Fundamental analysis of Satran stocks / the threat of profitability of cement companies by leaving the commodity exchange

According to Tejarat News, if the monthly reports of Tehran Cement Company are reviewed in recent months, it will be clear that the price of Tehran cement has gone through a balanced and growing trend over the past 20 months. This issue caused “Stran” to have a specific scale for its production and sales and to manage its sales parameters.

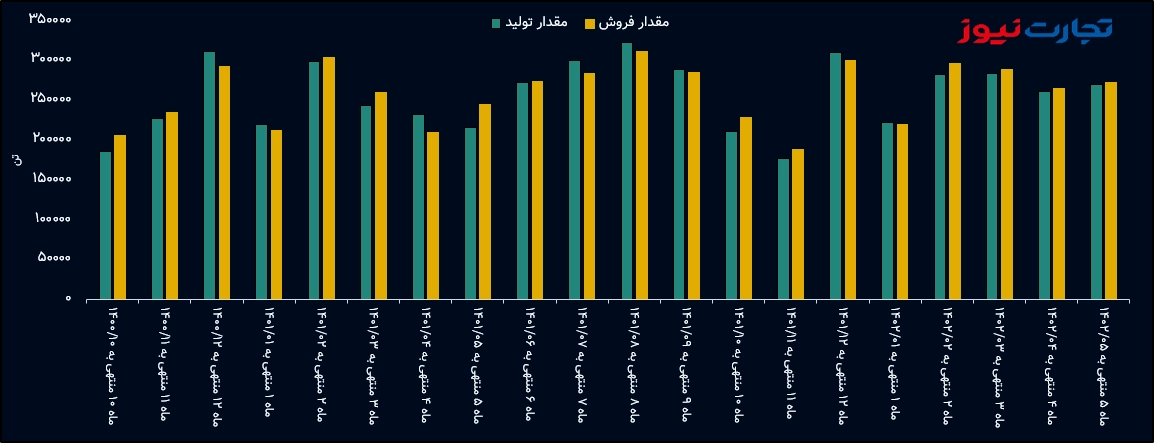

Naturally, if the pricing mechanism for a product is clear, the producer can manage his cost and profit margin accordingly and finally achieve sustainable profitability. It is good to have a look at the quarterly reports of Setran in the last five seasons. As shown in the chart, Setran’s seasonal operating profit this spring has increased by 58% compared to last year’s spring. The net profit of the company has also doubled during this period and has reached 184 billion tomans.

Prediction of Setran’s net profit in 1402

Since Tehran Cement has no export sales and sells about 92% of its products in the commodity exchange, the price of cement in the commodity exchange is of great importance for estimating the company’s net profit. Now, if the average selling rate of cement is calculated in the commodity exchange in 1402 and the same rate is used as a parameter for the sale of Tehran Cement Company in the rest of the year, a certain net profit will be obtained from Setran.

By averaging the price of cement in the commodity exchange in the first 6 months, 1,402 908,000 Tomans per ton for bulk cement, 663,000 Tomans per ton for domestic clinker is calculated. Also, according to Satran reports, the company buys limestone and plaster at an average price of 66 thousand tomans per ton.

In this way, assuming the above for Tehran cement transactions, if the company operates in the second 6 months of the year as last year, in the most cautious case, Setran’s EPS will reach 969 Tomans in 1402. This is while the profit per share of Setran was calculated at the end of 1401 around 600 Tomans.

Finally, the calculation of Setran’s forward P/E shows the number 5.8. It is interesting to say that currently, Setran’s P/E number is 8.6.

Razor sharp loss is near!

This was the only way of profitability of Tehran Cement Company in 1402, if the company’s current sales trend continues in the stock market. But if one day Siman receives the red card from the government and leaves the commodity market, the situation will be very different. Because in that case, the cost and final price will not increase with a certain slope and control of the cost price will not be possible for cement companies and sooner or later they will lose.

Just look at the automotive industry. Companies that have not seen the color of profitability for years and are making losses after losses. Heavy losses that are unlikely to be compensated in the near future.

Read more reports on the capital market page.