June 2022 ended, but the price of Bitcoin reached the record of 2017; Browse analysts’ opinions

With the end of June, the price of Bitcoin managed to remain higher than the record price in 2017 (2016). Bitcoin’s worst month and worst season since 2011 ended with Michael J. Burry warning of a continued fall in the US stock market.

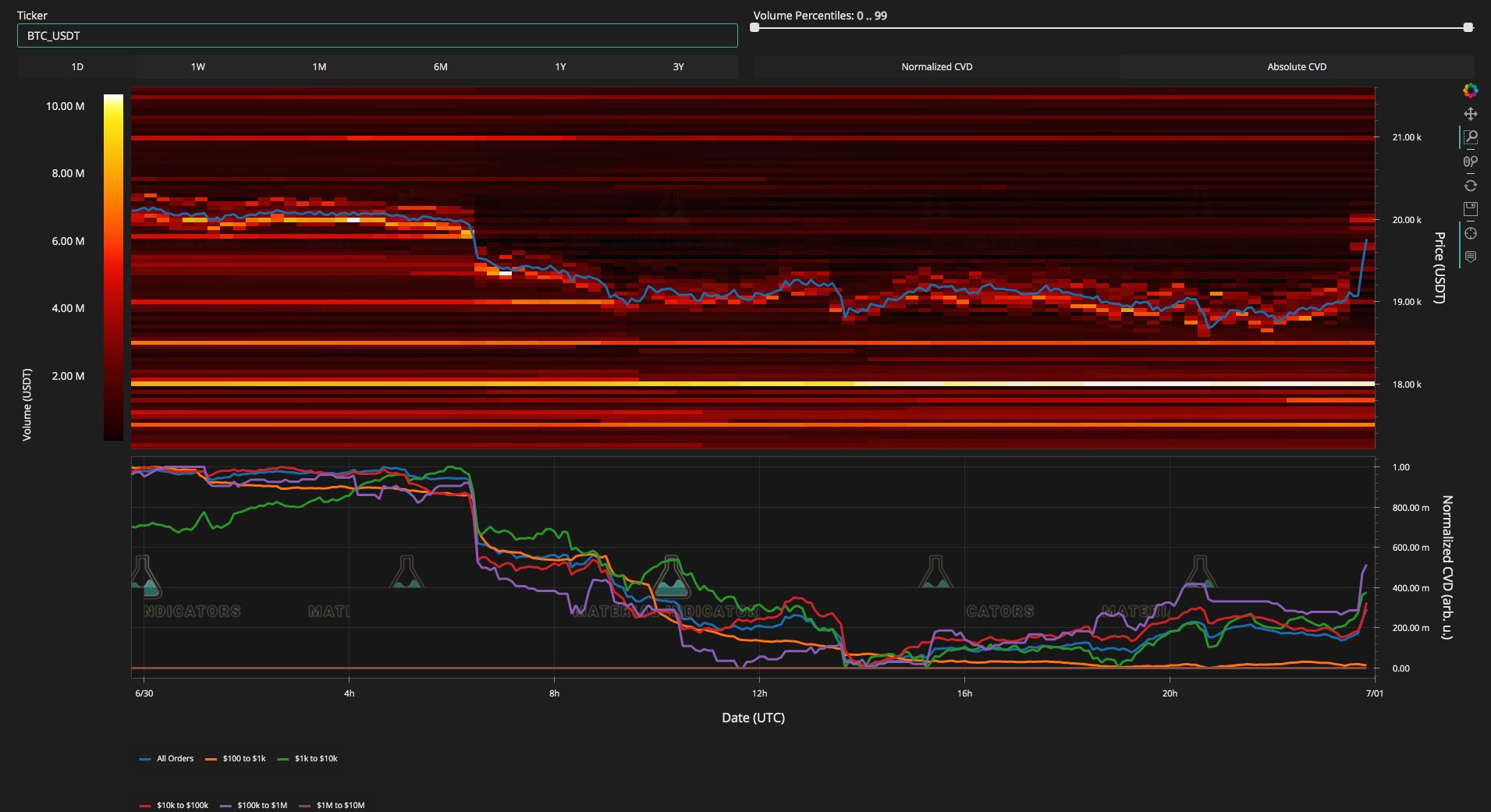

To Report Cointelegraph, the price of Bitcoin remained below the $20,000 level in the last hours of the previous month, before bulls raised the price to prevent a 40% drop in the price of Bitcoin this month. to take

Analysts: It is possible that the price of Bitcoin will remain unchanged for months

The data shows that the price of the Bitcoin/US dollar currency pair increased at the end of the month and reached $19,924 on the Bitstamp exchange.

This caused the monthly price of Bitcoin not to close below the highest record in the previous halving cycle for the first time. The halving of Bitcoin mining reward is called halving. The Bitcoin price of Bitstamp exchange was around 37.3% in November 2017.

This was perhaps the least he could do this month. The month in which the Bitcoin market witnessed its worst fall since September 2011. However, this small price increase was short-lived and on the first day of the new month, the price returned to $19,000.

Philip Swift, creator of the indicator and analyst at the Decentrader trading suite, added in a Twitter comment after the price close:

We consistently get a cycle below this price.

Bitcoin lost such value when the US stock market also went down. According to analysts, the second quarter of the new year was the worst season for the S&P 500 index since 1970 and the worst season for the Nasdaq index since 1998.

