How will the US mid-term elections affect the Bitcoin price trend?

Many Bitcoin investors probably don’t consider the US mid-term elections a significant event in determining the price trend. However, a repeat of a historical price pattern that occurred during the 2018 election could be an important clue in predicting the price of Bitcoin before the end of 2022.

Will the price of Bitcoin reach $12,000?

To Report Cointelegraph’s comparison of Bitcoin price action data ahead of the 2018 US midterm elections with the upcoming elections in November shows a similar bearish trend in the market.

For example, Bitcoin’s downtrend after the 2018 midterm elections broke below the horizontal support level in the $6,000 range.

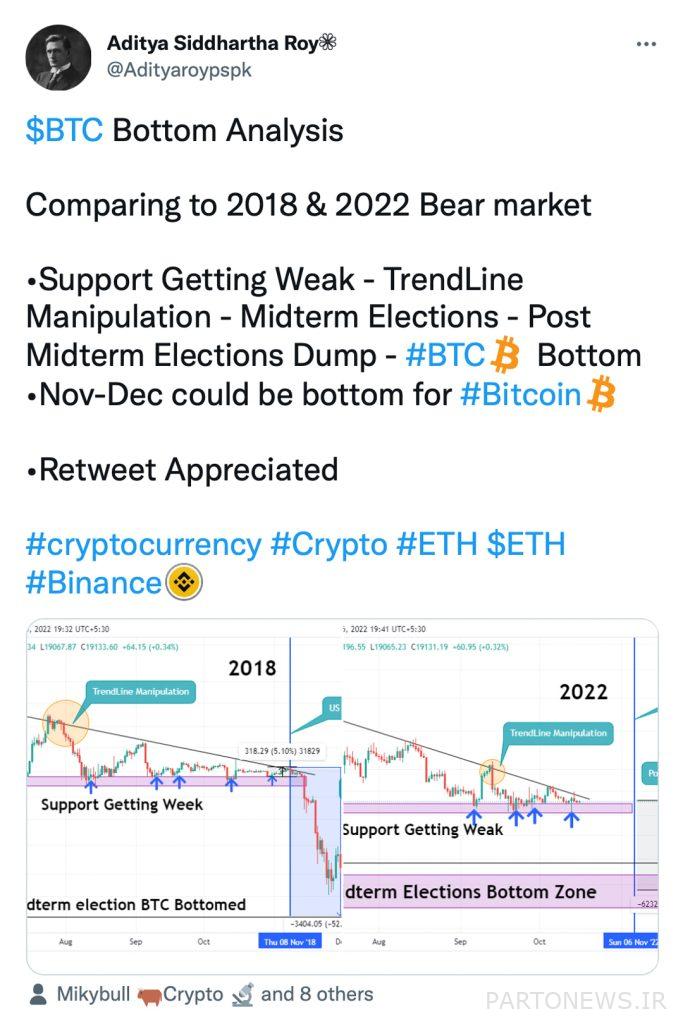

As you can see in the chart below, Bitcoin has retraced the halfway point of the 2018 pattern and the price is now waiting to close below the current $19,000 horizontal support line. As a result, the scenario of falling prices may happen sooner or later along with mid-term elections on November 8 (Aban 17).

Aditya Siddhartha, an independent market analyst, thinks that if a breakout similar to 2018 occurs, the price of Bitcoin will fall to the $12,000-$14,000 range. He further pointed out that price stabilization (and the start of a new trend) could happen in November or December 2022, similar to 2018.

Stock market problems for Bitcoin

While the correlation between Bitcoin and the US stock market is getting stronger in the wake of the Federal Reserve’s monetary policies, the level of bearish forecasts is also increasing. Both markets have seen a sharp decline in market value during the period of interest rate increase by the central bank in 2022.

