“Jimbo” flew! / Should we put our money in the bank? / Forecast future interest rates

Ibrahim Alizadeh – Mohammad Ali Nejad : He had a smile on his face. Jimbo was able to solve any crisis. But safe from the day he was going to land. It was critical when he arrived. The windows of the watchtower were shaking. If you do not remember this cartoon of the children of the sixties, watch the teaser of the beginning of this cartoon.

But what has Jimbo got to do with these days in Iran’s financial markets?

If you are worried about the future of your economy and capital, read this Business News analysis. The Money Watch series of reports can help you get the most out of the latest market and economic situations in the shortest possible time, and rely on this information to make less risky decisions.

A yellow and red plane. With amazing power. Ready to solve any crisis. You must remember “Jimbo”. Imagine in the Iranian economy during the last year such an airplane has flown with a special mission of collecting people’s money.

The latest statistics from the country’s central bank show that something important has happened in the year leading up to October this year. 45% growth in bank deposits. A figure equivalent to 1500 thousand billion tomans. With the addition of this money to bank deposits, the total volume of bank deposits has reached 4800 thousand billion tomans.

If we consider the average amount of deposits in banks even 100 million Tomans, during the last year ending in October of this year, 15 million people had new deposits of 100 million Tomans.

Now, if we divide the total bank deposits by the total population of the country, on average, every Iranian has 57 million tomans of money in the bank.

With these figures, it seems that “Jimbo” has skyrocketed in the Iranian economy, and in the last year, while the financial markets have been even lower than inflation on average, money has moved to the banks.

But did those who took their money to the banks win? Did they make a real profit or did they make at least 15% on paper alone? Has inflation allowed them to make a real profit?

Winner among markets but victim of inflation!

The latest statistics from the Statistics Center of Iran show that point-to-point inflation was 36 percent and one-year inflation as of January this year was 42 percent. With this figure, those who have deposited in the bank during the last year have not made a real profit. The interest rate announced by the central bank for a period of one year is 15%, but even if a bank has gone further and claimed a profit of up to 24%, the depositor has not made as much interest as inflation.

Earlier, Tejarat News reported in a report on bank interest rates that some banks have promised to give up to 24% interest.

However, these depositors seem to have won compared to financial market participants. During this one-year period, the returns of the financial markets, including the dollar, gold, stock exchanges and housing, averaged only 10%.

However, if we look more closely, the dollar with 3%, gold with 3% and the stock market with 6% return were not as profitable as bank deposits. But in the housing market, the 29 percent price increase reported by the Statistics Center shows that presence in this market has been cheaper than depositing in a bank.

These returns, including $ 25,800 Tomans on February 14 last year and 26,650 Tomans yesterday, gold of 1,165,000 Tomans on February 13 last year and 1,203,000 Tomans yesterday, stock market index of 1,214,000 units on February 12 last year and One million and 284 thousand units were calculated yesterday.

However, the car market has been a little different. According to the Statistics Center of Iran, in the group of durable goods, including home appliances and cars, the increase rate was 35% during January last year to January this year. So bank depositors seem to be stagnant compared to the commodity market, but probably the best benchmark for comparison is the average return on financial markets, which seems to have been better for depositors.

Should we put money in the bank or not?

The important question is, given the current trend, should we leave our money to the banks now or not? Comparing the potential returns of financial markets, the future of inflation, the future of macroeconomics and the future of banks are four important components in this decision. Watch the video below to explain this process and answer these questions.

What signal do the state of the financial markets give us? A possible Iranian deal and a possible orderly collision in the foreign exchange market are two components that mitigate the scenario of a significant increase in the price of the dollar over the next year.

Even if no agreement is reached, it is unlikely that a currency jump will occur at the beginning of the new government’s term, the first year of the presidency. This can be deduced from previous experiences of the Iranian economy, which usually did not have a significant fluctuation in the price of the dollar during the tenure of the first government of previous presidents.

