Fundamental analysis of Shepaksa / Paksan’s profitability depends on the increase in the price of detergents – Tejaratnews

According to Tejarat News, with the continuation of the shadow of inflation on Iran’s economy, the production cost of companies, including detergent production companies, is increasing day by day. Because the cost of transportation, maintenance, and raw materials used in production, despite the final product, do not follow the mandated pricing, and the only way to compensate for the decrease in the company’s profit margin is to increase the sales rate of detergents.

Based on the same principle, after many struggles to get permission to increase the price of detergent products in the last days of 1401, finally Bakhtiar Alambeigi, the chairman of the board of directors of the Association of Sanitary, Cosmetic and Detergent Industries, announced in a conversation with Hamshahri Online that the month of June this year will be the same as Last years, detergents get a rate increase in the license.

Shapaksa will return to profit making circuit in 1402?

Examining Paksan’s annual financial statements shows that after 1998 and 1999, which succeeded in increasing profitability, the company was unable to continue this process in 1400 and somehow ended its upward profit-making rally.

Shepaksa’s profitability did not return to its trend in 1401 and even the financial situation of this company worsened in the mentioned year. Because the company made a loss for the first time in 22 years. Now, with the increase in production costs due to existing inflation, the question arises whether the company will make a profit in this year’s financial statement?

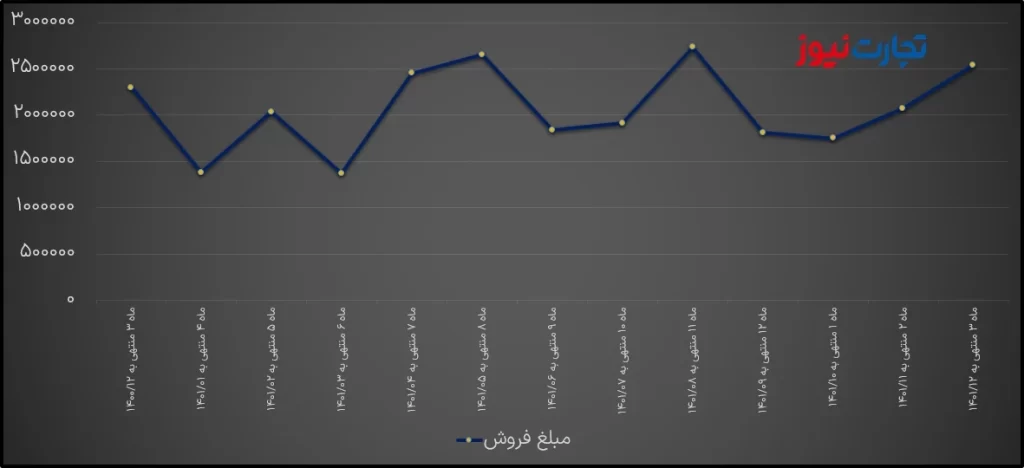

Examining the production and sales reports of the three months of January, February and March in the years 1400 and 1401 of Paksan Company shows that the total income of Shepaksa in the said three months of 1400 was about 435 billion tomans.

Meanwhile, Paksan increased this income to 635 billion tomans with a growth of about 46% in the target period of 1401. Meanwhile, the sales rate of Paksan products in the first quarter of 1402 compared to the same period of the fiscal year 1401 has grown by an average of 33%.

This comparison clearly shows that the company performed better in the first quarter of the 1402 fiscal year compared to the 1401 fiscal year. This increase in the company’s income has occurred following a 23% increase in the company’s sales volume. The mentioned performance improvement is a turning point to reduce last year’s losses in a way that, if the company’s production and sales continue to increase, as well as obtaining permission to increase the rate of detergent products, it will provide the basis for the company’s re-profitability in the fiscal year 1402.

It should be mentioned that Paksan Manufacturing Company was registered in Tehran Companies and Industrial Property Registration Department in early January 1989 under the name Pakan with limited duties and changed its name to Paksan Company on October 30, 1999.

Finally, in April 1980, Paksan shares were offered for the first time in the Tehran Stock Exchange at a price of 510 Tomans. Currently, the shares of Paksan company are traded with the symbol Shepaksa with a market value of two thousand and 655 billion tomans in the first market of the stock exchange.

Read more reports on the stock news page.