Fundamental analysis of Shepdis/Perdis Petrochemical’s profitability threat due to decrease in global price of urea

According to Tejarat News, the statistics after the end of the long stories of Europe’s harsh winter and the risk of gas shortage show that the problem of gas shortage in Europe was not as serious as Iranian experts believed. Because the increase in Europeans’ access to natural gas and the growth of liquefied natural gas (LNG) imports led to an increase in urea production in this continent, which made it easier for farmers to store urea.

The increase in the stock of this product in the past months caused urea producers to face a lack of demand for this product, and urea will discover lower price floors in the global markets from January 2021.

This caused Iranian urea petrochemicals to export their products at a lower rate.

But gradually, as the last days of April approached, the intense fever of urea supply in the market decreased and caused the price of this product to rise a little in the market.

If this low growth of urea in the global markets is not considered as a correction for the strong decline of this product, it can be said that domestic urea manufacturers can continue to export their products at a higher price.

Increasing the production and sales of Shepdis

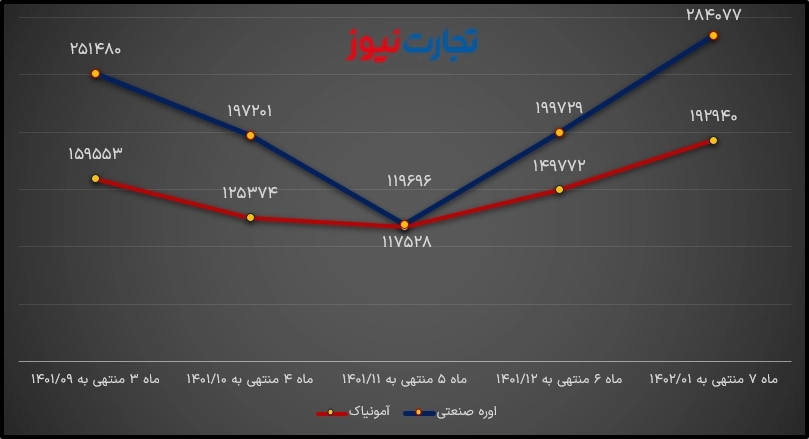

The monthly performance report of Pardis Petrochemicals shows that despite the increase in the production and sales of industrial urea and ammonia due to the decrease in the prices of these products in the world markets, the company could not increase its income from sales.

This report shows that in April this year, the company has been able to increase its production amount by 36% compared to March 1401, from 349 thousand 541 tons to 477 thousand 17 tons. Of course, the amount of production of this company has decreased by about one percent compared to the same period last year.

Also, this report shows that the company’s sales increased by 16% compared to March 1401 and decreased by 9% compared to April of the previous year and recorded 302 thousand 386 tons.

As discussed earlier, due to the decrease in the global price of the company’s products in the global markets, Pardis Petrochemical could not sell its products at a high price, and this caused the company’s income to decrease compared to March 1401 despite the increase in sales.

So that the income from the sale of Pardis petrochemicals in April this year was recorded as 2,626 billion tomans, which is a five percent decrease compared to the 2,754 billion tomans in March.

Another point that may affect the profit of this company is the requirement to sell one-third of the urea produced by urea complexes at an average price of less than 10% of the FOB rate of the Persian Gulf, which raises the possibility that if this policy is not changed, Urea producers will suffer like methanol producers.