How will the Fed’s 2% inflation target affect Bitcoin?

While analysts believe that Bitcoin needs to maintain a level of price volatility for widespread acceptance as a global currency, it seems that the fundamental indicators of this digital currency are much less affected than in the past by the increase in interest rates and the revision of the target inflation rate by the Federal Reserve. .

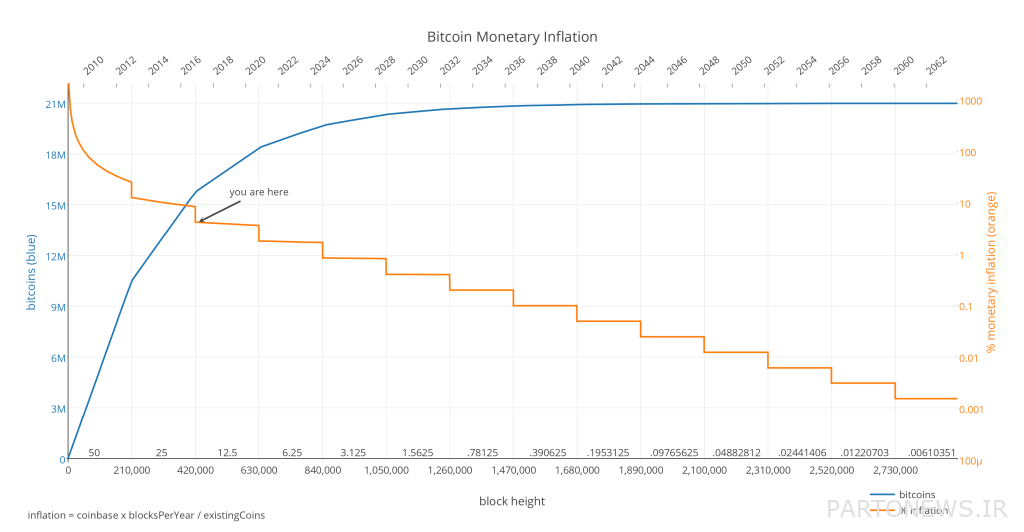

To Report Cryptoslit, the inflation rate of Bitcoin decreased from 50% in 2011 (1390), just before the halving of 2020 (1399), to 4% and now it has reached 1.7%; A figure lower than the 2% target monetary inflation rate of the Federal Reserve.

While this rate indicates rapid mainstream adoption of Bitcoin, the digital currency’s fundamentals are unaffected by negative US GDP growth in 2022. At the same time, the pressure on the US Federal Reserve to revise the inflation rate target of 2% is increasing.

According to reports, the Federal Reserve should review the 2% target inflation rate due to the increase in the interest rate and the utility cost of the monetary inflation rate of 4%.

Some experts argue that an increase in the inflation rate will lead to a rise in the average nominal interest rate, which will create enough room for monetary policy to be implemented, possibly eliminating the risk of creating a liquidity trap and limiting the central bank’s capacity to stimulate economic growth.

Despite the fact that the price of Bitcoin is sensitive to macroeconomic events and inflation data, blockchain proponents believe that this technology can help reduce inflation and solve the world’s monetary problems; Because Bitcoin seems to have maintained the stability of its fundamental indicators following macroeconomic problems.

Satoshi Nakamoto designed Bitcoin in such a way that its monetary inflation rate is fixed when the number of coins in circulation reaches 21 million.

Bitcoin’s unique deflationary features are used to control the price as well as the supply volume. However, the coin faced strong backlash from a section of the fintech community who believed that Bitcoin’s high volatility rate would negatively affect its investors.

Despite all the criticism, price volatility has played an important role in the success of Bitcoin and other altcoins. Of course, analysts believe Bitcoin needs to maintain some level of price stability in order to remain a top-performing global currency.

In addition to all this, unlike fiat currencies such as the US dollar, whose inflation rate can be adjusted, Bitcoin’s inflation rate is predictable and cannot be controlled by centralized institutions.