Fundamental analysis of Dezharavi symbol / 42% drop in production in the first 6 months of the year – Tejaratnews

According to Tejarat News, Zahrawi Pharmaceutical Company was registered in Tabriz Companies Registration Office at the end of March 2016. The capital of this company at the time of establishment was 10 million tomans, which reached 320 billion tomans after eight stages of capital increase.

The last capital increase of this company was in 2019, by which the company’s capital increased by about 28% from cash and receivables.

It should be mentioned that the shares of this company were offered for the first time in Tehran Stock Exchange in March 2010 at a price of 720 Tomans.

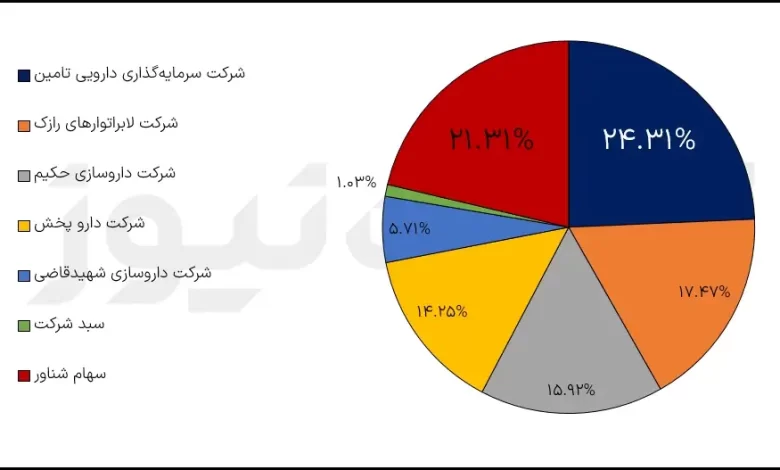

Composition of shareholders

Tamin Pharmaceutical Investment Company by acquiring about 24.31% of the shares Dezheravi It is the largest major shareholder of this company.

Also, Razak Laboratories and Hakim Pharmaceuticals Company have acquired about 17.47 and 15.92% of the shares of this company, respectively, and are the other major shareholders of Zahrawi Pharmaceuticals.

Also, 21.31% of Dezharavi’s shares are held by small or so-called floating shareholders.

The graph below shows the composition of shareholders of Zahrawi Pharmaceuticals and their ownership percentage.

Defrost efficiency compared to the total index

Examining the yield of Zahrawi pharmaceutical company shares and comparing it with the overall index shows that this symbol does not perform well in the long term.

For example, in a recent year, while the “Pharmaceutical Materials and Products” group index and the total index grew by 32.54 and 12.53%, respectively, Dezharavi’s stock recorded only a 5.88% increase in its annual record.

Also, in the period of three years, compared to the 322% growth of the total Dezharavi stock index, the price decreased by more than 45%.

Of course, as can be seen in the table, in the short term, Zahrawi pharmaceutical company shares have performed better compared to the index of its group and the overall index.

Losses despite the increase in drug prices

The review of Dezharavi’s 6-month financial statements indicates that the sales rate of the company’s manufactured items increased by 117 percent on average in the 6 months ending September 1401 compared to the same period last year.

Meanwhile, Zahrawi Pharmaceuticals suffered a loss of seven billion and 461 million tomans in this half year.

It should be noted that this loss is caused by the decrease in the production of this pharmaceutical company in the first half of this year.

It should be noted that the production of this company in the first half of 2011 has decreased by 42% from 384 million pieces to 223 million pieces.

The quarterly financial statements of Zahrawi Pharmaceuticals also show that the increase in drug prices prevented this company from incurring more losses.

These financial statements show that the sales rate of Dezharavi production items in the summer of 1401 compared to the spring of this year has doubled on average.

The strange thing is the profit from the sale of these products, which has increased by about 368% in these three months despite the lower production compared to the spring of 1401.

In general, it can be said that if the drug sales rate did not increase in recent months, this company would have been stuck in the swamp of losses and it would be difficult to get out of it.

Read more reports on the Kodal page.