How to get a loan with stock exchange?

According to Tejarat News, one of the concerns that all of us have faced at least once is applying for a loan or buying in installments. The process of pledging and providing a valid guarantor is the biggest concern of people when getting a loan or buying installments. The smart electronic verification system or the star system has been launched with the aim of online pledging of stock exchange shares and other properties.

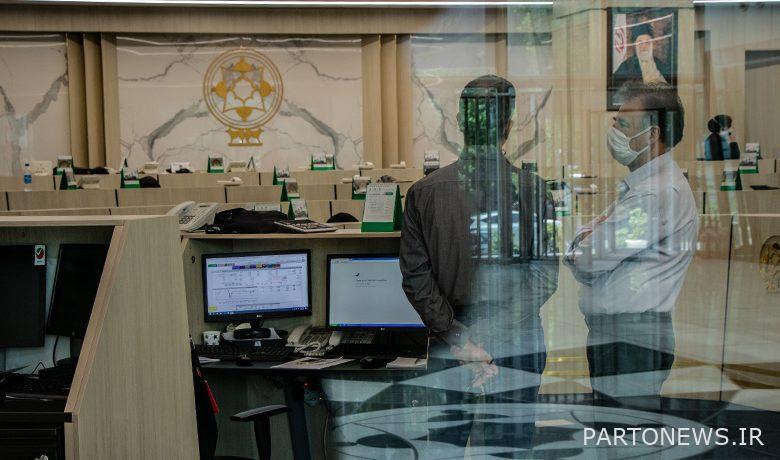

This system was implemented for the first time in the country by the efforts of the Ministry of Economy. In fact, the Ministry of Economy has provided the necessary infrastructure for online and smart verification of property and has also made it possible to pledge shares in the capital market. that your shares be used as collateral in all matters that require a guarantee.

In fact, the Star system has provided the possibility that all small and large assets of individuals, including capital market shares and securities, life and annuity insurance reserves, real estate and car documents, coins, trust gold, SIM cards and other such things can be To be used as collateral by the public.

Which properties are guaranteed in Star?

Currently, stock exchange stocks are used as collateral for stock exchange stocks, and in the near future, coins and certificates of deposit, life and annuity insurance reserves, deduction certificates from government organizations, and car and property bonds will be used as collateral.

star advantage

One of the advantages of the electronic confirmation of shares is that, in addition to facilitating the terms of obtaining a loan, it stabilizes the capital market. Because it makes people to finance their assets, instead of selling their assets and withdrawing their liquidity from this market, they can pledge it to their banks and get the facilities they want without withdrawing money from this market. In fact, the electronic confirmation of shares is a bridge between the capital market and the money market. As a result, these banks play a role as one of the main factors in this process.

Now, three banks Melli, Mehr and Resalat, which are leaders in the field of micro-facilities, have joined this system. Somehow they implemented it in their ports. The depository company has no restrictions on providing these services to banks and the general public. But we are currently preparing memorandums to complete the legal capacity of this process in addition to real people. After the public announcement, other banks can join this process, which will increase the variety of these facilities.

How to use the star system

When the shareholders complete the initial steps in their respective bank, refer to the capital market services page and select the verification service, it is necessary to remind again that the shareholders can use these benefits if they are Sajami. After people enter the verification registration page, they will receive a one-time password and this password will be sent to their Sajami mobile number, and in a way, a verification of will will take place. However, they will see their verifiable asset at the same time as they enter the one-time password. They select the amount of the total asset or a part of that verifiable asset and then they are directed to the page of the central depository company.

After entering the page of the Central Depository Company, there are some conditions and obligations that the shareholders of the stock exchange must read carefully and accept the conditions and obligations. After that, it is necessary for the applicant to pay the fee and then at the end of the process, he will be redirected to the bank page.

Shareholders should note that providing all services related to smart authentication can be done during working days and hours. In fact, at the end of the working day, all requests from the operating banks that have implemented these services are sent to the central depository company and then After processing in the relevant information systems, the result of the request will be notified to the respective banks the next working day.

What are the conditions for stock exchange validation?

The conditions of approval in the capital market are such that the shareholders do not have the restriction of the supervisor or the so-called frozen assets. It is necessary for people’s assets to be tradable and deposited and not to have seized or confirmed assets in advance. If they do not fulfill their obligations and in fact default occurs. The shareholder’s property will be sold by the relevant banks and based on the contracts.