Kegel’s fundamental analysis / the effect of global market fluctuations on Gol Gohar’s profitability – Tejaratnews

According to Tejarat News, a look at the annual financial statement of Kegel in the fiscal year 1401, which was published on the Kodal website, indicates a decrease in the company’s income in 1401 compared to 1400. So that the company earned 44 thousand 455 billion tomans from the sale of its products this year. Meanwhile, the company’s income in 1400 was about 49 thousand 87 billion tomans.

Decrease in profit making in 1401

The negative point of Kegel’s 1401 financial statement is the growth of the company’s production costs despite the decrease in its income, which has severely reduced Kegel’s profitability. In such a way that the total price of Gol Gohar products in 1401 has reached 32 thousand 737 billion Tomans from 26 thousand 229 billion Tomans in 1400 with a growth of 25%.

In addition, the general expenses of the company have also increased by 58% in this period compared to the fiscal year 1400. All these caused Kegel to not be able to increase its profit compared to 1400.

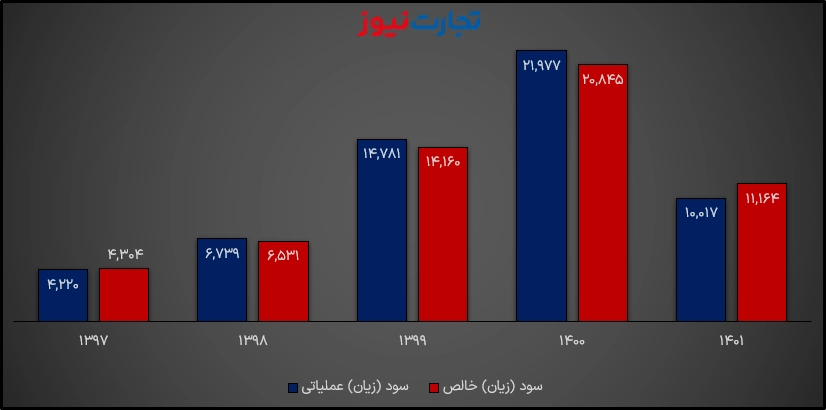

In this way, Gol Gohar Company recognized about 10 thousand and 16 billion Tomans profit from its total operations in the fiscal year 1401, which was more than 54% less than the year 1400.

Of course, the company’s net profit was equal to 11 thousand 164 billion Tomans at the end of this financial year, despite the increase of about three times the company’s financial expenses due to the tax exemption in 1401, which caused the company’s net profit to exceed its operating profit.

It should be mentioned that this number has dropped by 46% compared to the profit of 1400, which was also subject to tax.

Increase sales

The noteworthy point of Gol Gohar Company’s production and sales performance report is the increase in the company’s sales in 1401 compared to 1400. Meanwhile, the company could not increase its profit this year.

To explain the decrease in the profitability of Gol Gohar, at first glance, we can refer to macroeconomic parameters. Because with the increase in the interest rate of the Federal Reserve, the price of commodities has decreased in the world markets. But a look at Gol Gohar’s financial statements shows that the domestic market is the target of this company. Because last year only 13.92% of the flower products were exported.

However, policies such as the mandatory reduction of sales prices in the commodity exchange, preventing the export of products and imposing heavy export duties, as well as cheaper sales conditions of products due to the embargo, caused the company’s products to face a price reduction in 1401.

This is while in the year 1401 dollars experienced a jump of more than 80%, and this has caused the expectation of inflation at the end of last year and following it this year. In this way, with the growth of the dollar price, the company’s production costs will also increase, and its impact will be more visible in the future.

Due to the fact that the fluctuation of global commodity prices is normal, but the mentioned policies can lead Gol Gohar to the swamp of losses.

Read more reports on the stock news page.