Indicators for examining the correlation between the US stock market and digital currencies

US stock market correlation with digital currencies is at an all-time high. While most bitcoin holders are at a disadvantage, examining this correlation can be helpful.

To Report Crypto Slate Most digital currencies fell sharply on May 10, losing more than 10 percent of their value overnight. The price of Bitcoin has decreased by 23.57% compared to last month. This figure for Atrium also reaches 26.32%. During the same period, however, US stock market participants suffered less losses. The S&P 500 is down about 11.07 percent and the Nasdaq 100 is down 14.93 percent.

As can be seen in the chart above, digital currencies continue to decline worse than the capital market. Rising interest rates have boosted investors’ desire to avoid risky and volatile assets such as digital currencies.

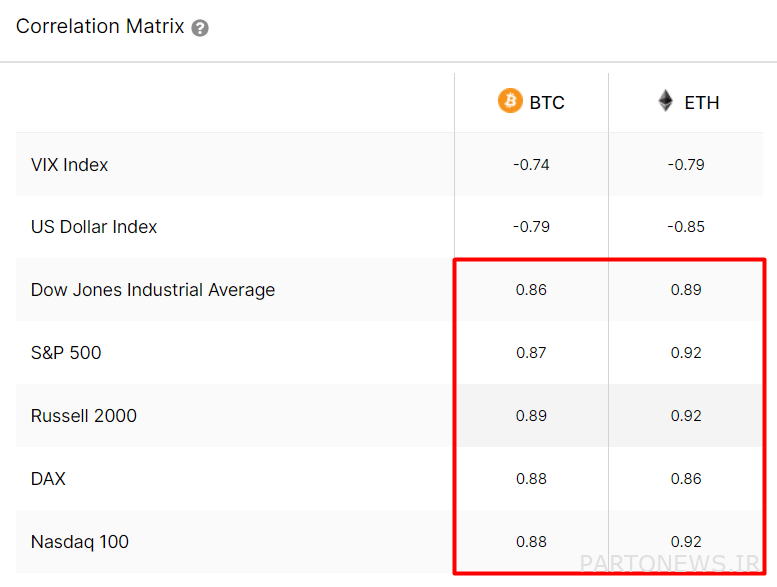

The decline in digital currency prices stemmed from the US stock market on May 10; But this market was able to recover in a short time. As in previous months, the monthly correlation between the digital currency market and US stock indices has strengthened, and even in recent weeks the correlation of Spendpi and Nasdaq indices with Bitcoin and Atrium has reached 0.9, which is the highest level in history.

The fact that the correlation coefficient between the US stock market and digital currencies is close to one means that the correlation between the two is very strong and these indicators have a strong statistical relationship with the digital currency market; As a result, each is aligned with each other, increasing or decreasing. Understanding how this relationship is formed will help you understand how macro markets affect markets such as digital currencies and where you should look for indicators related to the digital currency market.

The recent fall in the price of digital currencies, during which the price of most digital currencies fell by more than 10% in one day, is also before our eyes. This is the second time in the new year that most digital currencies have lost more than 10% of their value. Over the past month, Bitcoin has experienced a 23.57% drop in price, compared to 26.32% for Atrium.

In addition to the external factors affecting the digital currency market, looking inside this market can also be beneficial. Bitcoin still dominates other digital currencies, so let’s look at on-chain data as well.

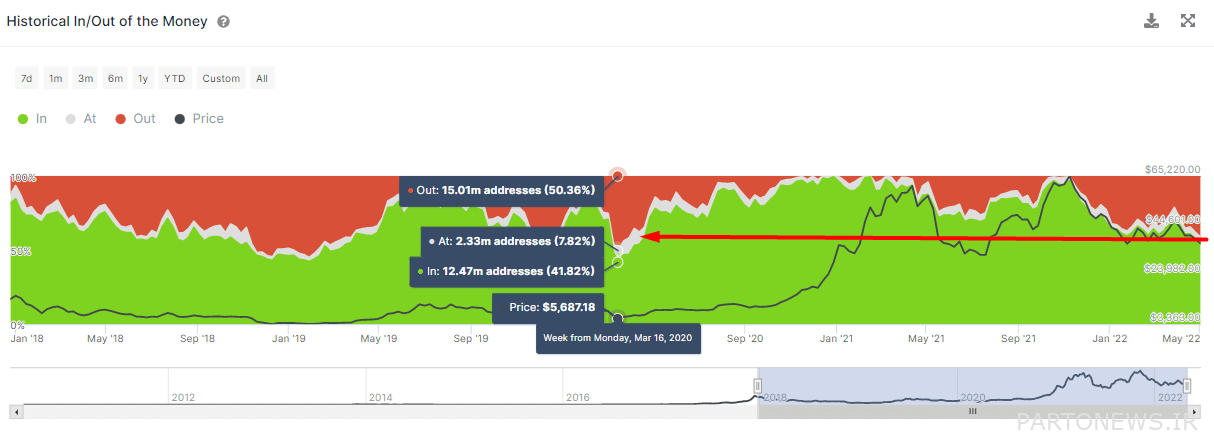

As we already know, investors are sensitive to instantaneous changes that hurt their investments. The position of Bitcoin has become critical in this regard. Almost half of the addresses that have bitcoins (47.8%) will suffer losses if they sell their bitcoins at the current price. This is unprecedented since the peak of the Corona epidemic in March 2020.

This indicator shows us the change in the amount of profits of bitcoin holders over time. The percentage of addresses that would have made a profit or a loss if they had sold their bitcoins at a certain time can also be calculated with this index. Bitcoin addresses in this index are marked based on profit (In), failure (At) and loss (Out).

Although it is always possible for a small number of users to use multiple different URLs, the number of URLs is usually equal to the number of investors. If we look at how long investors have kept their bitcoins, we find that the vast majority (26.74 million addresses) have owned bitcoins for more than a year. As you can see in the figure below, the growth in the number of these people marked with a blue line has not decreased.

The chart shows that the number of bitcoin investors who have invested in it with a long-term outlook is growing, despite recent market turmoil and poor returns on digital currencies; But the number of short-term bitcoin holders is quite different. When significant price changes occur, the number of these people marked with an orange chart increases, and high-risk investments boost the entire ecosystem.

Also read: New data: Weak investors are leaving the market as fears increase

The US stock market started this year worse than it did 83 years ago, raising the question of whether the current market situation could be a good buying opportunity for long-term investors.

The future trend of digital currencies will undoubtedly be affected by the US stock market, although at least most current bitcoin holders have run out of water.