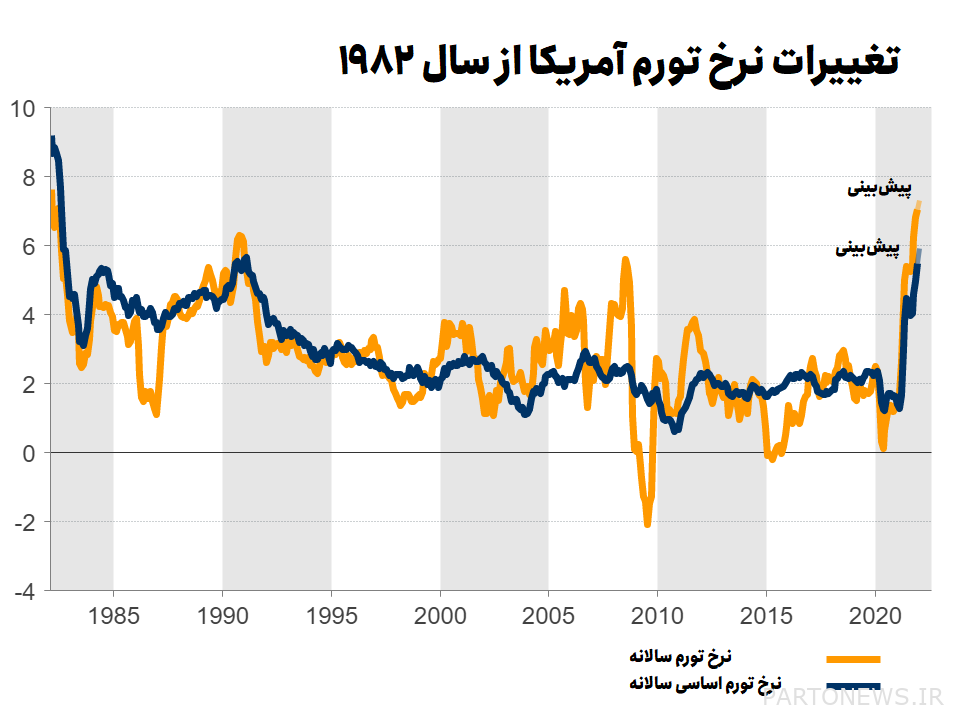

With this forecast of the dollar exchange rate, a significant jump in the gold market can probably not be expected. In addition to the price of the domestic dollar, the global gold rate is also an important factor influencing the domestic gold market. One of the most likely factors influencing the future of gold is the change in US interest rates. Foreign media reports in recent days suggest that interest rates in the United States are likely to rise due to inflation control.

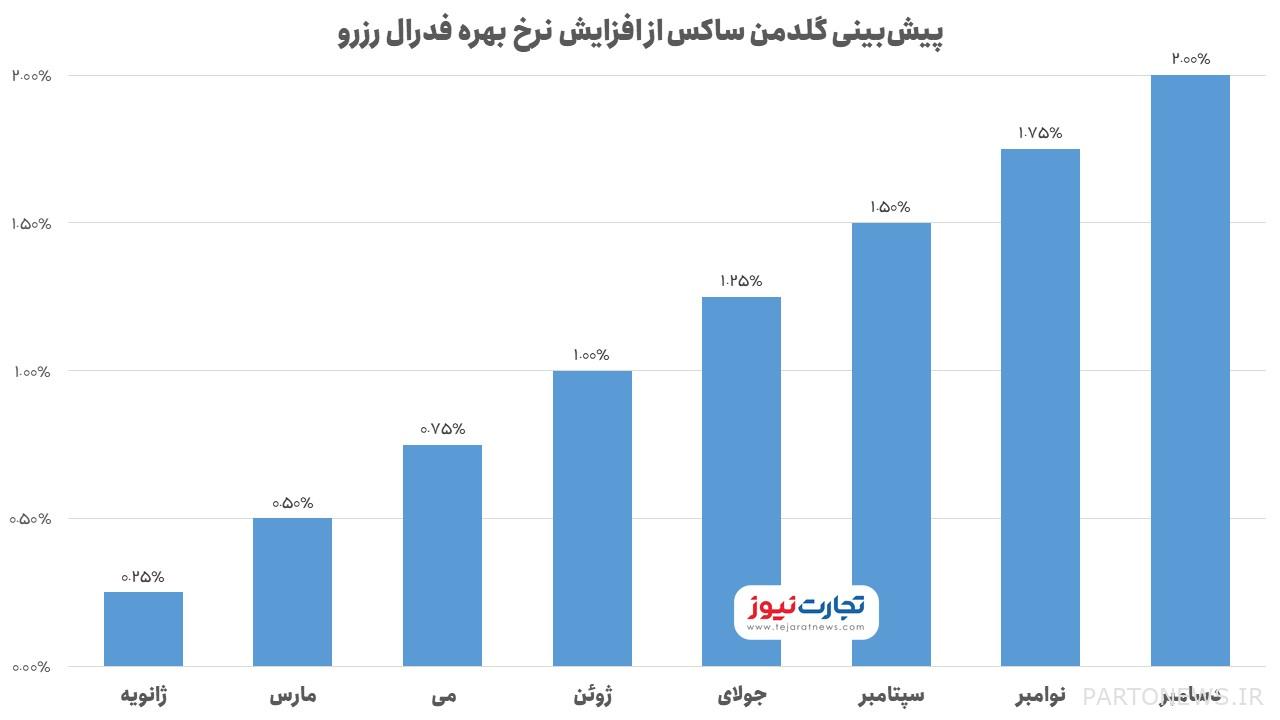

Goldman Sachs Investment Bank predicts that the Federal Reserve will raise interest rates seven times this year to curb inflation, which has been unprecedented since 1982.

Inflation was 7.5 percent in January, the highest level since 1982. This inflation has not only affected food and energy, but has also affected household appliances and health insurance.

According to Goldman Sachs economists, the Federal Reserve is likely to raise interest rates by 0.25 basis points over seven consecutive phases and possibly raise interest rates to 2 percent by December.

