Fundamental analysis of the refining symbol / a basket of profitable stocks that distributes losses! – Tejarat News

According to Tejarat News, after three months have passed since the approval of the amendments to the charter of low-income investment funds and Parish 1 by the Council of Ministers, Parish is still trading around 47% below its NAV.

A significant gap between the price of refining and the net value of its stock market assets

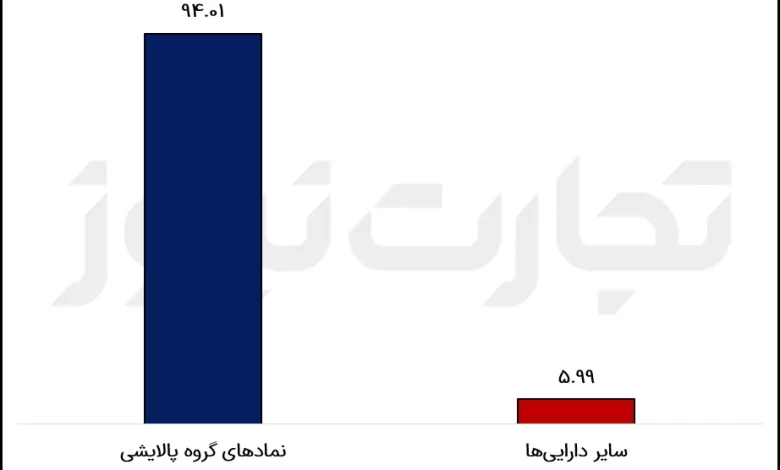

The financial statements of 6 months leading to the end of September 1401 of the 1st Refining Fund indicate that the majority of the assets of this fund are stock market. So that more than 94% of the assets of this fund are the shares of petroleum products, coke and nuclear fuel. It should be mentioned that 3.4% of the assets of the first refining fund include bank deposits.

What symbols make up the refining basket?

The refining portfolio includes four refining shares: Shepna, Shatran, Shabandar and Shabriz, the number of each is given in the table below.

As can be seen, by multiplying the current closing price of each share by its number, the daily value of the 1st Refining Fund’s stock exchange assets is obtained. By dividing this number by the total number of investment units with investors, which is about one billion and 164 million and 923 thousand units (1,164,923,170), the stock market value of each refining unit is determined.

Calculations show that the value of each refining unit, excluding its other assets (bank deposits), is equivalent to 13,458 Tomans. This is despite the fact that Ikem Refining Fund has grown by about 30% in the last two months and has not even reached the price of 10,000 Tomans, even with the discount at the time of release.

NAV increase in the first half of this year

By examining the 6-month financial statements of Parish, it can be seen that the main income of this fund comes from the profits of the shares it has in its portfolio. Comparing this income with the 6 months of 1400 shows that the income of this fund from the profit of its shares has grown by about 55% and has recorded 1,459 billion tomans.

In this half, the net profit of refining has increased by 61% and recorded 1,349 billion tomans. Also, these financial statements report an 11% increase in the assets of this fund and a 24% decrease in its liabilities in the first half of this year compared to the first half of 1400.

Despite this increase in assets and reduction in liabilities and the subsequent increase in NAV (net assets of each investment unit), this fund is still poorly received by the public.

The weak reception, which may be due to people’s lack of trust in the stock market, and especially this government fund, which entered the stock market only by compensating the budget deficit of Rouhani’s government.

Reducing trading risk or reducing profit?

Basically, the purpose of investment funds is to reduce the risk of buying and selling shares for investors who do not have enough knowledge to invest in the stock market.

But by looking at the yield of refining shares in different time frames and comparing it with the yield of refining, it is clear that risk reduction in Iran’s inflationary market is nothing more than an excuse.

For example, in the weekly period, the whole market experienced a good increase following the growth of the total index. Shares of the refining portfolio behaved in line with the overall index and grew by 5.42% on average.

But as can be seen in the table, Parish grew only 2.35% and did not even reach half of the average return of its shares.

The following chart shows that the 1st Refining Investment Fund recorded a lower return than the average of its shares in most of the time periods.

This graph shows that Palisah was able to surpass the average shares of its portfolio only in its 6-month period due to the weak performance of “Shabriz” shares in this period.

In a recent year, while the shares of Shabandar, Shapna, Shatran and Shabriz increased by 67.96, 82.10, 48.92 and 58.25% respectively, refining experienced only 32.72% growth.

Examining this chart shows that if a person had invested in all four shares of this fund’s portfolio on average instead of buying refining stocks in the last year, he would have received much more profit.

Read more analysis on the stock news page.