Getting to know 11 free digital currency research tools

Investors who intend to check the status of a company in the traditional markets have only limited quarterly reports on the financial health and growth capacity of that company. In the end, they are forced to rely on this information and make their investment decisions based on this.

However, the attraction and importance of blockchain is that much of the data related to digital currency projects is public and traceable and available to users instantly. Analyzing blockchain data helps investors identify trends and make informed investment decisions.

Familiarity with the tools of any field is one of the requirements of working in it. The world of digital currencies is no exception to this rule. Fortunately, various tools for analyzing the status of digital currency industry projects are available to users, some of which are free and others are paid or so-called subscription.

In this article, we are going to use an article from the website FemexLet’s review 11 popular and free analytical tools in the world of digital currencies. Using a set of these tools, you can not only review the data of each project; Rather, you can draw a general picture of this industry in your mind. We invite you to stay with us until the end of this article.

etrascan (EtherScan)

EtherScan is a block browser that tracks all changes on the Ethereum blockchain, from transaction volumes to gas prices, addresses, and many other details. EtraScan and similar tools provide you with a comprehensive and excellent picture of the state of the industry at a macro level.

Read more: What is Gas in Ethereum? A comprehensive guide

One of the main features Etrascan This is where users can review and approve smart contracts. This feature is especially useful for investors who use decentralized applications (DApps) to perform DeFi activities such as lending. Users can check the legality of lending protocols and other services with this tool.

Read more: What is DeFi or decentralized finance?

Additionally, investors can gauge the level of demand for DeFi protocols such as Aave by observing the level of activity and decide whether they intend to invest in the project’s native token or not.

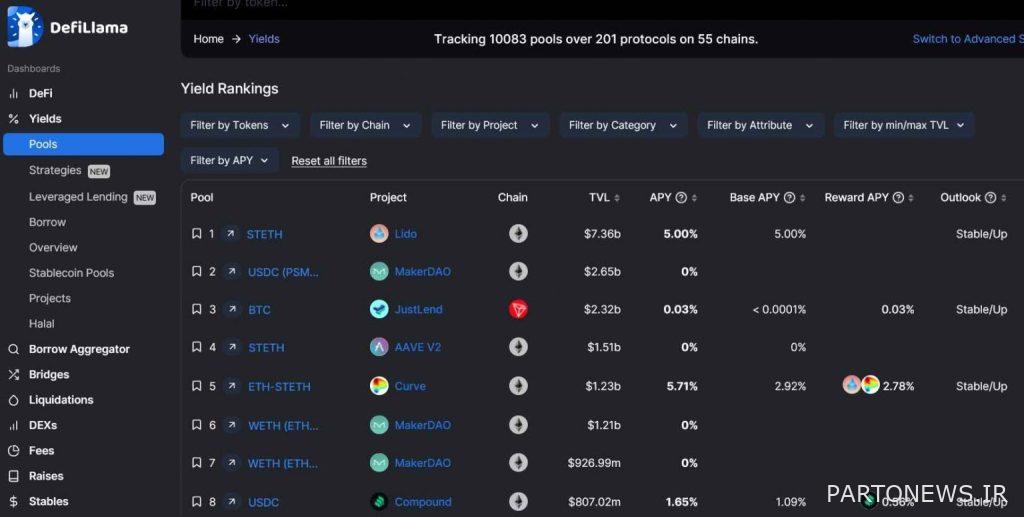

DefiLlama

DiFiLama is the largest analytics tool designed to track various DiFi activities. The tool tracks 1,750 DeFi protocols across more than 145 different blockchains. Activities tracked include borrowing and lending and investing.

If you are interested in knowing whether you should invest in the DiFi protocol, you can check out its TVL component on DiFiLama. TVL or Total Value Lock refers to the total collateral and assets deposited on the platform. The higher the TVL, the greater the collective belief of the market and investors in that platform.

Investors also use its TVL measure when judging the true value of tokens. If the token’s market value is too high compared to its TVL, it is likely that the token is overvalued.

