Fundamental analysis of Persepolis symbol / shareholders in the loss trap – Tejaratnews

According to Tejarat News, the review of annual financial statements of Persepolis shows that this company could not show an acceptable performance in the financial year ending at the end of June this year.

The downward trend of operating income and the increase of Persepolis’ expenses indicate that if the company proceeds with this order, it will be very difficult and even impossible to compensate the accumulated losses of the company.

Now this question is raised that despite the losses and the lack of transparency in the financial statements of Persepolis and Esteghlal in their financial statements, what was the insistence for these two companies to enter the stock market?

Was it just because of professionalization and AFC’s pressure to separate the owners of these two clubs, or was the purpose of these two companies entering the capital market to attract capital to get out of the financial crisis?

All the cases show that the financial situation of Persepolis and Esteghlal is not good and they have a hard way to compensate for the losses.

This report examines the annual and 6-month financial statements of Persepolis.

Persepolis is at the bottom of losses

Persepolis’ annual financial statement ending June 1401 reports a 42% decrease in the company’s operating income and a 32% increase in Persepolis’ operating costs.

Following this decrease in income and increase in expenses, Persepolis suffered a loss of 111 billion and 354 million tomans in the fiscal year ending at the end of June 1401.

Examining the 6-month financial statement of Persepolis shows that the company was able to make a good jump in its income in the 6-month period ending in December 1401 compared to the same period last year.

So that the operating income of the company increased from five billion and 850 million tomans in 6 months of 1400 to 45 billion and 303 million tomans.

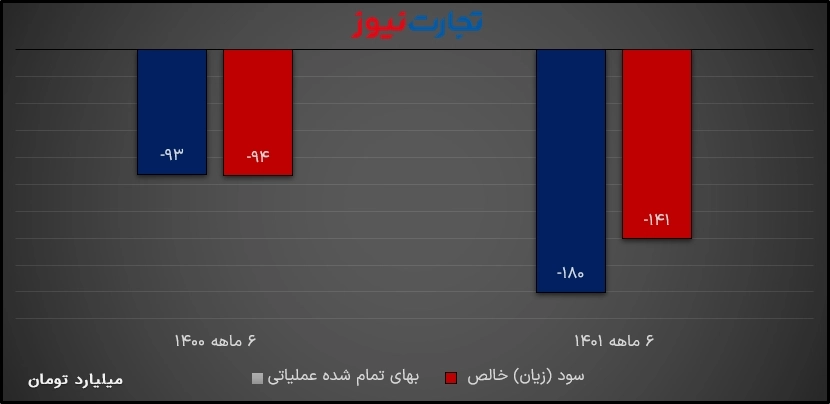

Of course, this increase in income could not stop Persepolis from making losses. Because the operating costs of this company increased by about two times and reached 180 billion tomans from 92 billion and 618 million in 6 months of 1400.

This has caused a loss of 140 billion 634 million tomans for Persepolis in 6 months of 1401. Compared to 93 billion tomans in the same period last year, this number has grown by about 50%, which makes Persepolis’ weak annual record even weaker.

Read more reports on the stock news page.