It is too early to determine the price floor of Bitcoin

With Bitcoin prices plummeting and recovering, some traders say the digital currency has hit a low. However, to ensure this, we must also consider the correlation between bitcoin and traditional financial markets, as well as the impact of current political conditions.

To Report The Telegraph fell 23 percent in the eight days after February 16, when Bitcoin failed to break its $ 45,000 resistance. On February 24, just after the escalation of the conflict between Russia and Ukraine, the price of bitcoin fell to $ 34,300 and the risk of increasing sales pressure increased.

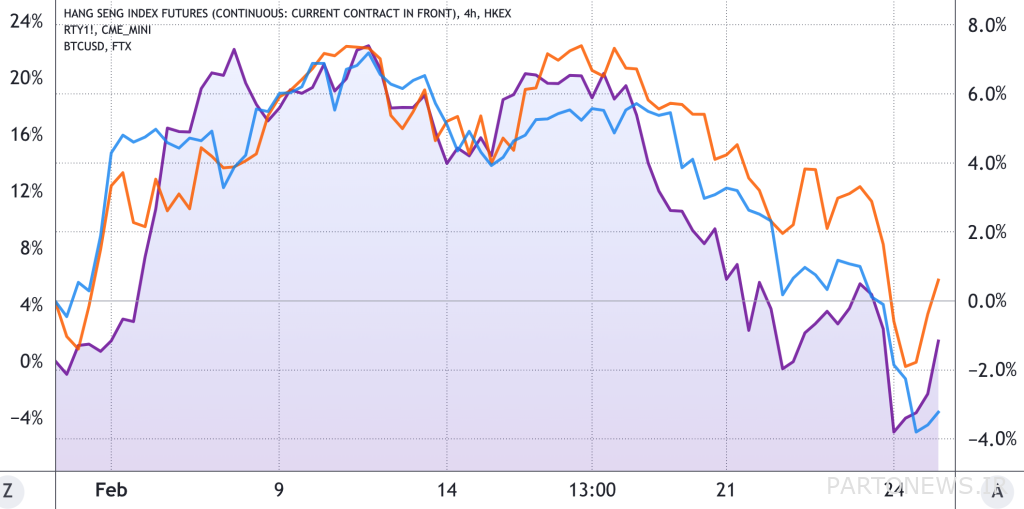

As the price of bitcoin hit its all-time high, Asian stock markets plummeted. Hong Kong stock market index Hang Seng, for example, fell 3.5 percent. In addition, the Tokyo Stock Exchange Nikkei reached its 15-month low.

The question that arises in the first place is whether digital currencies have overreacted to other high-risk assets. Undoubtedly, Bitcoin fluctuates much more than traditional markets, and the annual fluctuation of this digital currency reaches 62% annually.

Compared to Bitcoin, the annual volatility of the Russell 2000 index is only 30%. Russell 2000 is an index used to study the stock market of small and medium-sized companies in the United States. In addition, according to China’s MSCI index, shares of Chinese companies fluctuate by 32% annually.

There is a strong correlation between the price of Bitcoin, the Hong Kong stock market and the Russell 2000 US index. One possible reason for this correlation could be the US Federal Reserve’s contractionary policies to reduce the money supply. During this period, the Federal Reserve slowed down bond redemption and threatened to raise bank interest rates, causing traders to panic and seek to create a safe margin for themselves.

Although bank interest rates did not rise as inflation hit 7.5 percent in January, investors are looking to protect their assets against the devaluation of the dollar and US Treasury problems. It is worth noting that when the feeling of distrust in the market increases, this is quite true.

Bitcoin futures traders are feeling down

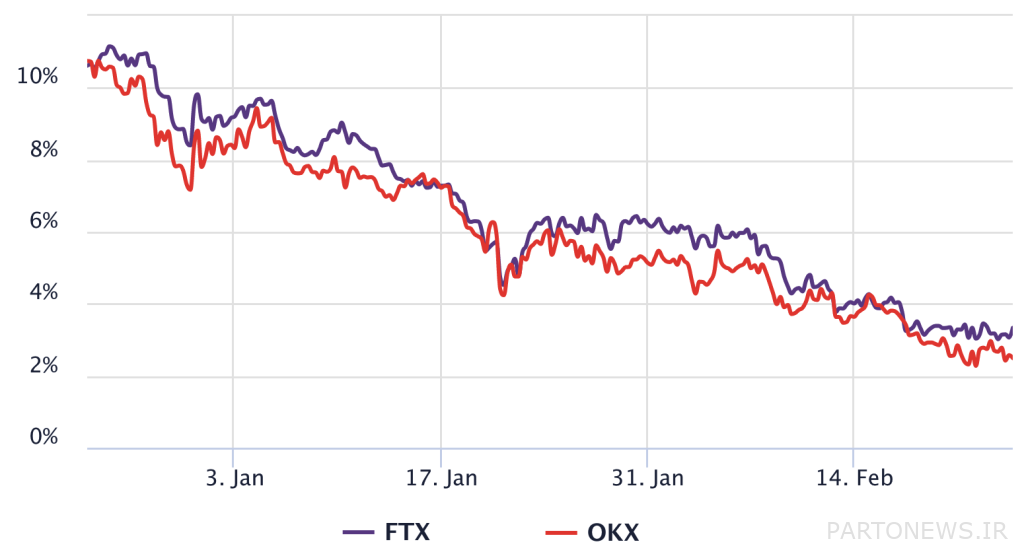

To understand the views of professional traders, we need to look at bitcoin trading in derivatives markets. The annual premium for Bitcoin futures contracts should be between 5 and 12 percent for traders to be willing to lock their money for two to three months, until the end of the transaction maturity date. Premium futures is an indicator that calculates the difference between the price of futures and the price in current markets.

If the annual premium index is less than 5%, it means that traders expect the price of bitcoin to fall sharply. On the other hand, if the annual premium index is more than 12%, it means that traders expect the price of bitcoin to rise sharply. As you can see in the image above, the Bitcoin futures premium index fell below 5% on February 9th. This shows that the professional traders in this market were not sure about the increase in the price of bitcoin.

The current 2.5% premium is the floor of this index from July 20, 2021 (July 29). At this date, the 74-day price correction of Bitcoin was over. In fact, the 71% rise in the price of Bitcoin since that day, reaching a peak of $ 69,000, confirms the theory that the futures index is the only measure of the past.

In the image above, you can see that on July 20, the bitcoin correction had a strong correlation with the Russell 2000 index. However, the situation was quickly reversed; Because Bitcoin was able to start its upward trend independently of traditional markets.

It is too early to determine the price floor

As with the futures index, historical data is used to evaluate correlations. As a result, it is not possible to use it to predict whether the bitcoin trend will change. Investors, especially professional fund managers, tend to avoid volatile assets in turbulent markets.

Understanding the psychology of the market is a very important issue to avoid unexpected price fluctuations. As a result, as long as members of the digital currency market view bitcoin as a risky asset, these short-term reforms should be considered a rule of thumb and part of the process; Not an unexpected event.

So, instead of predicting whether Bitcoin is at its price floor or not, it is better to wait for more signs.