The new features of this platform are:

- Borrowing (DefiLIama Borrow): Difaylama provides users with information on the best collateral and token borrowing deals.

- Raised funds (DeFiLlama Raises): DiFiLama collects a list of investors supporting the digital currency project. This information can be useful for users; Because it guides small investors to the next big project, and if users enter them early and before the sharp growth in prices, they will significantly increase their investment returns.

Do not forget that only having the support of prominent investors does not necessarily mean that the project is safe; So, as always, do your research and only invest money in cryptocurrencies that you can afford to lose.

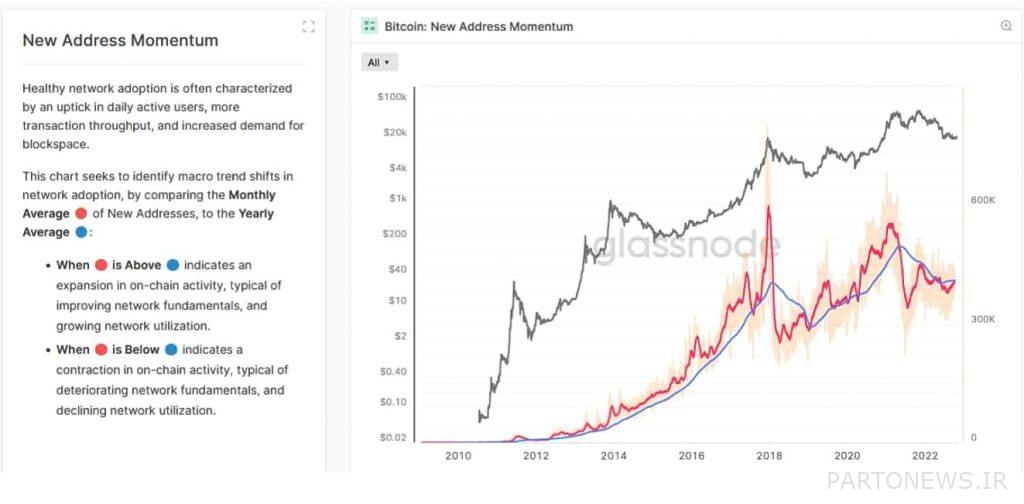

Glassnode

Glassnode provides market intelligence and on-chain data to institutional and small digital currency investors to make more informed investment and trading decisions in Bitcoin, Ethereum and other digital currencies.

Many features of this tool are intended for paid subscribers; But some important features, especially the main features related to Bitcoin, are free. It can be said that Glassnod’s user interface is one of the best of its kind; Because it not only shows the data; Rather, as you can see in the image below, it explains why this data is important.

