters. Comparing this number with December of last year also shows that the sales amount of this company has decreased by eight percent.

Examining these production and sales figures of Tehran Oil Refining Company in the monthly activity report of Azar shows that this company has not performed well in this month since 1401.

Read more reports on the stock news page.