Interbank interest rates are approaching historic highs

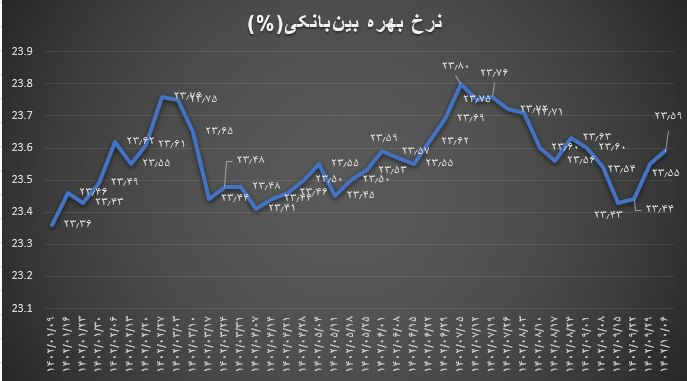

According to Iran Economist, in its latest report, the Central Bank increased the interbank interest rate by 4 hundred percent to 23.59 percent in the week ending on January 6. The highest interest rate this year was on October 5, which reached 23.8%.

According to the announcement of the Central Bank, the interbank interest rate on December 29, 22, 15, and 8 was 23.55, 23.44, 23.43, and 23.54 percent, respectively. This rate was 23.60 percent on December 1.

This rate was 23.63 percent in the week ending November 24 and 23.56 percent in the week ending November 17. This rate was 23.60 percent on November 10 and 23.71 percent in the week ending November 3. The interbank interest rate in the week ending October 26 was 23.72 percent. This rate was 23.76% in the week ending October 19, and 23.75% the week before that.

At the end of the week ending on October 5, the interbank interest rate had increased to 23.80%, breaking a 10-year record. This rate reached 23.69% at the end of the week ending on 29th of Shahrivar.

The interbank interest rate in the week ending on September 22 also increased by 7 percent to 23.62 percent. This rate decreased to 23.55 percent during the week ending on September 15. The interest rate in the week ending on September 8 also reached 23.57% with a decrease of 200%. This rate increased to 23.59 percent during the week ending on September 1. The interbank interest rate has fluctuated in the last two months.

The lowest rate of this market in the last three months was around 23.4. The upward trend of the interbank interest rate started in February of last year; From the week ending December 30th, the interbank interest rate entered the 21% channel and until the week ending February 19th, it fluctuated in the same channel, but from February 26th, this rate set a new record in the 22% channel, and now this rate It fluctuates in the 23% channel.

With the increase in the bank interest rate last week, it seems that the central bank has been forced to increase the interest rate to control the operations of the banks in the interbank market. The interbank interest rate has broken the record of the past years and is close to the ceiling of the corridor.

In response to the increase in the interbank interest rate, the central bank increased this rate from 14 to 22% to 17 to 24%, the interbank interest rate is once again approaching the ceiling of its new corridor, and it should be seen that the central bank Will he allow this ceiling to be broken or not?

Currently, the central banks of the world define an interest rate corridor in monetary policy, the floor and ceiling are defined, and usually the target interest rate is determined in the middle of this corridor, for example, the target interest rate is 18 percent.

In case of proper management, naturally, the interest rate in the interbank market should not go higher than this corridor ceiling or reach a lower number than its floor.

Central banks are currently doing inflation targeting and this is normal, for example, they announce that the target inflation rate is 22% and with the same interest rate, they reach that goal and direct the economy; So, the interbank interest rate, which is called the nominal anchor, is a tool for controlling and targeting inflation that is used all over the world.

end of message/