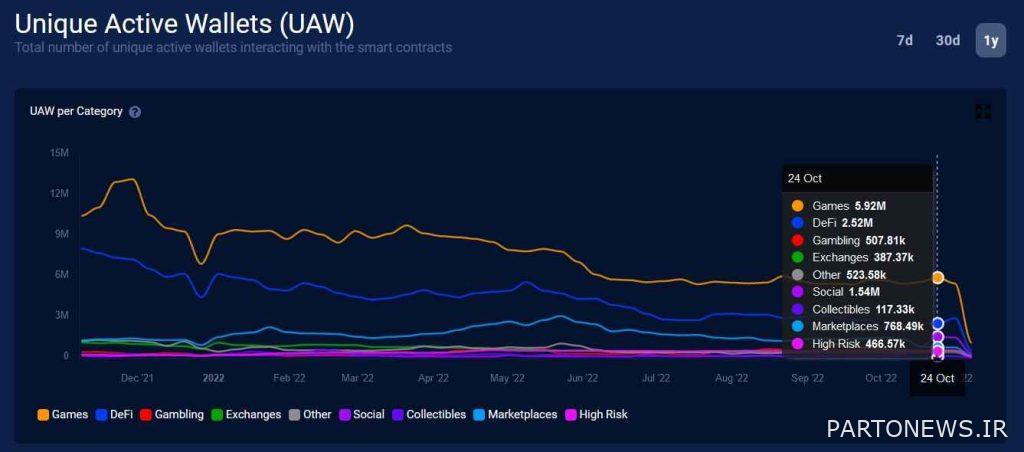

DappRader

DepRadar tracks over 12,000 decentralized applications (DApps) from over 47 protocols in all categories, from gaming for monetization to DeFi and NFT, various marketplaces, and more. Launched in 2018, this platform is one of the well-known analytical platforms that not only provides investors with an overview of the cryptocurrency industry; Rather, it deals with the details of each project.

In fact, everything from information about how much users spend in decentralized applications to the number of unique addresses of active wallets and their value and the value of NFTs are covered on this platform.

To create a diverse portfolio, it is better to always consider investing in different categories. Try to have game tokens, DiFi and exchanges in your basket.

In addition, Depredar has a portfolio section with cross-chain or cross-chain traceability. As the name “interchain” suggests, interchain technology enables the transfer of digital currencies and information from one blockchain to another. DeepRadar’s cross-chain traceability helps users track their tokens and NFTs moving between the Ethereum and Polygon blockchains and other blockchains.

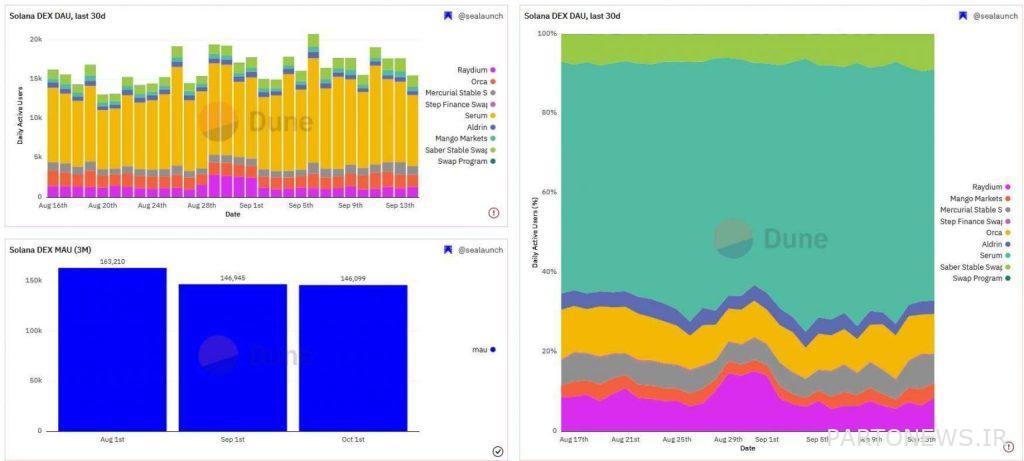

Dune Analytics

Don Analytics is a powerful blockchain analytics platform that provides clear graphs of the status of a specific segment or project or the entire ecosystem. The interesting thing is that the mentioned charts are created by the users themselves and make others see the trends and big changes of each project; So that before making a decision to invest, they can find out what the market and conditions of that project are.

For example, you might want to know about Solana’s perspective. Just go to the dashboard of this tool and click on Solana Transactions and “NFT Solana Marketplace and DEX”. Then check the graphs to make an accurate assessment.

Don Analytics, with only 3 years of activity and the support of big investors such as Dragonfly and Multicoin Capital, has been able to reach the value of 1 billion dollars among analytical tools and provide itself a worthy position.

