Fundamental analysis of Shapna / increase in production in Azar 1401 – Tejaratnews

According to Tejarat News, with the publication of the monthly activity reports of listed companies on the Kodal website, the question arises as to what large refining companies such as Isfahan Oil Refining Company, whose shares are traded under the symbol Shepna on the Tehran Stock Exchange, will do in the month ending in December of this year. They have left a performance.

Get to know Shepna more

Isfahan Oil Refining Company in January 1977 as a subsidiary of the National Refining and Distribution Company

Iran Petroleum Products was established. The shares of this company were offered for the first time in the Tehran Stock Exchange on 4/9/2013 at a price of 589 Tomans.

It should be mentioned that Shapna is traded with a market value of 146,870 Tomans in the group of “oil products, coke and nuclear fuel”.

The main activity of this company includes refining and processing crude oil and other hydrocarbons, making petroleum products such as gasoline, kerosene, gas oil, furnace oil and other derivatives and by-products.

It should be mentioned that Avai Pardis Salamat Company is the largest major shareholder of Isfahan Oil Refining Company by taking possession of 15% of the shares.

Also, Refah Capital Development Company and Naftji Oil Refining Company are considered as Shapna’s other shareholders by acquiring 11.3% and 4.99% of the company’s shares, respectively.

Also, 43% of the shares of this refining company are in the hands of small or so-called floating shareholders.

Comparison of returns of Shepna shares with competitors

Investigating the performance of Isfahan Oil Refining Company shares in different periods of time shows that Shapna shares were able to outperform their peers and the overall index in the medium and long term periods.

For example, in the period of 6 months, the stock price of this refining company has grown by 26%. This is while the index of the refining group and the total index have grown by 20.36 and 11.46% respectively in the last 6 months.

Also, as can be seen in the table below, in the last one and three years, Shepna has recorded a better return than the average of its group.

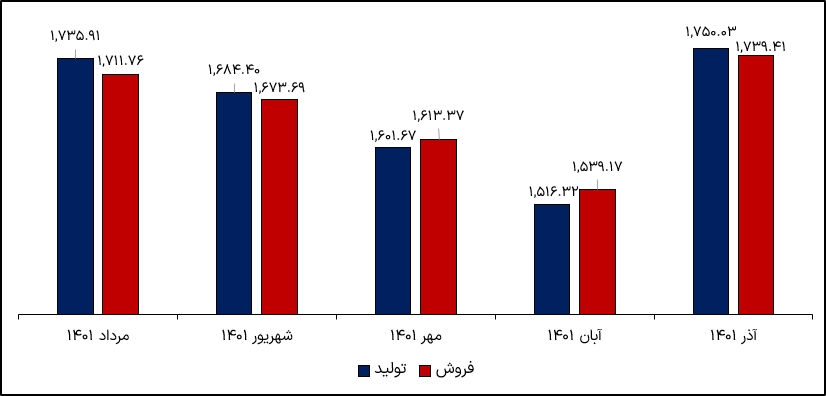

Increase in production and sales in Azar 1401

The review of the activity report of Isfahan Oil Refinery Company for one month ending in December 1401 shows that the production of this company in December of this year has increased, unlike its two traditional competitors, Shatran and Shabandar.

Based on this, the amount of Shepna production in the third month of autumn of 1401 has reached one million and 750 thousand cubic meters with an increase of 15% compared to November of this year. It should be noted that the total production of this refining company in the month of November was recorded in the monthly performance report of 1 million 516 thousand cubic meters.

Also, the total production of this company in December this year compared to the same period last year has increased by about 50 thousand cubic meters, which includes about three percent of the total amount.

Following the increase in the company’s production this month, Isfahan Oil Refining Company was able to make a 13% jump in its sales in December this year and bring its total sales to 1 million 734 thousand cubic meters.

Also, comparing the sales of this company in December of this year with the same period of 1400 shows that this refining company increased its sales by about 50,000 cubic meters, which is considered to be about three percent of the total sales.

The feed rate of petrochemicals increased

The review of the government’s 1402 budget bill shows that the rate of feed for petrochemicals increased by 40% from 5000 Tomans in 1401 to 7000 Tomans in 1402 according to Clause A of Note 14.

This is while capital market experts believe that this increase in feed rate will have a destructive effect on the operating profit of oil companies. Based on this, if the sales rate of oil-related companies does not increase in 1402, these state-owned companies will face a sharp decrease in profitability and even losses.

Read more reports on the stock news page.