Fundamental analysis of steel / the way of steel makers is separated from Farzin dollar? – Tejarat News

According to Tejarat News, after many arguments over the reference rate for calculating the dollar price of commodity exchange products, the Central Bank finally agreed that companies should “compete” based on the price of half a dollar. In this way, all steel chain companies are allowed to sell their products at a competitive dollar price.

Reviewing the transactions of the last weeks of the commodity exchange shows that the steel makers have sold their produced steel ingots to the customers at the price of 33 thousand tomans. This increase in the price of the dollar and its distance from the dollar price of 28,500 tomans half shows that the government has finally chosen a more rational behavior (compared to previous decisions) towards the steel exchange chain.

It is important to mention that pellet and concentrate transactions are also carried out in the commodity exchange at a dollar rate higher than 28,500 tomans. So that pellets are traded at the rate of 37 thousand 300 and iron concentrate at the rate of 34 thousand 200 tomans. It should be noted that as long as the trading rate of these two products is higher than 33 thousand tomans of steel, the production cost of steelmakers will increase. Accordingly, in order to align the dollar price of steel chain products in the coming weeks, it should be seen whether pellets and concentrates will become cheaper in the commodity exchange or not?

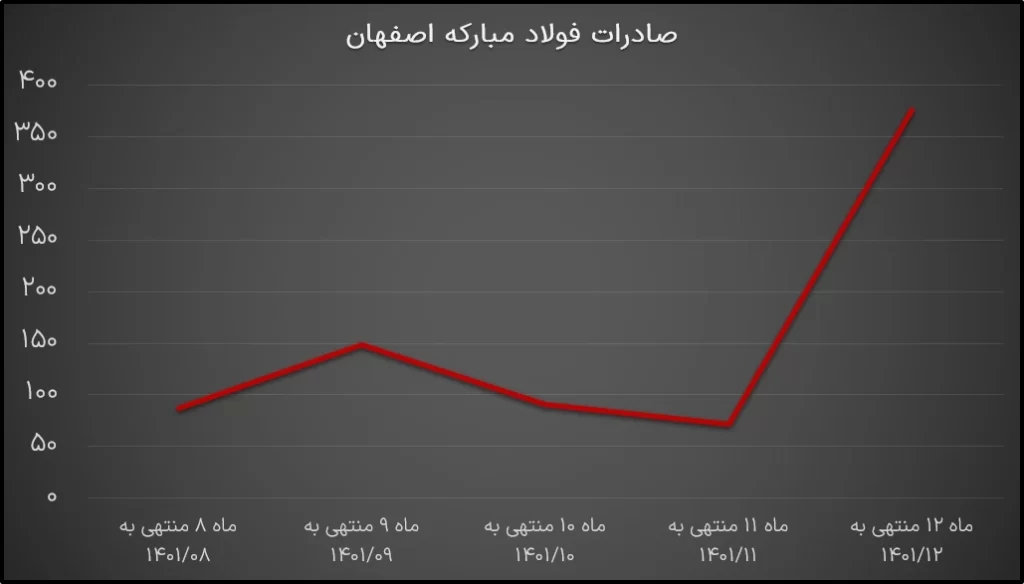

The monthly steel export record was broken

Reviewing the monthly performance report of Isfahan Mobarakeh Steel Company shows that after long stories of gas outages that led to a decrease in the company’s production in January and February of 1401, Mobarakeh Steel was finally able to overcome this crisis and increase its production and sales in Isfahan.

Therefore, the production amount of the company in the mentioned month reached 685 thousand tons from 634 thousand tons in February this year with an eight percent growth. The main increase in production is related to the production of hot products of this company, which has reached 384 thousand tons from 335 thousand tons in February 1401.

Of course, comparing the amount of production in March 1401 of this company with the production of 706 thousand tons in the same period of 1400 shows a three percent drop in the total amount of production of this company.

The noteworthy point of this monthly report is the 51% increase in the sales amount of Isfahan Mobarakeh Steel Company in March. Because Foulad managed to increase its sales amount from 614 thousand tons in February of this year to 928 thousand tons in March 1401. It should be mentioned that Isfahan’s Mubarakeh Steel was able to earn about 18 thousand 874 billion Tomans from this amount of sales, which is a 54% jump compared to Bahman.

Also, the comparison of the sales amount of this company in March 1401 with the same period of 1400 shows a 19% increase in sales of this company.

Further investigation of this report shows that the focus of Mobarake Steel in March 1401 was on the company’s exports; Because 376 thousand tons of the 928 thousand tons of steel sold – which is more than 40 percent – were related to the company’s foreign sales, and it can be said that Isfahan’s Mobarakeh Steel was able to achieve a passing grade in the export sector this month.

It should be mentioned that in February 1401, due to the problems of lack of production and reduced supply in the domestic market, only 11% of the sales of its products were allocated to exports.

12% growth in product sales

Another point that should be noted is that the sales rate of Isfahan’s Mubarake steel products has increased by 12% on average.

Of course, it should be noted that the price of products sold in the domestic market is much more expensive than the foreign market. This price disparity in Mobarake steel products in both domestic and international markets is usually caused by the difference in demand in these two markets. In this regard, it is very important to observe the global supply of steel by China and the amount of demand in the housing sector of this country, and it can provide a suitable analysis to determine the prospects of steel.

It should be mentioned that Isfahan’s Mobarakeh Steel Company was established in March 1369 and was put into operation two years after that. In the following, the shares of this company were offered in Tehran Stock Exchange in March 2005 at a price of 190 Tomans. The capital of the company at the time of initial offering was 1,580 billion tomans.

The main activity of this company includes the exploration, extraction and exploitation of metallic and non-metallic minerals needed by the steel industry, including the extraction of iron ore, dolomite, production of granulated iron ore, concentrates and pellets.

The latest market value of Mobarakeh steel was recorded on the 16th of March 1401, about 496 thousand billion tomans, which shows the importance of the behavior of this share in the group of basic metals. So that the weekly efficiency of steel is only one percent different compared to the average of the basic metals group.

Read more reports on the stock news page.