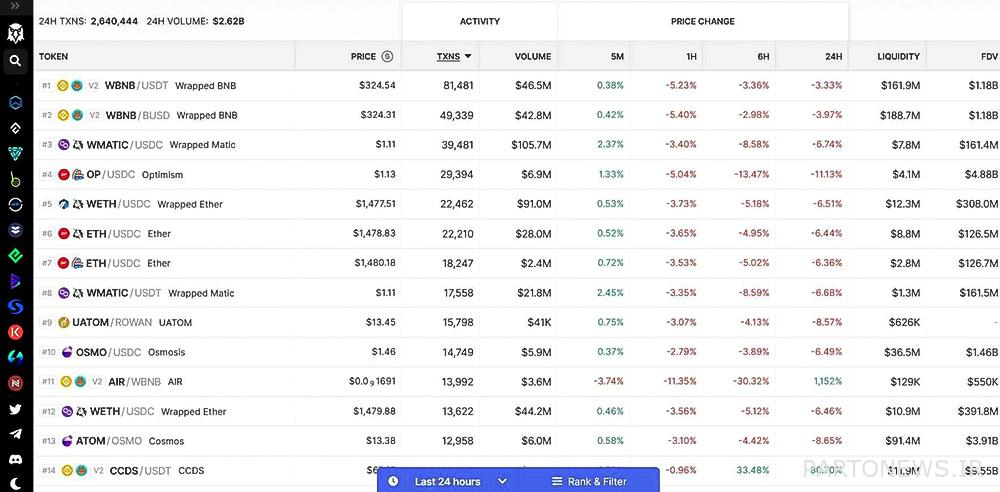

DexScreener

Dexscreener provides real-time price charts and trading history (bid volume and liquidity and FDV). This tool is especially useful for those looking for new cryptocurrencies. As you know, some newly released digital currencies even have the ability to grow by 1,000,000%.

Nanoly

If you are looking to profit from your passive digital assets such as stablecoins; But you are not sure where is the best place to get the most returns, you should know that Nanoli or formerly Coindix is a useful tool to cultivate profits. The platform shows users the most profitable farming positions and profit rates on its dashboard. Don’t forget to do more research before making any decisions; Because there is a possibility that the percentage of interest and other information is not completely up to date.

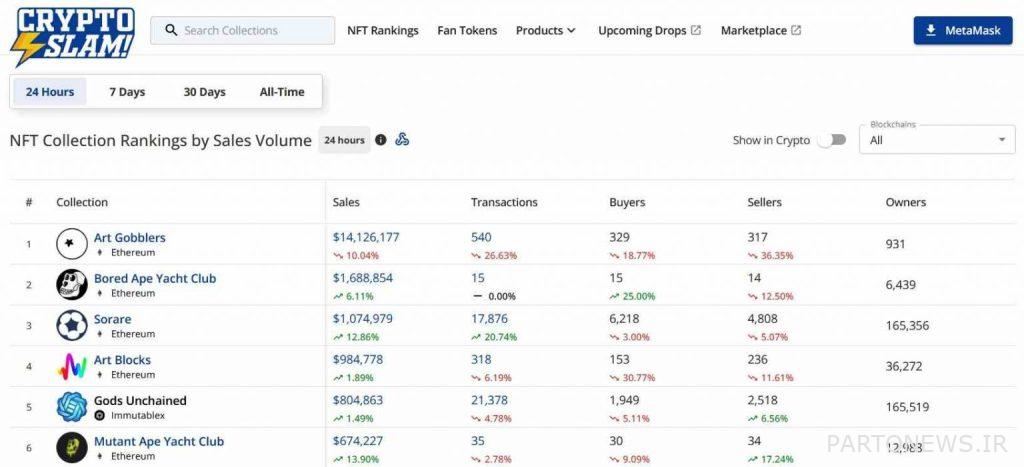

CryptoSlam

Cryptowaslam is an NFT aggregator platform that tracks data from millions of NFTs from over 15 blockchains and helps traders identify the next targets for their NFT investments.

If you want to know which NFT sets top traders are buying and selling, this is the platform for you. All NFT projects are ranked and listed based on their 24-hour trading volume. This measure allows you to better judge whether assets are valuable or not.

