Fundamental analysis of symbol D / Bank D and a mountain of accumulated losses – Tejaratnews

According to Tejarat News, the examination of the financial statements of domestic banks shows that the current situation of Iran’s banking system is deplorable. Because the accumulated losses of banks are increasing day by day.

A look at the financial statements of the banks indicates that the three banks, Amida, National, and Capital, have registered the largest accumulated losses among their competitors.

The monthly performance report of Bank D, which is the fifth loss-making bank in the country, reports a 31% decrease in the facilities granted by this bank in April, compared to March 1401.

In March of last year, Bank D was able to lend more than 729 billion Tomans to its customers. But this number has reached 502 billion tomans in April this year.

Also, the facilities granted in April last year were more than 1,935 billion tomans, which is 3.8 times the loans paid by Bank D in April this year.

In general, Bank D’s disbursed loans have decreased sharply since October last year, and the facilities granted by this bank have moved downward. In the future, this will greatly reduce the income from Bank D’s paid loans and even make the company’s accumulated losses heavier.

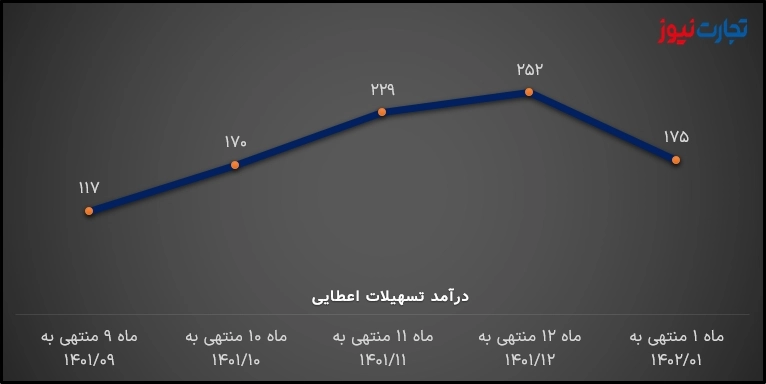

In this regard, it should be noted that the income from the paid loans of Bank D has decreased by about 30% in April compared to March 1401, which can be the start of the downward trend of the income from the paid loans of Bank D.

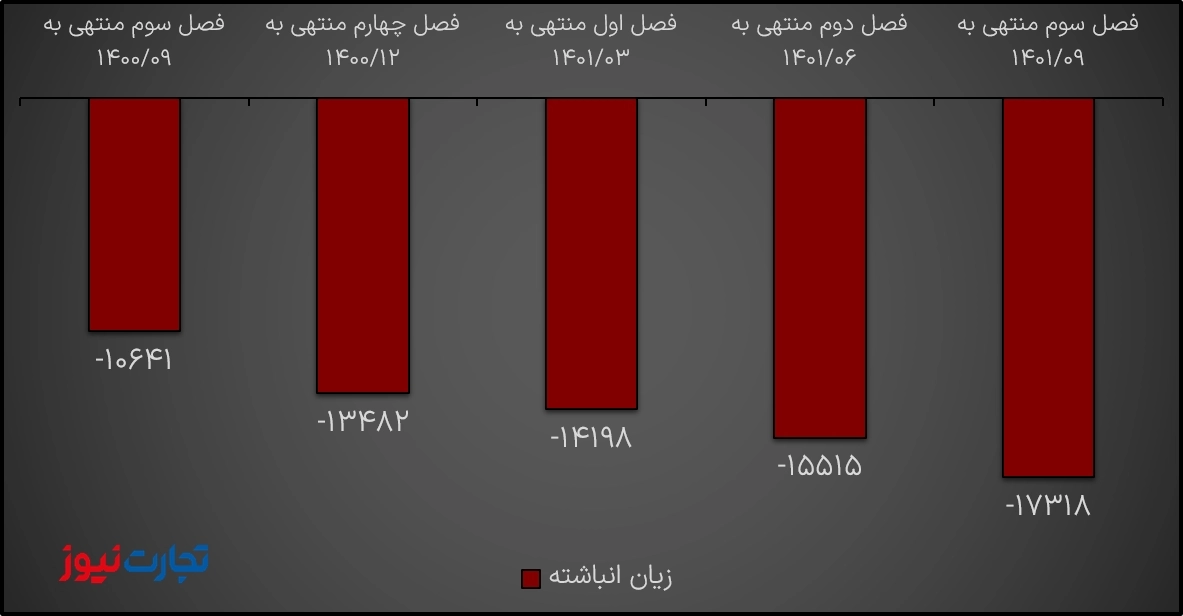

Accumulated loss d

Examining the balance sheet of Bank D shows that the accumulated loss of D is in an upward cycle and is increasing day by day. The monthly performance reports of Bank D are also not encouraging and this shows that the mountain of accumulated losses of D is still standing!

The downward trend of Bank D’s monthly income is also an important point that strengthens the growth of Bank D’s accumulated losses. It should be seen when this bank plans to reform its management policies. If Bank D continues the current policy, it is not unlikely that it will be called the biggest loss-making bank in the country in the near future.

Decreasing the sources of income of Bank D

Further investigation of the monthly performance report of Day Bank in April shows that in addition to the loans paid by the bank, the deposits received by Day have also decreased.

Although the decrease in deposits of Bank D customers will reduce the interest paid by this bank and then the expenses, but the continued downward trend of the deposits received by Bank D will reduce the bank’s resources for generating income and other operating income.

Earlier, in a report entitled “Technical analysis of D symbol / high potential for the rise of Bank D shares”, it was stated that although the shares of this symbol are prone to rise, the financial statements of this bank are in a pathetic state!

Read more reports on the stock news page.