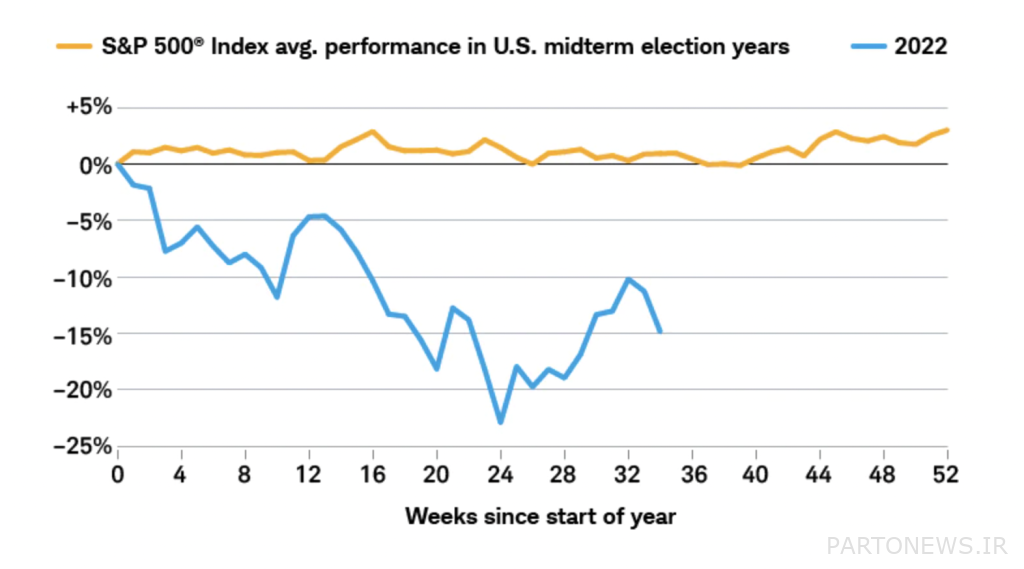

Historically, in 17 out of 19 mid-term elections since 1946 (1325) until now, the performance of the stock market in the six months after the election has been better than the six months before.

Liz Ann Sonders, chief investment strategist at Charles Schwab, notes that this is primarily due to market expectations of more government spending from the new Congress. He also argues that the 2022 process could have a different outcome. Saunders explained:

This year, an injection of additional funds seems unlikely given the historic level of government spending and the response to the effects of the Corona pandemic…Unlike in previous years, a combination of high inflation, the Ukraine war and a prolonged pandemic have made this cycle. Given the many other forces in the market, I don’t place much importance on the stock market’s historical midterm performance.

As a result, Bitcoin remains at risk of a fall following the US stock market with a price target of $12,000-$14,000.

Optimistic Bitcoin Price Indicators

However, a segment of the cryptocurrency market sees Bitcoin breaking away from traditional markets and believes that the digital currency is unlikely to follow the S&P 500’s fall in value after the midterm elections.

Stephane Ouellette, CEO of Front Financial, told Bloomberg:

Sometimes, the market is controlled by people from the community who believe in the long-term growth of Bitcoin and are very unlikely to sell; Along with the growing global community that uses Bitcoin for business.

Volt made his comments after the daily correlation coefficient between Bitcoin and the S&P 500 fell to a four-month low of 0.08 on October 9.

