Impact of Macroeconomic Events on Bitcoin

In the past few years, the macroeconomic landscape has completely changed, and the Corona pandemic and the restrictions associated with it have brought the vicious cycle of the supply chain to its knees. During this period, Quantitative Easing has been used a lot, and on the other hand, inflation has skyrocketed.

Governments, banks, traders and investors all react to these events in some way, and this causes significant movements and changes in all market sectors. In general, it should be said that the changes in the last few years of the world’s macroeconomics have been very impressive, and the activists of the investment field have fully felt this issue.

Read more: What is Bitcoin? All about Bitcoin + Video

In this article, we want to examine the impact of macroeconomic events on Bitcoin as well as the impact of monetary policies on digital currency markets and see what has happened and is going to happen during this time and in the future. If you are active in financial markets such as digital currencies and especially Bitcoin, stay with us until the end of this article.

What factors make the market move?

In general, markets move based on two important issues: one is the view of its participants about the future and the other is the performance of assets in the future. The output of these two variables causes people’s orientation or desire; Orientations that are different for each person. If we assume that people determine their financial situations based on their desire; Therefore, supply and demand are determined accordingly.

In other words, the appearance of the matter shows that the market moves based on looking into the future and on this basis, people are looking to buy or sell. Of course, there are exceptions, and investors sometimes buy and sell assets for other reasons and sometimes for no particular reason, and it is not necessarily related to the future. For example, maybe a person sells his property to pay his installments or debts, or another person has accumulated so much capital in his property portfolio that he wants to make a dream purchase with it. So everyone has their own reasons.

Macroeconomic events and Bitcoin

If you consider the market drivers mentioned above, it is not difficult to explain the impact of macroeconomic events on Bitcoin. Sometimes, when we see hot headlines about economic issues in the media, we wonder if these events can influence the direction and inclination of market players.

Markets react to news much faster than one might think; Because people try to change their position based on new news. Sometimes people overestimate the effects of the news, and this causes the terrible growth of prices; Of course, such events also create new opportunities.

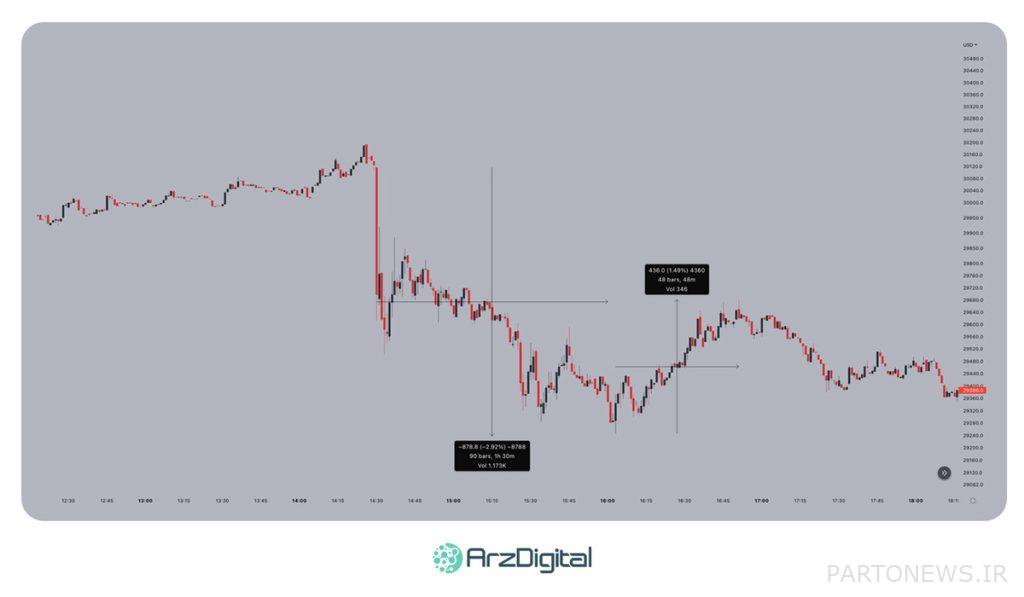

In the graph below, we can see the reaction of Bitcoin to the latest inflation data, which has caused its price to drop by 3% after 90 minutes of a news release. After that, the price of Bitcoin has compensated half of the 3% decrease and has risen higher. After this relative return, the market showed its new and fair value based on the new directions about Bitcoin.

This chart shows that you only have 1 to 2.5 hours to answer the question we mentioned above; That is, see if this new news and data can affect people’s orientation and ultimately change in supply and demand. Of course, you don’t have to make a deal right away; Rather, it is enough to think and come to a conclusion whether people’s desire will change based on this news or not, and if there is a change, how and in which direction it will be.

Once you have the answer to this question, you can adjust your trading position and decide if you want to go against the mainstream after the news is released. Of course, if you don’t have a clear answer for it, it’s not a problem; Because we are not supposed to know everything and our choices will always be right.

