Glassnod: The price of Bitcoin has not reached the bottom yet

Although many indicators show that the digital currency market is probably nearing its bottom, time will be the final factor in determining this. Most analysts also believe that the unrealized losses of some Bitcoin investors have not yet reached a level that indicates a bearish market bottom.

To Report Cointelegraph, Bitcoin is being distributed from weak investors to powerful investors due to the capitulation of small investors and miners. This indicates that the bottom of the downward trend of this digital currency may be near.

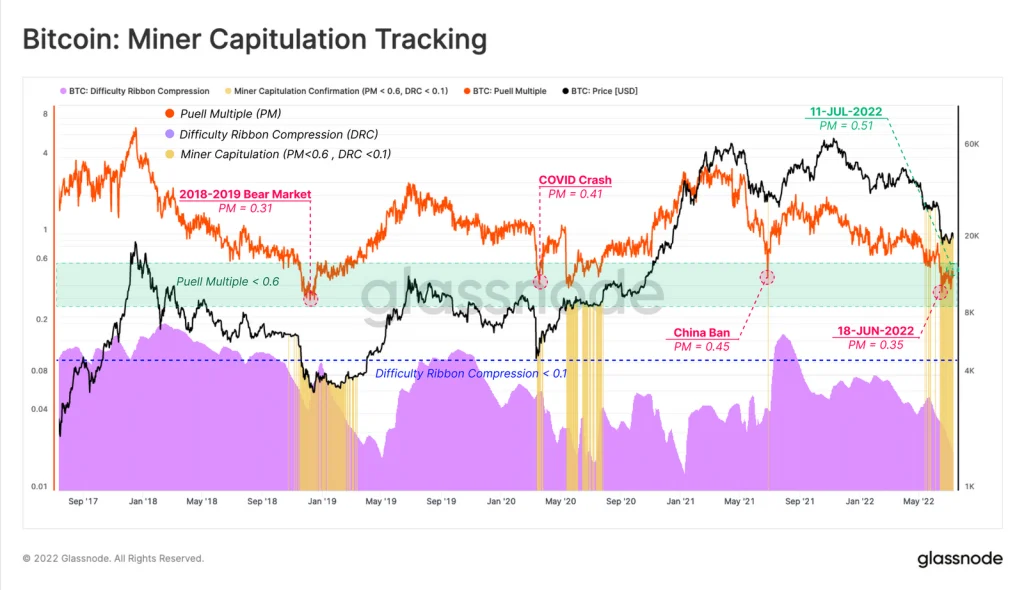

Analytics platform Glassnode published a report on the cryptocurrency market’s off-chain data on Monday. According to this data, investors have given up for about a month and several other signals indicate that Bitcoin has bottomed out.

However, Glassnod analysts wrote that the bear market still needs more time. That’s because long-term holders who have trusted Bitcoin as a technology increasingly bear the brunt of unrealized losses.

Golsnod stated in his report:

For a bear market to reach its final bottom, those bitcoins held at a loss must first be transferred to those with the least price sensitivity and the most belief in it.

They added that the market probably needs more downside risk to fully test investors’ resolve and create a resilient floor.

It should be noted that unrealized losses mean the dollar losses of the trading positions of the holders before the sale.

Glassnod made this assessment based on observations of previous bear markets in 2015 and 2018. In these two cycles, long-term holders held more than 34% of the bitcoins in the market, which were at a loss. Meanwhile, the share of short-term holders was only 3-4%.

Currently, however, short-term holders hold 16.2% of the bitcoins that are at a loss, while long-term holders hold 28.5% of these bitcoins. This means that this digital currency is moving towards new holders who only aim for short-term profits and have less faith in this asset.

This suggests that long-term holders must have “diamond hands” as they accumulate more bitcoins. What this term means is that they should not sell their holdings until the analysts are sure that the market has reached its bottom. The experts of Delphi Digital Institute also believe that in the current market conditions, we need more time to be able to determine its bottom.

The sale of Bitcoin by miners shows that this digital currency can reach even lower prices. According to Glassnod data, miners have sold 7,900 bitcoins since the end of May; But recently they have reduced their sales to about 1,350 bitcoins per month.

Now, time has once again emerged as a critical factor in determining the market floor. During the bear market of 2018-2019, it took about 4 months for the miners to give up and the market bottomed out. This is despite the fact that they have only sold for one or two months in 2022. Miners still hold about 66,900 bitcoins; As a result, there is a high probability that the distribution risk will continue in the next three months. This can only be prevented if the price of Bitcoin improves significantly.

Overall, the market appears to be near its bottom, Glassnod said. In addition, many characteristics show that the market has reached the next stage of its downward trend. However, investors should be aware that the price of digital currencies can fall further.

Golsnod wrote about this:

In general, there is still the possibility of widespread surrender (selling) and the formation of feelings of severe financial anxiety.