CryptoSlam also shows users the rarity score of certain NFTs. The rarity score, as the name suggests, refers to the uniqueness of the NFT’s features. NFTs with a high rarity score are usually more valuable than those with a lower score. When buying an NFT, users should check whether the price of the NFT matches its rarity score.

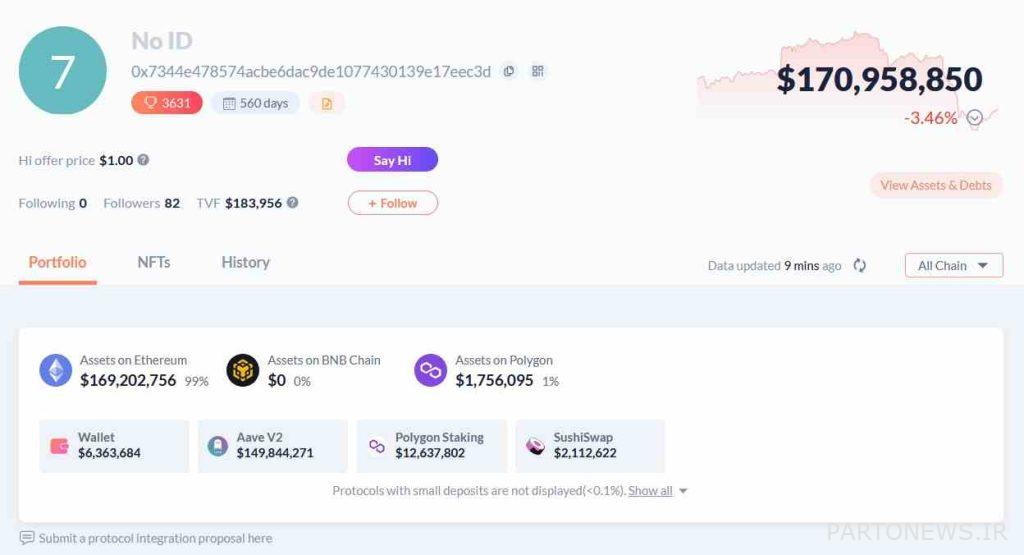

DeBank

DBank is a multi-chain portfolio tracker that supports the largest number of DeFi protocols, decentralized lending protocols, stablecoins, margin trading platforms and DEX; But perhaps its most useful feature is its digital wallet tracking, which allows you to track and manage your assets as well as track whales and copy millionaires’ trades.

