How to get rid of fumo and stick to our strategy?

FOMO stands for Fear of Missing Out. Fumo is mostly used in the field of investment and it is interesting to know that it is not only for new investors. This feeling often affects professional investors as well. The decisions that follow Fomo are not based on research, but on the feeling that “lest I do not benefit as much as others,” or in other words, on “comparing myself to others.”

There are many destructive emotions in the financial markets and Fumo is one of the most destructive emotions. Of course, it should not be overlooked that fumo is a natural and common feeling among all human beings, especially investors; But in order to have a successful investment, we must control it in some way so that it does not take control of our minds and does not harm us. Too often we find that the area or market in which we have not invested is growing rapidly and profitably. This is when the feeling of fumo comes to us and we think we are all ahead of ourselves and we have lost a lot of profit, which is natural; But we must overcome this feeling of fear as much as we can.

In the following, we are going to discuss the effects of this feeling of fear and ways to get rid of fumo. In this article, we will review how emotional investment is structured, how it capitalizes our capital, how it affects our profit and loss, and how we can avoid getting caught up in the red lines of our trading strategy. Stay with us.

What is emotional investing and what are its implications?

Emotional investing can lead investors to act on their inner feelings and pulses instead of analysis, and this has a strong negative impact on their trading strategy and profitability.

Overcoming emotions is one of the most difficult obstacles that investors have to overcome, and one of the most important reasons for investors to lose money in digital currency trading is this fumo.

Unfortunately, our emotions are a natural reaction to market ups and downs. When the market falls, the fear and anxiety overwhelms us, or when the price of an asset reaches its highest levels, the fumo or fear of losing intensifies within us.

All successful investors know that following these pulses and emotions will either lead to early sales and deprivation of further profits, or to late purchases and falling prices and loss of capital.

Although these feelings are very common in traditional markets; But in the world of digital currencies, they are much more visible. This is due to the sharp and not very predictable price fluctuations that lead to significant gains and losses.

Read more: 6 ways to control emotions when buying and selling digital currencies

What are the reasons for emotional investment?

Emotional investing occurs when the financial benefits and emotional feelings of an investor or trader become very close.

More precisely, one of the most well-known reasons for the success of trading or emotional investing is that one does not look at investing only in terms of investing or seeing the money invested as mere money, but sees investing as a means to achieve emotional emotions.

For example, it is very dangerous for an investor to look at his investment as something like a new car, a luxury vacation, or getting rid of past debts.

How to make an investment without emotions?

If investors can look at their investments and assets in the form of a third person and as a stranger, they may be able to get rid of the emotional mentality.

What does it mean in the third person? This means that one can consider the loss of a transaction as a normal event that can always happen without considering oneself a beneficiary. In such a situation, the person realizes very well that this loss is as much as he expected at the beginning of the investment, neither less nor more.

If the investor has this view, he does not consider profit as a kind of personal superiority over other people, but considers it as something that happened because of putting money in the right place at the right time.

Of course, because this thought process is somewhat far removed from human nature, it is necessary for the investor to start with less money and at least form the right mindset to overcome emotions.

What tools can help investors manage their assets properly?

Automated or automated solutions can help traders formulate their trading strategy so that they are not forced to trade and invest based on their emotions.

In addition to one’s mentality, various tools can help overcome emotional investment. One of the most common of these tools is trading platforms that have pre-defined settings for buying and selling. These features enable the trader to maintain a trading strategy and allow another strategy or platform to think and act in his place.

Tools such as robots make the trader experience more of a passive experience in which the trader does not need to examine and read charts and graphs, which is a time-consuming activity.

However, it has been proven that robots can counteract some of the effects of trading and emotional investment; But they are not a guarantee of profit or creating a risk-free environment. So it is better for traders to work with simulators before investing in robots and experiment with unrealistic numbers so that they do not suffer losses.

Conclusion

In this article, we have tried to discuss fumo and its effects, as well as ways to get rid of fumo. We have said that fumo means the fear of losing and falling behind others. This feeling of fear comes to us when we see the benefit of others in markets and assets in which we are not present; It is a kind of self-comparison that overcomes negative emotions and makes irrational decisions about trading and investing. Emotional investing can cause us to act outside the rules of our investment strategy and cross red lines. In these circumstances, one can expect nothing but loss.

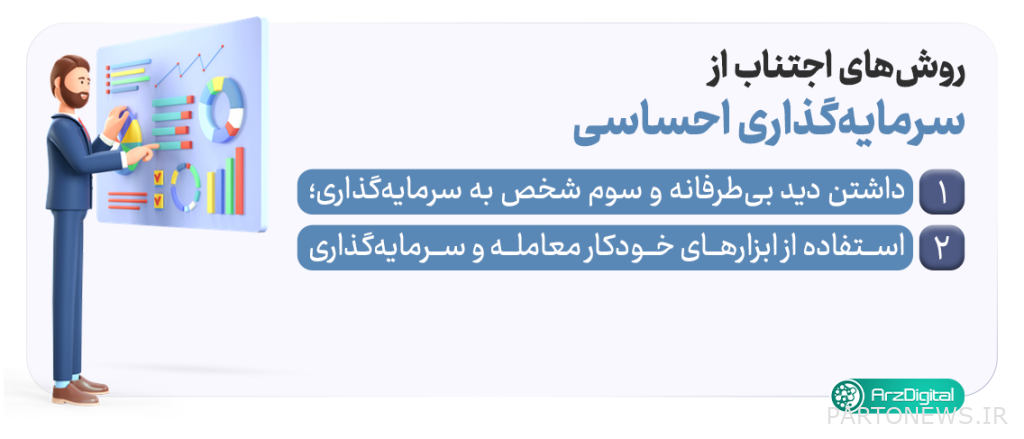

We tried to introduce you to two practical and helpful ways to overcome fumo and emotional investing: first, to look at your investments as a third person, and second, to use tools and platforms that have predefined settings and effort. Reduce checking charts and spending time getting data.

Of course, we mentioned throughout the article and reiterate that these automated tools and platforms somewhat reduce the risk of investing and trading; But they do not guarantee a profit or a loss. It is therefore advisable to use trial versions before using them to fully master the skills of using them.

And finally, our general advice to you is to create a constructive mindset for yourself; A mindset that is far from emotional and has a lot of respect for your predetermined strategy. In this way, you can make transactions and investments rationally and away from the feeling of fear.