Interest rate decline in most financial markets in the second week of August

Quoted from Economy News, the interest rate trend in the second week of August has recorded a downward trend in all markets. Statistics show that the most important reductions have been recorded in the interbank market and the primary market of government bonds.

Reduction in the interest rate of government bonds in the second week of August

The interest rate of government bonds decreased in the second week of August. In this market, banks and stock exchanges buy bonds from the government and thus they can contribute to the non-inflationary income generation of the government.

Reviewing the statistics of buying and selling bonds this week shows that most of the bonds bought this week by banks belonged to Arad 106. This will has a profit rate of 21.5%, and this has caused a drop in the balanced profit rate in this market.

The weighted interest rate of government debt bonds this week is equal to 21.54% and has decreased by 0.4 percentage points from the previous week.

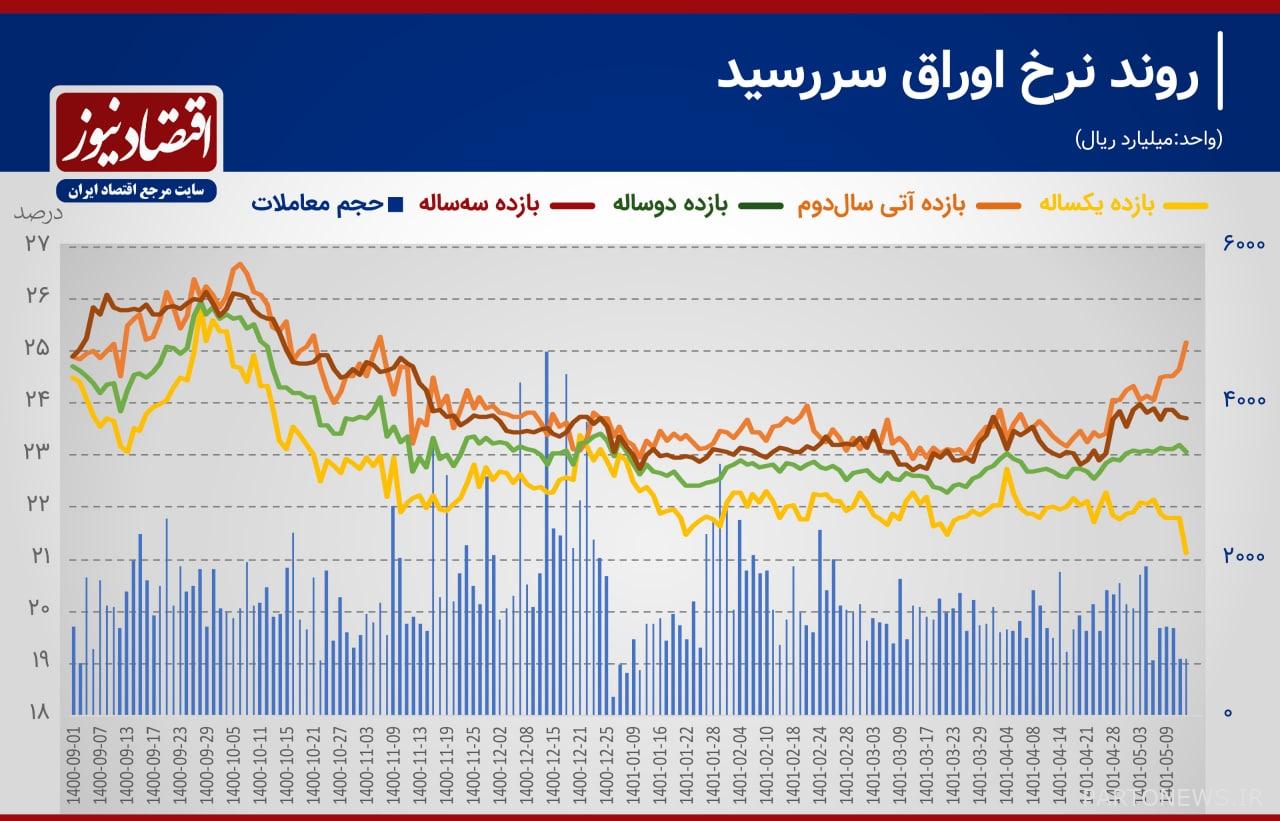

Reducing the interest rate of one-year maturity bonds in the secondary market

For the purpose of liquidity, debt securities purchased in the primary market are traded in the secondary market. According to some economists, the interest rate is very important in this market.

In this regard, the interest rate of bonds with a one-year maturity has been decreasing in recent weeks, while in other maturities, the interest rate has been rising.

In this regard, the interest rate with a one-year maturity date has reached close to 21%, and this index has reached an upward trend beyond the 23% mark in the two-year maturity. In bonds with a maturity date of three years, this trend was also upward and reached 24%.

Interest rate reduction in the open market in the second week of August

Another market where debt securities are bought and sold is the open market. In this market, the central bank buys bonds from banks and somehow lends to these financial institutions with a maturity of one week. The interest rate in this market is of great importance, which has been faced with a decrease of 1.5 percentage points in the last week.

This figure decreased from 21.5% in the second week of August to 20%. A decrease that was somehow in line with the interest rate control in the country.

Significant drop in the interbank interest rate in the second week of August

The interest rate is discovered in the night market or the interbank market. This rate is calculated in a weighted manner from the borrowing of banks with a deficit from banks with a surplus, which are always in the range of 14 to 22 percent.

In the last week, with the change in the Central Bank’s policy of controlling the interest rate, this index, according to some experts, returned to the 20% channel and reached 20.64% with a drop of 0.5 percentage points compared to the previous week. Is.