Getting to know the Lindy effect and its connection with the future of Bitcoin

About 13 years have passed since the life of Bitcoin; An adventurous digital asset that was able to change many global parameters. Of course, we should not forget that the world’s top digital currency emerged when most traditional financial institutions were struggling with the widespread financial crisis of 2008. Although Bitcoin was a different and emerging phenomenon, many did not expect that this disruptive financial technology could last this long and survive the many obstacles. However, Bitcoin is still standing in the market turmoil and is likely to continue its lead for years. What is the reason for the durability of Bitcoin? Maybe the Lindy effect theory can give a suitable answer to this question.

Generally, By Lindy It is a theory that states that if something or an immortal idea can be considered valuable for a long time, it is very likely that it will remain durable and valuable in the future; Because longevity and so-called old age will no longer be effective in its valuable process. In this article, we are going to check whether Bitcoin is included in this framework or not. For this purpose, we first provide a history of Lindy’s theory and then point out some criteria that play an effective role in the durability of the value and importance of Bitcoin. In the end, we will go to the criticisms that have been raised in the denial of Bitcoin following Lindy’s work; So we recommend that you stay with us until the end of the article.

Lindy’s workLindy Effect) What is?

Based on the Lindy effect theory, which is named in some sources Lindy’s law It has also been mentioned that the longer the life of an indestructible thing such as technology or an idea, the more likely it will survive in the future. In fact, the Lindy effect says that something that has lived longer will live longer in the future. Longevity in Lindy’s work refers to characteristics such as immutability, not getting old, not having competitors, and more luck for continued life in the future.

The Lindy effect is rooted in human nature. We humans naturally trust things that have been around for a long time. For example, when the Wright brothers built and flew the first airplane in the early 20th century, people thought they were crazy. This is despite the fact that air travel is considered a matter of course for us today. The same phenomenon applies to technologies such as mobile phones and computers, and it may be true to Bitcoin as well.

History of Lindy’s work

In 1964, Albert Goldman coined the term “Lindy effect” for the first time an article called “Lindy’s Law” (Lindy’s Law) Goldman used the term to refer to the “Lindy’s Diner” in New York, a gathering place for comedians to talk about their careers. In this gathering, an idea was raised that the more a comedian has been in the media before, the more likely he will have a longer professional life in the future. Note that here we are talking about possibilities and not certainty.

This issue can be examined and observed from the religious and belief aspect, which has been raised in various religions and rituals; Therefore, if something that has no expiration date can remain popular and popular for a long time, then it will continue to be popular and popular. Note that the Lindy effect is only true for so-called immortal things; For example, we humans, who are mortal beings, will face death if we get old.

Nassim Nicholas Taleb, a prominent writer and analyst, in the book Rewarding (Antifragile) He points out the important difference that the Lindy effect is only true for things like ideas or technologies that have stood the test of time and have not been lost despite changes in society and the passage of time. For example, gold has been valuable for thousands of years and will likely continue to be so. Also, old and classic written works that have been considered masterpieces for decades and centuries will probably be so in the future.

If we look at Lindy’s work from a physics point of view, this topic somehow refers to the inherent inertia of things. This means that something useful and valuable in the past will continue in the same way in the future and will continue to be useful and valuable. Of course, we emphasize again that past performance cannot definitely guarantee sustainability in the future. We mentioned gold. For example, the probability of gold becoming devalued is very small; But it is not impossible. Another issue that we need to mention is that lifespan by itself cannot be a good measure to measure the value of things. For example, the mountains around us are older than anything else you know; But they have no practical value and no one cares about them.

The connection between Bitcoin and the Lindy effect

Now that we know the concept and basis of the Lindy effect, we can better understand its connection with Bitcoin. The first Bitcoin block was added to the blockchain on January 3, 2009. So, we can say that Bitcoin is more than 13 years old. As we said, according to the Lindy effect, the longer something has been around or used, the longer it is likely to have a life expectancy. Understanding this, can we say that the Lindy effect is also true for Bitcoin? Will Bitcoin, which has lasted this long, continue to last as defined by the Lindy effect? To answer this question, first, it is better to look at the two parameters of Bitcoin hash rate and the growth rate of users of this network.

Bitcoin hash rate

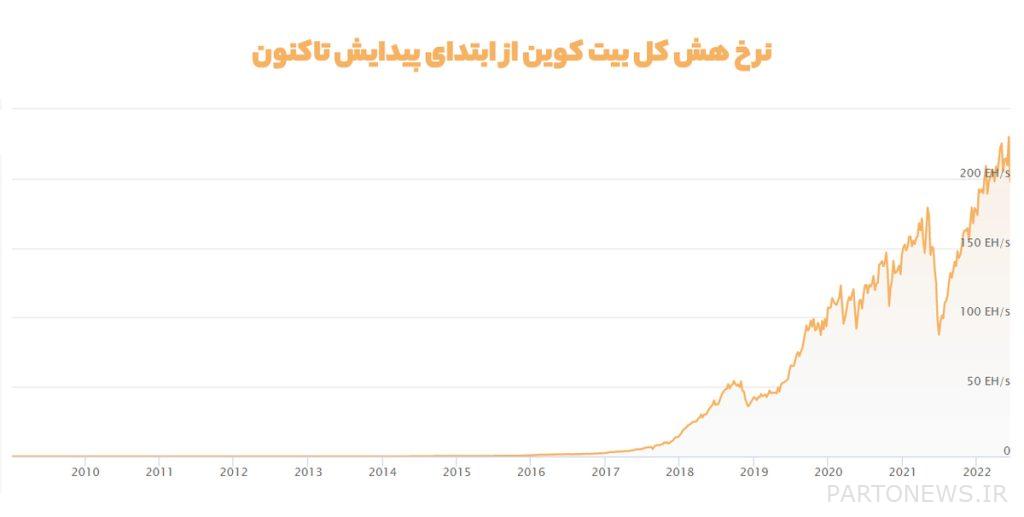

Ensuring the safety of the Bitcoin network is its proof-of-work mining system. Thus, the security of the entire network is calculated by the hash rate produced by the miners. The chart below shows the hash rate of the Bitcoin network since its inception. As you can see, Bitcoin’s hash rate has increased exponentially over its lifetime. It should be noted that the decrease you see in 2020 happened due to the approval of the law banning Bitcoin mining in China.