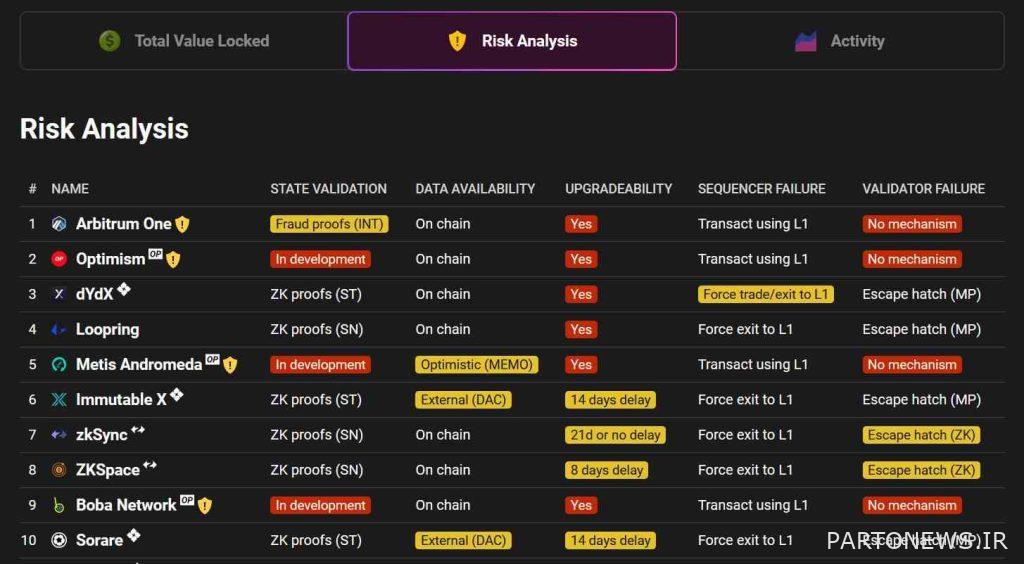

L2Beat

As the name of this platform suggests, L2 is about second layer solutions. The difference between this platform and more well-known platforms such as Defi Pulse and Defi Lama is that these programs mainly track the total value locked (TVL) of DeFi projects on different blockchains. At the same time, Altbit does not only do this; Rather, it examines the risk criteria related to the nature and security of projects.

Blockchair.com

This tool is a blockchain search and analysis engine for Bitcoin, Ethereum, Litecoin, Polkadot, Solana and many other cryptocurrencies. The tool aims to be a “Google-like search engine for blockchain.” If you take a look at its website, you will see that the creators of this tool are very serious about achieving their goal.

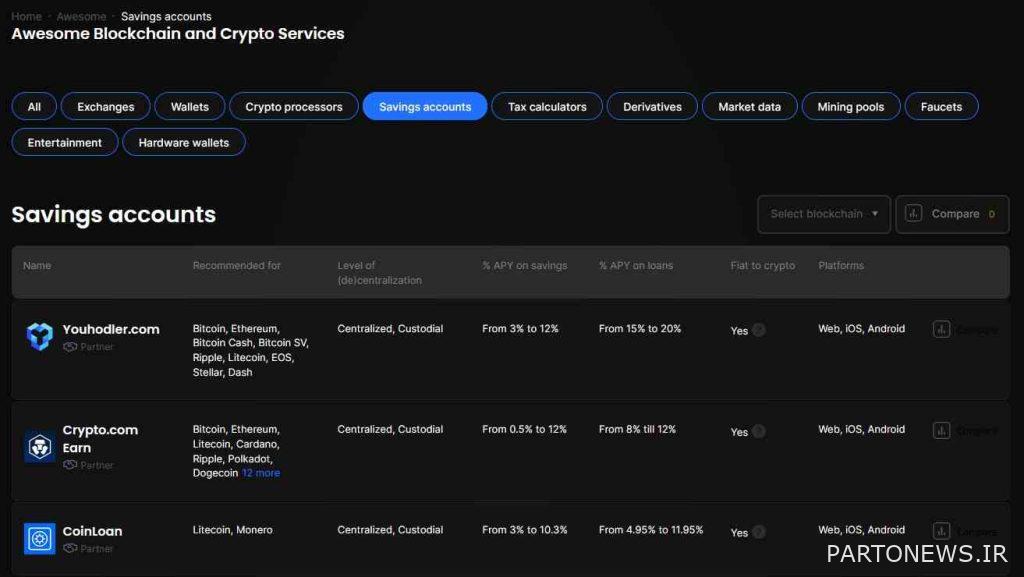

In addition to tracking transaction sizes, node counts, fees, and other metrics that indicate network activity, growth, and health, the tool also monitors “special services.” Blockchain lists deposit and loan rates to benchmark these services. All this information is arranged in one dashboard so that you can keep your digital currencies where you will get the most profit from it.

Another interesting feature of this tool is the ability to measure the privacy of projects (Privacy-o-Meter). This feature helps to check the privacy level of your Bitcoin transactions by entering the hash of Bitcoin transactions. With this information, you can better choose the app or website to use for your next transactions.

Conclusion

One of the thousands of positive features of blockchain is its transparency. By using analytical tools, which are increasing in number every day, you can get complete and comprehensive information about the status of the project and the entire industry. These tools have been created to minimize the extent of fraudsters’ actions and to maximize the ability of investors to correctly identify them.

In addition to the tools mentioned in this article, various monetary tools have also been designed and implemented; But we can safely say that by using these free and available tools Error and mistake It will reach its minimum in choosing the right goal and investment.