Fundamental Analysis of Fakhuz / Black Shadow of Mandatory Pricing on Profitability of Khuzestan Steel

According to Tejarat News, it was expected that due to the existing inflation and the daily increase in the price of products, Fakhouz’s income and profit will grow through the increase in the sales rate of the products. But the annual financial statements of Khuzestan Steel showed similar figures to the financial statements of Isfahan Mobarakeh Steel.

These figures show that the situation of steelmakers is not good and if the government’s intervention policies in steel transactions do not end, the profits of steel companies will decrease day by day. So that a look at the annual financial statements of Khuzestan Steel Company in 1401 indicates that last year, Fakhuz was able to increase its total income only with the support of increasing its sales.

Disappointing revenue growth

According to what is stated in the financial statements of Fakhuz, the income from the sale of Khuzestan steel in 1401 compared to 1400 increased by only 6%, which was caused by an 8% increase in the company’s sales this year.

The amount of production of the company has also increased by four percent compared to 1400 and has reached 12 million 400 thousand tons. The diagram below shows the production and sales process of Khuzestan steel.

The observed difference between the company’s production and sales is due to the consumption of pellets and sponge iron produced by Khuzestan Steel in the steel chain of the company.

The stability of Fakhuz’s total income proves only one thing, and that is that Khuzestan Steel could not sell its products such as slabs, blooms and billets at a higher price in the past year despite the existing heavy inflation.

This caused the total income of the company to remain constant compared to last year, but the company’s expenses grew with inflation. Because the cost price of Khuzestan Steel Company products has increased by 29% compared to 1400 last year.

The same stability of income and the increase in the price of sold goods of Fakhuz caused a sharp decrease of 43% in the gross profit of the company and recorded the number of 9 thousand 335 billion tomans.

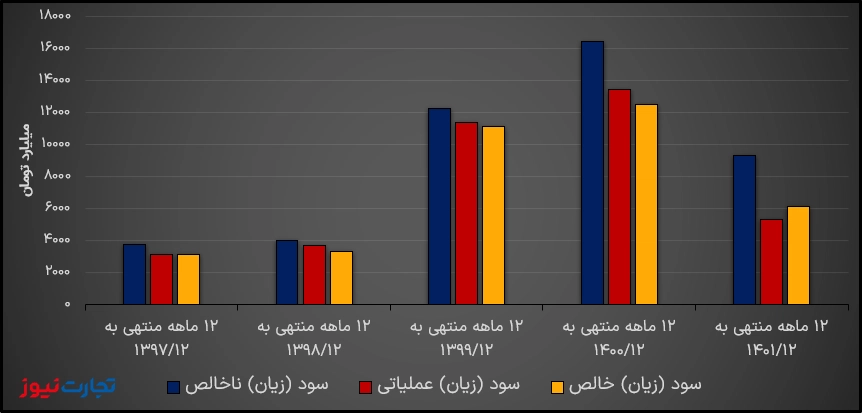

Profit making trend of the company in the last 5 years

The chart below shows the profitability of Khuzestan Steel Company in the last five years. As can be seen, Fakhuz ended his upward trend of profit making in 1401. It should be mentioned that the company’s operating profit and net profit in 1401 compared to 1400 have decreased by 60 and 51%, respectively.

Also, this year, this company has recognized a profit of 32 tomans per share, taking into account the capital of 19 thousand billion tomans.

Read more reports on the stock news page.