In addition to increasing the hash rate (security) of the Bitcoin network, over time the mining distribution rate has also grown significantly. In the early years of Bitcoin, the number of miners and countries participating in mining were very few; But today, thousands of miners from all over the world are involved in creating the Bitcoin hash rate; Therefore, we can say that the security of this network has become more decentralized and powerful over time. In addition, large institutions and even countries such as El Salvador are accepting this digital currency and entering the Bitcoin mining space. Accordingly, it can be said with certainty that the Bitcoin network will continue to grow in the future.

The growth rate of Bitcoin users

The growth rate of any technology is tied to its ability to achieve the network effect. The network effect states that the value or utility of a product or service increases with the increase in the number of its users. Network effect is usually considered a positive phenomenon; Because as the number of network users increases, the value of the product also increases and as a result, each user receives more value from the used product. To illustrate the power of the network effect, we can take a look at Facebook. The number of user accounts of this network since its inception in 2004 has reached nearly 3 billion accounts worldwide.

Now imagine that you were the first users of the Facebook network. Back then, you could only interact with a small number of other users; Therefore, the value of the network was not very high. However, compare that to today, where each Facebook user has instant access to about 3 billion other users around the world. Facebook shows us the enormous value of the network. Now let’s examine the growth rate of Bitcoin users based on the number of wallet addresses to determine if we are witnessing a strong network effect in this digital asset. The graph below shows the growth rate of Bitcoin wallet addresses since the inception of this digital currency.

As you can see, the number of users who have joined this network has grown exponentially over time. Currently, the number of Bitcoin users is more than 80 million people, and we can say that the effect of the Bitcoin network has grown significantly since its inception.

The immutability of Bitcoin

Bitcoin is resistant to change. Although critics of the world’s top digital currency consider this feature to be Bitcoin’s weakness, Bitcoin’s immutability is actually a positive and very important feature. In order to change the network’s consensus rules, most users running the Bitcoin protocol software must agree to the update. Since Bitcoin is decentralized and millions of people around the world run versions of the software on their computers, achieving consensus will be very difficult. Therefore, only updates to the Bitcoin code that the vast majority of participants agree with are applied. Bitcoin seems to have the opposite approach to Mark Zuckerberg’s in Silicon Valley. He believes in the “move fast and change everything” approach; But Bitcoin’s strategy for the world’s future monetary network seems more cautious.

Is Lindy’s work necessarily toTheWhat is the meaning of Bitcoin durability?

With all that we have said so far, there are still criticisms regarding the validity of the Lindy effect phenomenon about Bitcoin. Many fans of two-fire Bitcoin mention Lindy’s work as an important proof of the stability of Bitcoin’s value; But these people do not consider some points. For example, the life of Bitcoin is prolific, but relatively short, and only about a decade has passed since the peak of this digital currency, which cannot be enough time to prove the Lindy effect. It is enough to compare the value of Bitcoin (digital gold) for a decade with gold metal, which has been considered valuable and precious for centuries. Although Bitcoin has outlived many newer coins, 13 years doesn’t seem long enough to prove that Bitcoin can survive societal changes.

Also, saying that Bitcoin will forever be the flagship of all digital currencies cannot be completely true. Most of the time, people are cautious and conservative in adopting new technologies and digital assets. Usually, most people wait for other users to identify the bugs and problems of new systems, and after making sure that these networks are completely safe, they enter them. With this assumption, older digital currencies are more likely to be safe; But that doesn’t mean newer assets aren’t capable of achieving a powerful network effect.

Another point is that being a pioneer in the market is not necessarily equal to being invincible. There are many historical examples in the world of technology that show that unless the technology has a special competitive advantage, being first does not mean lasting. Yahoo’s messaging network or Nokia’s phones are among the clear examples of market failures that initially stole the lead from competitors; But they could not maintain their superiority.

It goes without saying that Bitcoin fanatics claim that in the worst case scenario, Bitcoin’s value is maintained by its transaction fees. We must not forget that banks probably charge more fees from transactions; But history shows that even the probability of 200-year-old banks going bankrupt is not zero. Also, the energy used to mine Bitcoin is practically wasted and cannot add anything to its intrinsic value. In the end, we must remind again that age cannot prove the value of something. In this case, fiat money is much older than bitcoin, and we should consider the chances of fiat currencies competing with bitcoin to survive much higher.

TotalTheclassification

In this article, we learned about the phenomenon of the Lindy effect and its history, and we explained that according to the hash rate and the number of users and immutability, how Bitcoin may maintain its durability and value in the future according to the Lindy effect. However, in an unbiased view, we tried to point out the criticisms of Lindy and Bitcoin.

According to Lindy’s theory, the longer something has lived in the past, the more likely it will be in the future. Bitcoin is the oldest and most valuable digital currency that uses blockchain technology; Therefore, we can consider the probability of its survival, growth and durability in the future to be high; But no hypothesis will be completely verifiable until it is implemented in practice. The Lindy effect is a phenomenon that is proven over time, and nothing but the passage of time can prove the correctness of this theory about Bitcoin.