Glassnod: An important indicator shows that we have reached the end of Bitcoin’s downtrend

Bitcoin news

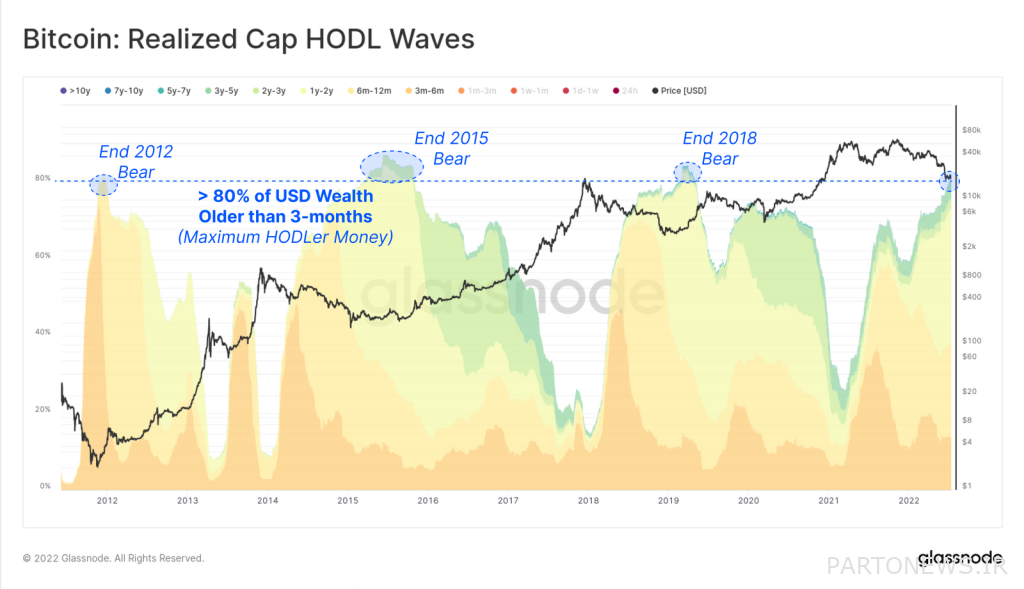

As can be seen from the latest statistics, a significant part of the short-term holders of Bitcoin have already exited the market, and the share of long-term holders of the circulating supply has reached the levels where the end of the previous downward cycles of Bitcoin was recorded.

To Report CoinDesk, there are currently signs of seller fatigue in the Bitcoin market, and this issue has created a situation that could be a serious sign for the end of the downward trend of this digital currency.

- The air temperature in this city reached minus 5.2 degrees!February 3, 2024

The on-chain indicator of realized losses (realized losses) or the same loss caused by the sale of Bitcoin holders, shows how much investors are disappointed with the future price increase and have started selling.

The collapse of the Terra network and the fall in the value of “UST” and Luna tokens in May caused the realized loss of Bitcoin investors to reach 28 billion dollars in a 30-day period. As can be seen from the statistics of the analysis platform Glassnod, after the price of Bitcoin fell to the historical peak levels of 2017 on June 18 this year (June 28), the 30-day realized loss of Bitcoin increased to its highest level in history at 36 billion dollars.

As small and short-term investors withdraw from the market during these heavy sales, the saturation of real holders or a group of investors who hope for a long-term price increase and do not care about seasonal fluctuations, will continue to be more visible. The greater the number of long-term holders, the more stable the price of Bitcoin will be, and in such a situation, it can be said that the probability of reaching the end of the long-term downward trend in the price will be higher.

More than 80% of the bitcoins in the addresses of the holders of this digital currency are currently more than three months old (that is, the last time it was moved more than three months ago), and this means the extensive sales made in May and June (May and June) has exhausted almost all short-term holders.

These statistics are consistent with data from the end of Bitcoin’s downtrend in 2012, 2015, and 2018; That is, the end of all these downward cycles occurred when the share of long-term holders reached more than 80% of the dollar value of the Bitcoin supply.

Golsnod wrote in his report:

Despite the very challenging conditions of the world from the point of view of macroeconomics and geopolitical issues (conflict between Russia and Ukraine), the presence of long-term and serious Bitcoin holders is on the rise, and therefore it can be accepted that a real price floor is forming.

Nothing found.