If you want to accurately and successfully predict macroeconomic events, you must always be up-to-date. Events often have signs. If you pay close enough attention, you will find that people are giving you news about upcoming events such as disease outbreaks or inflation or even war even before the media. Find out who usually predicts the future most accurately and listen to what they have to say and reason.

When you listen to what these people say, you can understand the logic of their predictions to some extent and from now on have your own magic ball and predict the future. By listening and understanding the logic of topics based on available information, you can make more informed guesses about the future. Also, by receiving enough information and logical analysis, you can predict future events and not be surprised when they come.

Monetary policies and digital currencies

In the introduction, we mentioned that governments have their own reactions to macroeconomic events. One of the clear examples was the reaction of the central banks of the world countries to the economic shutdown caused by the spread of the Corona disease. During this period, most of the governments of the world changed their monetary policies.

Monetary policy can be seen as a toolbox that governments and central banks use to control the money supply. Two popular tools of this toolbox are “quantitative easing” and “interest rate changes”. They use these tools to direct the movement of inflation and prices and the economy in general.

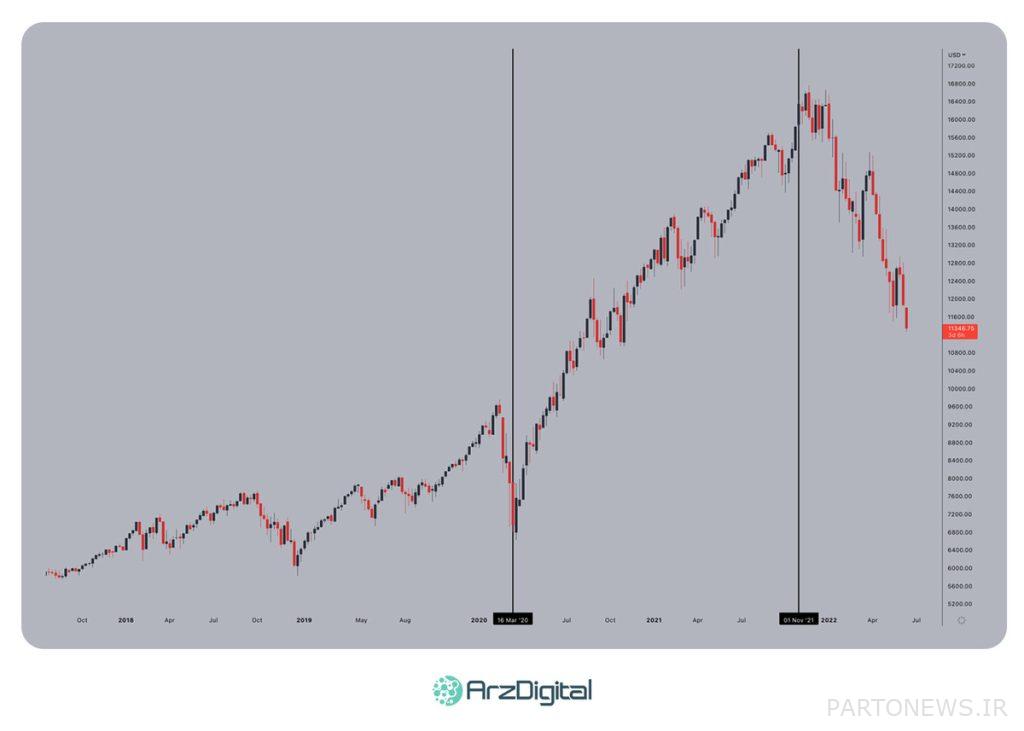

These changes in monetary policies have significant effects on our world and the orientations of investors and traders. In the chart above, you can see that the announcement of changes in monetary policy has caused major changes in price trends, and these changes have become price turning points.

Overall, the last two years have shown that Bitcoin and digital currencies are among those assets that are under the complete control of macroeconomic factors. Although traders are used to trade only based on technical analysis, they should open their eyes to the real world and its potential events and effects and not underestimate these factors.

Conclusion

Navigating the macroeconomic landscape can be complex and difficult in the true sense of the word, and familiarity with its theories and concepts takes time; But devoting time in this perspective will be beneficial not only for trading, but also for people’s financial position. With a more open and transparent view of the macro economy, you can make more informed decisions in the cryptocurrency space and beyond.

Also, by combining your current trading skills such as fundamental analysis and technical analysis or both with macroeconomic analysis, you can become a more competent trader or investor. In general, to experience successful trading, one must be able to analyze the future, not just the present. For this, more time should be spent and the future should be estimated as clearly and accurately as possible. With this approach, you will definitely become a better trader.

Don’t forget that none of the content mentioned in this article should be taken as investment advice. This article intends to say that the future and perspective of macroeconomic events can be very important and influential and cause significant changes in prices. Finally, be aware of your investments and transactions and be sure to spend time analyzing the market and try yourself Predict the next movement of the market using available and reliable news and data.

In your opinion, after the Corona pandemic and the war in Ukraine, what other event in the future can have a significant impact on major markets, including digital currencies?