How to identify RugPull projects?

RugPull is one of the new scams in the digital currency space. In this way, the project development team with deceptive promises and market manipulation causes a sudden increase in the project token price; But after the buyers put their capital in the market, they steal their assets and leave the investors alone with worthless and unsupported assets!

This scam usually targets investors who, hoping to make money overnight, tend to invest in hot, new projects sooner than others. The reason for these people’s rush to invest is the possibility of making a multiplier profit after the project grows. The noise of DeFi or Decentralized Finance (NFT) projects, NFT tokens, Metawares and Web 3.0 has made scammers take advantage of the enthusiasm of users in this space.

Meanwhile, the lack of rules and sufficient knowledge of digital currency users has also made things easier for criminals. According to the Chainalysis report at the end of the year, about 37% of scams in 2021 were done using the rag money method. It is interesting to know that this rate was only 1% in 2020.

At present, most defenses do not offer specific insurance and guarantees to their users; For this reason, investors who lose money with this type of scam are unlikely to be able to get it back. Therefore, if you are planning to invest in Difai projects, we suggest that you stay with us until the end of this article to find out more about this.

Read more: What is DeFi or Decentralized Finance?

What is money rag and how does it work?

Rug money is a form of digital currency scam in Difai space in which the founders of fake projects, abusing the trust of early investors, raise a lot of money and then leave the scene without presenting a product.

Rag money literally means “pulling the carpet under someone’s feet” or so-called “emptying someone’s back”. In the world of digital currency, too, scammers are actually emptying the back of project investors by making money, leaving them alone with worthless and fake tokens.

It is worth mentioning that money rag can be considered as an exit scam or Exit Scam. In Exit Scam, too, the founders of the project pocket users’ money and disappear; But the common denominator in all of these scams is gaining the trust of abusive users and abusing them.

Most money laundering starts with the project support team using various marketing methods through social media and influencers to put their project name on the tongues. Then, they list their token in one of the decentralized exchanges such as Uniswap or Pancake Swap and pair it with another valuable token such as Ether or BinanceQueen.

The next step for these people is to create liquidity in the market. Liquidity ensures that there are enough tokens in the market to buy and sell. Injecting liquidity can pump the project token price and attract more people.

The temptation to “go through a hundred years overnight” causes some to buy these tokens in the hope of making astronomical profits, and as a result, increase the price bubble of these assets. In such a situation, investors see profits of several thousand percent, and this temptation can attract more people to the project.

Once the price of the token has risen enough, the founders take out the liquidity of the token pool, pocket valuable coins such as ether, and disappear with the accumulated capital. In the end, only investors are left who have bought large amounts of worthless and unsupported tokens.

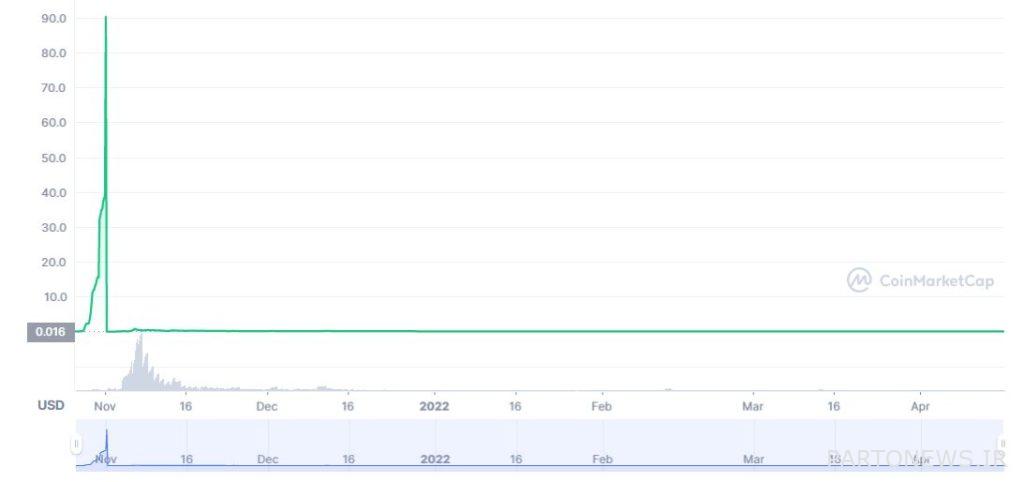

Of course, it should not be forgotten that these steps may be simpler or even more complicated than what we have said. For example, smart project contracts may limit the process of withdrawing or selling assets in order to victimize them. One well-known example was the Squid token scam, which, by abusing the popularity of the popular Squid Game series, was able to grow by 45,000 percent in a short period of time. However, after a few days, the founders sold a large number of tokens at once; While other investors could not sell their tokens. Finally, the market reached the situation you see in the chart below.

How to detect money rag?

One of the most important issues is identifying Rug Money projects. In this section, we are going to point out a few tips that can help you when investing.

Liquidity has no time limit

Rug money projects usually do not have a time lock for token liquidity. Normally, project developers should use long-term smart contracts (often between 3 and 5 years) to create large amounts of project liquidity to show that there is no possibility of draining liquidity and devaluing investors’ assets.

Lack of time lock for liquidity is one of the main ways to steal users’ capital. In addition, the percentage and amount of locked liquidity is important. Ideally, the value locked in the project (TVL) should be about 90 to 100 percent of the total tokens. Usually, the higher the value locked in the project, the more secure the project.