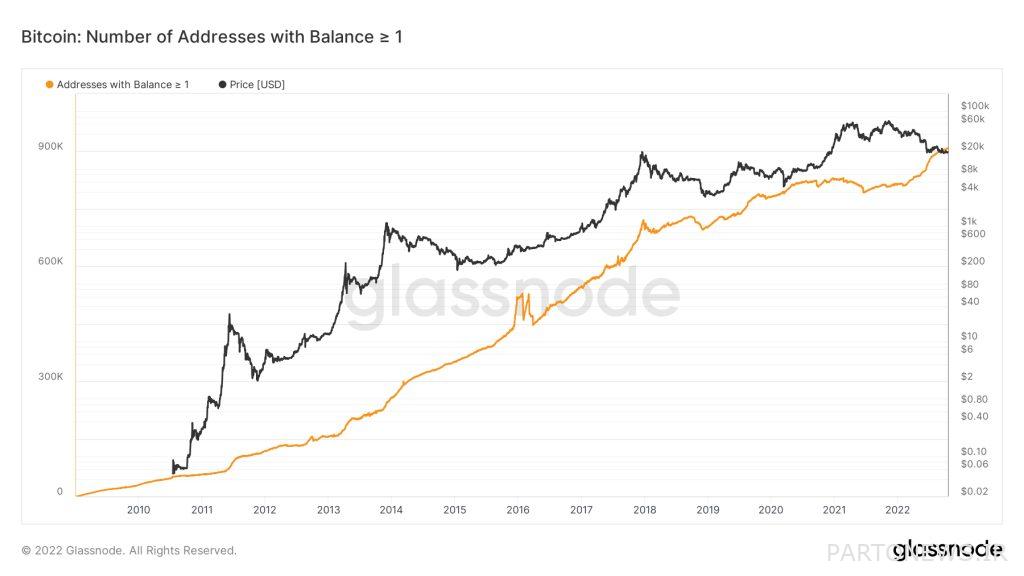

At the same time, the number of unique addresses that have at least 1 Bitcoin reached a new record on October 17; Contrary to the trends we saw in the bear market of 2018. This shows that investors are hoarding Bitcoin at the same time as the price is falling.

Bitfinex digital currency exchange wrote in a note:

Such data shows that investors are optimistic that the market will return to its previous state, and as a result, they have kept the market’s fundamental condition relatively favorable.

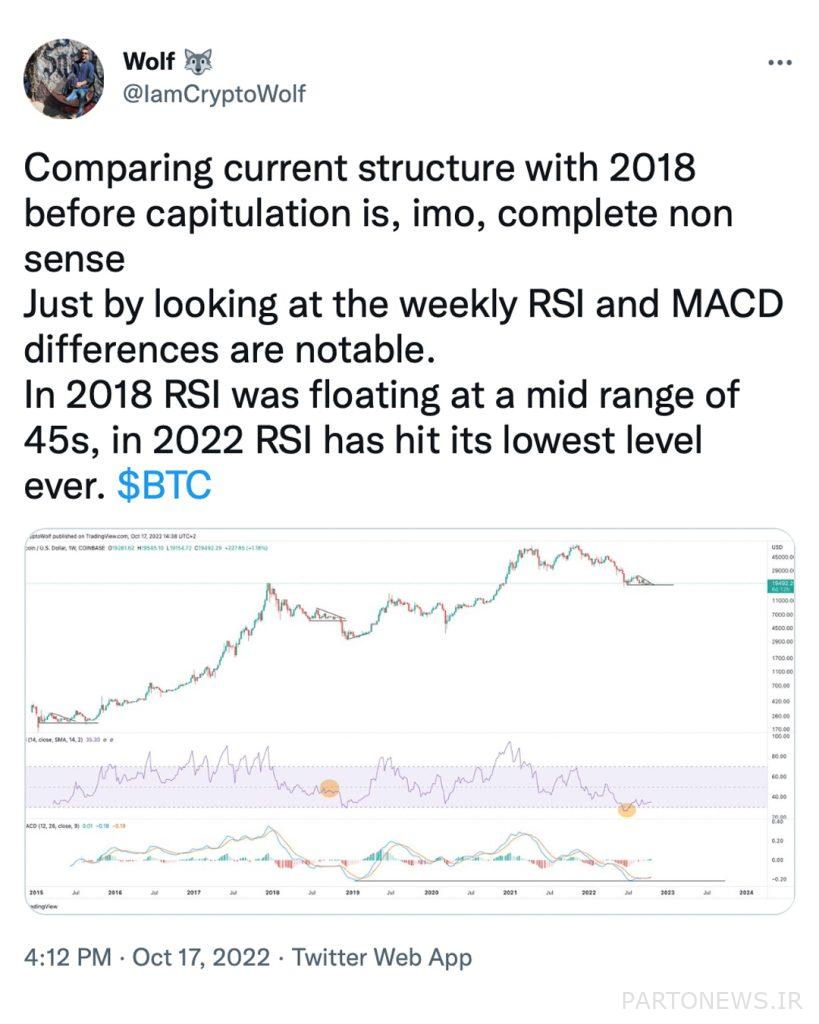

Market analyst IamCryptoWolf also offered a similar outlook on the upcoming accumulation period from a technical analysis perspective, citing Bitcoin’s extremely high Relative Strength Index (RSI) and MACD indicator (MACD) on the 2022 weekly price chart. .

For comparison, these oscillators were in the neutral zone before the 2018 mid-term elections; This means that the price of Bitcoin has more room to fall.