Glassnod: Bitcoin’s recent spike was a bull trap

Despite the recent increase in the price of Bitcoin, which may have been influenced by the decisions of the Federal Reserve and the President of the United States of America, Glassnod believes that there are no clear signs of a change in the bearish trend of the market at the moment. In its report, this analytical platform considers the recent surge of Bitcoin a bull trap, citing low transaction fees and no new active addresses being added to the network.

To Report Cryptopotato, after several consecutive weeks of price decline, Bitcoin finally managed to gain some ground in the market and reach its highest price level in the last 6 weeks, which is around $24,500. This happened shortly after the Federal Reserve raised interest rates by 0.75 percentage points and President Joe Biden refused to admit that the United States had entered into a recession despite negative GDP in the previous two periods. It has stagnated.

However, Bitcoin failed to continue its upward trend and fell below $23,000 earlier today. In its latest report on the market situation, Glassnod attributed this price reduction to the relatively low use of the network by users.

This is evident in the examination of Bitcoin network fees. When more users (usually in bull markets) interact with each other on the blockchain, Bitcoin network fees increase and decrease in reciprocal markets. Glassnod confirmed that it has not yet seen a significant increase in the cost of fees.

In addition, Glassnode has also reconfirmed its current analysis by examining network activity data (number of active addresses). These data, except for a few short jumps in user activity that occurred at the same time as the mass selling of some investors, show a small flow of new demand entering the market.

Ethereum has the same conditions as Bitcoin

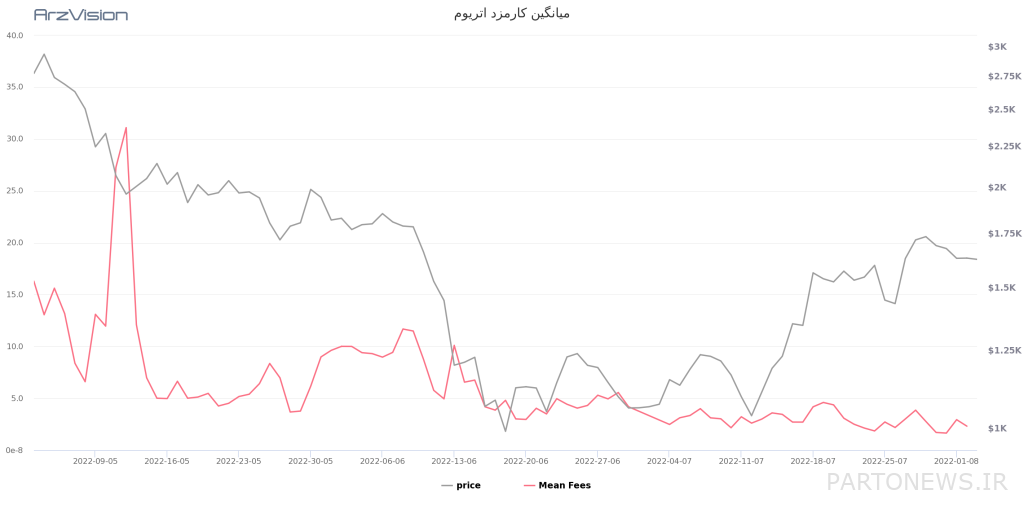

If we examine the short-term price performance of Ethereum based on network congestion (number of active addresses) and fee costs, we can conclude that Ethereum is in a very similar situation to Bitcoin. The cost of gas paid by users on the second largest blockchain in the market has reached its lowest level in recent months, and the average fee per transaction on the Ethereum network is now below $5.

This can also cause problems for Ethereum digital currency. The “EIP-1559” plan, which was implemented with the London Hardfork last year, cannot burn enough Ethereum without using the network and making transactions by users, and as a result, this digital currency has taken on an inflationary form again.

However, the cryptocurrency community is hoping that this will change after Ethereum’s Merge update is rolled out in the next few months.