Checking a project for liquidity lock requires a great deal of technical knowledge, and you may not be able to easily identify the time lock, duration, and percentage of assets being locked. In this case, the best option is to ask the main project developers in Discord or Telegram groups to show you proof of liquidity lock. This request can be another test to evaluate the project; This is because fraudulent projects generally do not have specific and crowded groups on social media or do not allow individuals to ask basic questions.

Another way to check for liquidity lock-in is to refer to professional appraisal teams, which we will discuss in more detail in the following sections.

The identity of the developers of the project is unknown or fake

Examine the credibility of developers and their activities in the digital currency space. See if the project development team has the special ability and expertise to deliver on their promises. If you are faced with anonymous developers who ask you to invest in their project without any questions or answers, you are most likely facing a scam project.

Also, most of the time, scammers block the possibility of posting comments on their social media accounts and do not allow comments that are not related to the project advertisement.

Try to check the background and activity of these people and their followers on social networks. Note that the project team may have created fake profiles on networks such as LinkedIn. In this case, the newness of the social account and the small number of followers and not interacting with them can sound the alarm for you.

Another point that can help you is how to promote the project. If the project sounds too loud, or influencers unfamiliar with digital currencies are promoting the project, you probably are not dealing with a healthy project. Projects that come up with a new idea are attractive enough and do not need to be advertised by influencers to be seen more.

Note that the anonymity of the founders in the proverbial tokens industry is different from contexts such as defa; Because in this area, there may be unknown developers who can launch and manage credible and successful projects. For example, the Bored Ape Yacht Club’s collection of unique tokens had founders with nicknames and cartoon profiles; But these people were able to show a very successful performance.

Read more: What is an ipat club board?

However, anonymity in the realm of defiance can provide a good excuse for scammers to make millions of dollars by creating fake accounts. In these cases, it is best to use other criteria to identify potential Rug money projects.

The project promises astronomical profits

Diffie scams often come in handy with the promise of several thousand percent rewards to raise a lot of money in a relatively short period of time. However, in most projects, large profits are often irrational and unstable. Therefore, we suggest that you be skeptical of the promise of astronomical profits. In general, even if you do not face scams, excessive profits always come with a lot of risk.

Whenever you come across a promise that sounds too great, you better doubt it!

The project has not been evaluated by a professional team

Digital currency projects and smart contracts are often reviewed before being offered by an independent security company. Unverified smart codes and contracts can have many bugs and issues. This allows fraudsters to easily steal people’s funds. The issue of liquidity lock-in, which we mentioned earlier, is one of the points addressed in these assessments.

An important point to keep in mind is to read the review reports yourself carefully and not be content with the fact that the project claims to have already been evaluated. If you read the published reports carefully, it is possible that you can find signs that the project was fake.

It should be noted that evaluations are often costly; For this reason, it is possible to use independent auditing platforms such as sniffer tokens (Token SnifferOr Rag Dock (RugDoc) یا بیاسچک (bscheck.eu) used. These collections often publish their reports for free.

The project does not offer specific innovations

Since the purpose of fraud projects is not to sustain, develop, and develop, their creators do not seek to change and provide solutions to existing problems. Most of the time, criminals do not even launch a quality website, and the project website layout is often repetitive and imitated from other websites.

In addition, the white papers of these fake projects are written vaguely and do not come up with new ideas. Most of these whiters are short (probably less than 20 pages) and are copied from other whiters and do not have an innovative solution.

Read more: What is white paper and how to read it?

Note that in non-criminal projects, white papers are usually presented with statistics, charts, and detailed images, and offer new solutions to a particular problem.

Most tokens are in the hands of a limited number of people

If the price of project tokens is jumping; But the sheer volume of these tokens is only in the hands of a few, we are probably dealing with fraudulent projects.

The concentration of tokens in the hands of limited individuals can allow founders to manipulate the price of tokens and deceive uninformed investors. Even if 20% of the tokens are concentrated in the hands of one or more specific individuals, the one-time sale of these tokens can cause the price to plummet.

In general, you can consider that no wallet should hold more than 5% of the token supply; Unless you have a time lock. Blockchain browsers such as Atrascan (Etherscan) Or non-invasive scan (BSCscan) Can help you to learn more about the number of holders and how the tokens are distributed.

Project unveiling of smart contract NFT Shortly before the public release

The last warning is for unrelated tokens projects. Some NFT projects announce their project launch to attract more users; But they do not mention the date of creation of the unique tokens. This issue can create FOMO in a short time and make many people interested in the project!

Read more: What is FOMO in the market and how to avoid it?

Although this method has been associated with benefits for early users in some projects, it has unfortunately been misused by some developers. Therefore, not announcing the release date of counterfeit tokens can be a sign of unsafe projects.

Conclusion

In this article, we got acquainted with Rug Money, one of the new methods of scams in Difai space, and reviewed the solutions that can help us to detect these scams. However, you should be aware that observing all of these points alone cannot guarantee the security of your entire assets; Because with every step the industry takes to advance various technologies, it opens up new avenues for criminals.

do not forget Caution Your best bet when it comes to investing in unfamiliar projects. Never put large sums of money into any new project all at once. Before investing in any project, buy very small amounts of tokens and then sell them immediately. Only invest according to your strategy if you are sure that there are no sales restrictions after a few sales. Finally, our constant advice for any type of investment is that Be sure to research yourself. Wise and informed decisions can be your greatest weapon against any scam, including money laundering.