Is Iran’s stock market approaching the dividend standards? – Tejarat News

According to Tejarat News, not long ago, the issue of reducing the deadline for the payment of dividends of assemblies made news in the capital market. Iran’s capital market supervisory body obliged the companies to reduce the period of deposit of profit and only up to four months after the date of the meeting. According to stock market experts, this issue has led to the capital market becoming more dynamic and, most importantly, the standards of the Iranian stock market have become closer to the financial markets of the world.

According to the information that Investopedia has worked on, if a company is profitable and decides to pay dividends to shareholders, the amount and date of payment of that amount will be announced to shareholders. This announcement date is actually what is called the General Assembly in Iran. In most countries, such as the United States, the general assembly is held quarterly (once every three months); But there is no clear and reasonable standard in this regard. For example, public meetings in England are held every six months and in Qatar (similar to Iran) annually. In fact, it is important to pay interest, which varies from one company to another. For example, the reports of an oil symbol in the Qatar capital market are as follows:

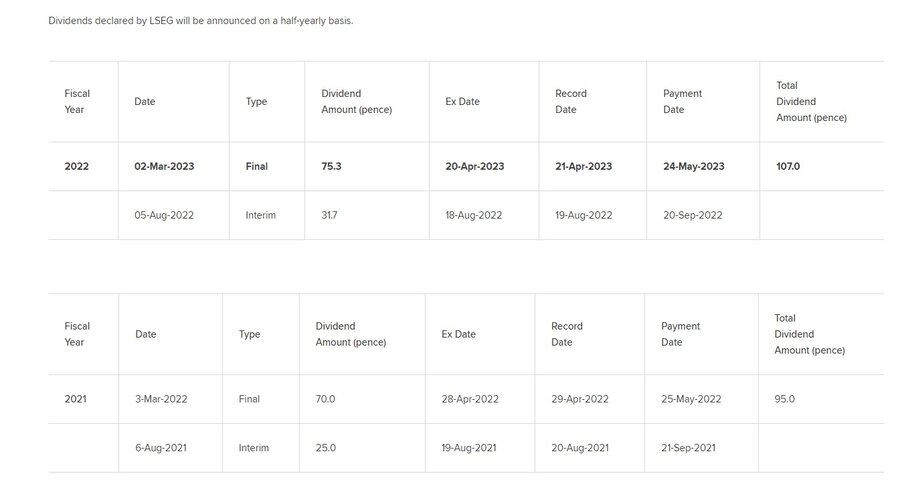

The reports of the symbol LSEG, which is an investor of the London Stock Exchange and has its own tradable symbol, are also as follows:

The payment date is different in different countries and companies.

According to Instopedia, there are several types of dates in this mechanism: the date of profit announcement, the date of registration of profit, the date from which the calculation of profit is transferred to the next period and the date of payment. Interest can be paid in various ways, including cash and credit, and of course in the form of shares. But what is important is the distance between the meeting date and the payment date. Some companies in the world pay dividends the day after the date of the assembly, but usually this process takes up to a month.

In Iran, there are also companies that deposit profits up to one month after holding the meeting; But before the amendment of the new articles of association of the publishers accepted by the stock exchange organization, companies could pay dividends up to eight months after holding the general assembly. Eight months, which has recently been reduced to four months, and this means that Iran’s capital market is approaching the global averages in this regard.

Source: Senate