If these predictions come true, this US contractionary policy is likely to have a negative impact on the future of gold.

With this, it can not be expected that the domestic gold market will be stimulated by demand.

The stock market, too, with the current trend, seems very unlikely to be able to take a significant leap forward over the next year.

For a more accurate forecast of the markets, you can read the previous report of Trade News with the headline “Dollar, Gold and Stock Exchange after the lifting of sanctions”.

But there is a common factor in the housing and car markets, and that is the great promise of the government. If the government fails to build one million national housing units a year and increase annual car production to three million units, the two markets may fluctuate, but these fluctuations are unlikely to occur within the next year. Most financial market experts have predicted in trade news news live that by at least 1403, the housing market is unlikely to emerge from recession.

But in the car market the situation is a little different. It is possible that the government’s promise will not be fulfilled sooner and the same situation will be repeated this year. However, it may not be true to compare a bank deposit as an investment with a market return like the car market. At the same time, according to many experts, in the next one-year period, due to the possibility of continued high inflation in the Iranian economy, buying housing and cars with a consumer view seems reasonable.

Important signal of inflation

What will happen to inflation? The answer to this question is very important for financial markets. The passage of liquidity growth of 41% in the latest statistics of this year related to the one-year period ending in December of this year is an important signal. This rate was 38% in the same period last year.

In the one-year period ending in December this year, the monetary base growth rate was 38%, which was 30% in the same period last year.

Perhaps it is because of these important monetary variables that the World Bank forecasts 41 percent inflation in Iran’s economy in 2022. At present, inflation in Iran’s economy is 42%, and with this trend, the scenario of a sharp decline in inflation seems a bit unlikely.

The Parliamentary Research Center also predicts that the government will have a budget deficit of 150,000 billion tomans to 300,000 billion tomans next year. With this trend, if inflation continues, it is natural for the government to pursue a contractionary policy, which will mean an increase in bank interest rates. This issue can also be seen in the unofficial news from the banks, which have unofficially caused the central bank to react by raising interest rates. In recent times, the central bank has repeatedly warned banks not to promise to pay interest rates above 15% approved by the Monetary and Credit Council to customers.

In the macroeconomic sector, the continuation of the recession and the markets also send the message that liquidity in the markets may be a little difficult, and this will make depositing in banks more attractive.

The future of banks

But how reliable is the future of banks? In the latest reports published from the financial statements of the country’s banks, a picture of the banks is obtained, which is very worrying.

This sentence was a description of the current situation by the newspaper Dunya Eqtesad. According to a recent report by the newspaper, based on these financial documents, out of a total of 27 banks examined, 12 private and state-owned banks have accumulated losses and 15 banks have no accumulated losses. In total, the accumulated losses of 12 banks have been reported at 299 thousand and 318 billion Tomans, the highest of which belongs to Ayandeh Private Bank with 81 thousand and 955 billion Tomans and the lowest to the Cooperative Development Bank with 949 billion Tomans.

Among the 12 loss-making banks examined are six national banks, Sepah, Agriculture, Housing, Export Development and Development of Government Cooperatives, and six banks Ayandeh, Sarmayeh, Shahr, Iran Zamin, Dey and Parsian Private.

Bank Mellat with accumulated profit of 15 thousand and 350 billion Tomans in the first rank, Pasargad with nearly 14 thousand billion Tomans in the second, Saderat with nearly 2.5 thousand billion Tomans in the third, Tejarat and Saman each with about 1.6 billion Tomans in the fourth and Fifth, Mehrairan is sixth with 1500 billion Tomans and Eghtesadnovin is seventh with 1300 billion Tomans. Middle East, Entrepreneur, Sina, Resalat, Bank of Industry and Mines, Post Bank, Welfare and Tourism with 1122 billion Tomans, 1024 billion Tomans, 714 billion Tomans, 658 billion Tomans, 653 billion Tomans, 437 billion Tomans, 375 billion Tomans, respectively. 10 billion tomans are in the eighth to fifteenth ranks.

But previous experience of the Iranian economy in monetary institutions shows that relying on whether a bank is unprofitable or not can not be a very decisive criterion for decision making. These banks are all licensed by the central bank, and in case of any problems, the central bank must be held accountable. In the previous experience, the government was willing to spend more than 30,000 billion tomans for institutions to ease the crisis a little. So the government was even persuaded to pay depositors at the cost of printing money and creating inflation.

With this trend, it seems that depositing in loss-making banks will only increase the transaction costs of depositors. In fact, in the event of a problem, they may encounter events such as accessing their deposits later.

Overall, the low probability of a sharp decline in inflation, the low probability of a significant boom in the markets and the unofficial news of rising interest rates in some banks are three factors that may make a non-consumer investment look reasonable over the next year. But if things like the erasure of the Iran deal option are raised among the scenarios, naturally, this prediction can not be relied on much. In the event of such an event, Jimbo may be forced to land, which will frighten the markets, and the future scenario may be slightly different. In the Wonderful Plane cartoon, Jimbo landings always brought different crises.

Read the latest Money Watch reports here.