Is the dollar getting cheaper? / Forecast of financial markets in October 1400

According to Trade News, in the past week, another risk that had cast a shadow over the capital market was removed. The risk of the central bank governor, a position that can take the capital market to the margins or the text of the country’s economic system with its thoughts and decisions.

Now, with the election of Ali Salehabadi, the skeptical scholarship holders are looking at this market with a more confident look today. Evidence of this claim is the low volume and value of stock exchange transactions in recent weeks, which experts say is one of the reasons for the doubts of shareholders.

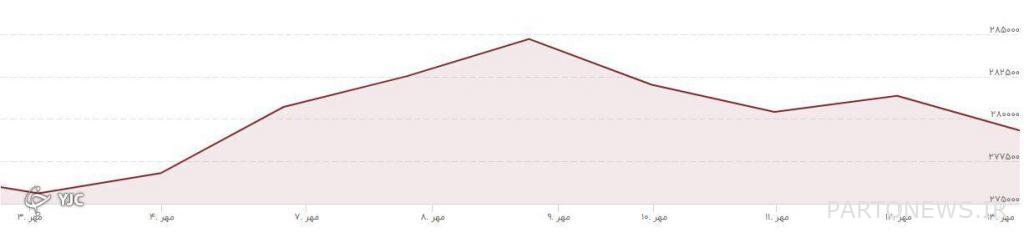

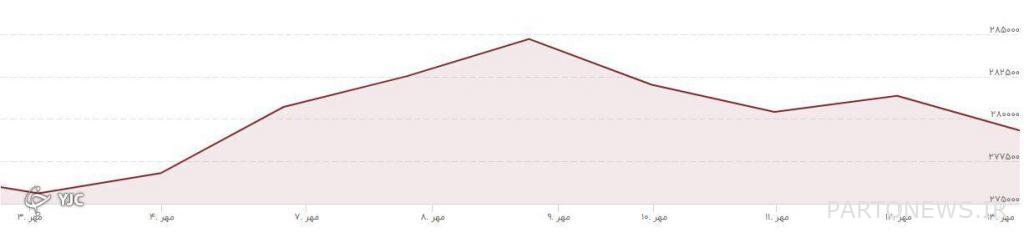

The euro is falling more than the dollar

This week, the exchange rate of the dollar and the euro had a downward trend, and the dollar experienced a 39.5% drop in price, and the euro experienced a 29.7% decrease in the rate, so that the dollar returned to the channel of 27,000 Tomans and the euro returned to the channel of 32,000. The toman had limited fluctuations.

The coin bubble reached 450 thousand tomans

The rate of coins decreased in line with the exchange rate and the coin decreased by 0.8% away from the channel of 12 million Tomans. Each gram of 18-carat gold became cheaper by more than 8 thousand Tomans and stood at the level of one million and 60 thousand Tomans.

Mohammad Keshti-Arai, the second vice-president of the Tehran Jewelry Union, said about the situation of the gold and coin market in the coming days: At the end of month zero, the market will have a good boom, and if the demand for coins increases, there is a possibility of price increases and bubbles for it.

He added: “It seems that the exchange rate will have a downward trend this week, but the global ounce rate does not seem to have significant changes, but with the decrease of the exchange rate in the gold and coin market, the exchange rate will remain in the current range.”

Three factors affected the exchange rate

Reza Zangavi, an economist, also said about the situation in the foreign exchange market in the coming days: “Over the past few years, following various sanctions, the government has always supplied the dollar to the market to control the exchange rate increase and has used the country’s foreign exchange reserves. Importantly, we have witnessed a sharp decline in the country’s foreign exchange reserves. Whenever the government reduces the injection of currency into the market, the exchange rate rises in a short time.

He added: “Currently, there are three main factors influencing the exchange rate. The first factor is the issue of the Vienna talks and its outcome, the second factor is Iran’s decision on the benefits, and the third factor is the economic and monetary policies of the central bank. Everyone hopes that these three factors will be managed in a prudent way in order for the currency issue to be resolved with the coming to power of the new government, but with the coming to power of the new government and the lack of positive developments for these factors, not only did we not control the exchange rate. It has increased by 20%.

Currency is not allowed to enter the country

The economist clarified: “Currently, there is no way for enough foreign exchange to enter the country and the volume of foreign exchange reserves has sharply decreased, and also considering that no action has been taken to return to Borjam, it should be noted that the rate Currency is more than 28,000 thousand tomans.

He said: “But the reason for the reduction of the exchange rate by 200 to 300 Tomans and the return of the dollar to the channel of 27 thousand Tomans on October 5 is due to the election of a new governor for the Central Bank, because people hope to reduce the exchange rate to a new governor.” However, it should be noted that the dollar exchange rate will gradually increase until the ways for foreign exchange to enter the country are provided, and any decrease in price will be temporary, and in the coming days we will see the return of the dollar to the channel of 28,000 Tomans.

The capital market has been neutral in recent weeks

Farhang Hosseini, a capital market expert, said regarding the stock market developments next week: “The market has had a neutral trend in recent weeks.” Major investors and analysts are examining market conditions and making economic decisions based on new conditions. The new directive on feed-in tariffs for refining companies changed the space somewhat, increasing scalability and transparency in terms of timing. In the current market conditions, it is monitoring these cases and possible reactions to them.

The capital market expert asked what events in the coming week could affect the trend of the capital market? He stated: The news of Salehabadi’s appointment as the head of the Central Bank, who has a long history in the field of stock exchange and capital market, can be accompanied by a positive approach of capital market activists in the coming week. On the other hand, the market is focused on the change in currency prices and the influence of export-oriented companies.

He asked the question, what industries can be the market leaders in the coming week? He replied: The world price is jumping and growing, especially in the field of gas products. The $ 80 oil and continued rise in gas prices has pushed up the prices of methanol, urea and gas condensate, which could lead to the growth and profitability of the group, which is part of the petrochemical industry. The group and its holdings have received a lot of attention from market participants in recent weeks and have experienced good price growth, so they have the potential to grow again.

Possible process of cash inflows and outflows

Regarding the possible trend of money inflows and outflows of real and legal market activists, Hosseini said: “The trend of money inflows and outflows from the beginning of the month, although it indicates the outflow of real money, but in general the outflow process is weak and may be in some groups.” Let’s see the arrival of real money. From the end of the week, corporate summer reports are published, which in the groups that had power outages, we will probably see weaker reports than expected, and in other groups, we will see better profits.

The capital market expert pointed to one of the competitors facing the stock exchange and said: the continuation of the government’s policy in selling bonds will also cause fixed income funds to buy these bonds, which can lead to the sale of a part of the shares of these funds in the market. Also, the continuous trend of selling bonds has to some extent led to an increase in interest rates, which is a competitor to the stock market.

Concluding remarks

In the end, it should be said that with the identification of the Governor of the Central Bank, who also has a history of leading the capital market, the systematic risk of investing in the stock market seems to decrease. Also, with the arrival of the time for publishing the six-month reports of the companies and the stabilization of the dollar exchange rate in the channel of 28,000 Tomans and the good growth of the oil price, a positive market promise can be given to the shareholders.

Source: Young Journalist Club

Read the latest news in the field of currency, gold and coins on the Gold and Currency Trade صفحه News page.