Michael J. Michael J. Burry, Big Short investor, adds:

Adjusted for inflation, in the first half of 2022, the S&P 500 index decreased by 25 to 26 percent, the Nasdaq index decreased by 34 to 35 percent, and Bitcoin decreased by 64 to 65 percent. This situation was a multiple compression, after that it will be the turn of earnings compression. So maybe we are halfway there.

Also read: Bitcoin price drop to $19,000 with Federal Reserve warning again about inflation growth

Blockware senior analyst William Clemente told his Twitter followers:

There is talk everywhere of identifying a new price floor or recommending accumulation. Everywhere, big lenders and borrowers are collapsing, and it’s the worst season on record. People with their blind faith hating non-investors and market naysayers blame us, the entire timelines say it’s different this time. If we have reached the accumulation zone, the price situation will probably be flat for months and many will give up and leave the market.

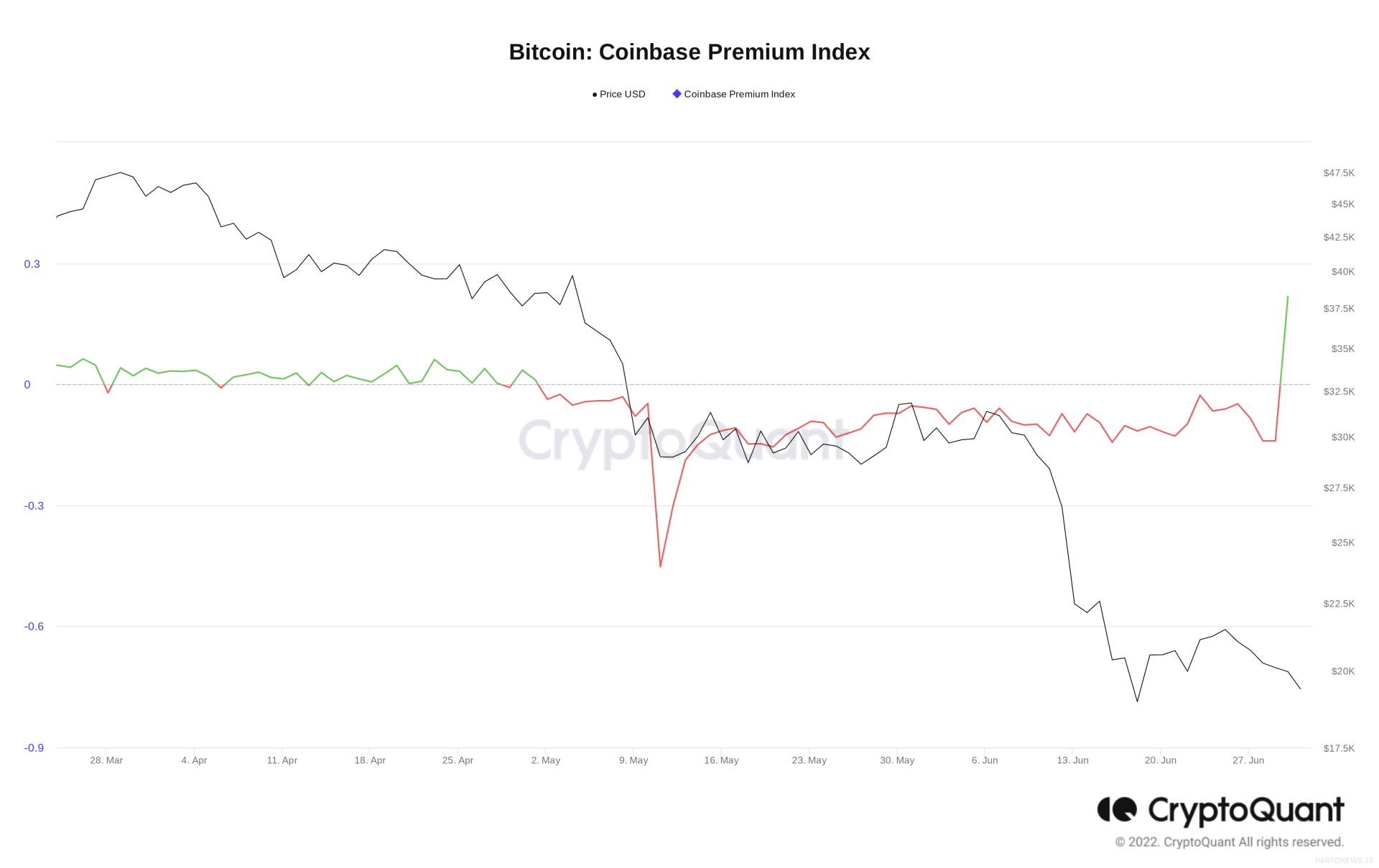

Bullish signal with Coinbase Pro review

However, there are positive signals among institutional investors to buy Bitcoin at $20,000.

Coinbase Premium returned to positive territory yesterday for the first time in two months, as shown by the on-chain analytics platform CryptoQuant. The premium represents the difference between the price of Bitcoin on the main exchange Binance and Coinbase Pro, the institutional arm of Coinbase in the United States. The positiveness of this indicator means that investors have a stronger presence on Coinbase Pro, which means that there is more demand. Yesterday’s premium value was around 0.217.

Ki Young Ju, CEO of CryptoQuant, commented on the data:

An increase in this index does not necessarily mean an increase in price; But it certainly shows that institutional buyers are active in this price range.