Last month, Defy’s token tokens and Quincy Prius tokens had the best performance

In April, tokens related to first tier networks and decentralized finance (DeFi) protocols caused the most losses to their investors compared to other sectors. While other sectors had similar conditions, in those 30 days of privatization, the coins were the only group that was profitable for their investors.

To Report Quinn Desk, Kraken’s research last week shows that memes such as the Dodge Quinn and Shiba Inu performed relatively better in April than other categories. In addition, while April is a relatively good month for digital currencies, the price of decentralized finance tokens, or Defa, including Aave and Thorchain, has fallen sharply during this period.

Defy tokens, as well as tokens related to the first layer networks or the basic blockchain blocks, lost 34% and 33% of their value in April, respectively. Bitcoin, meanwhile, has fallen about 17 percent this month. It should be noted that the protocols in the Difai section use smart contracts instead of third parties to provide their services (in areas such as token transactions and lending).

Diffie tokens have lost an average of more than 71 percent of their value over the past year, making investors the biggest losers in the market. However, the price of Atrium (the native Atrium blockchain native token on which most Diffie protocols are built) has grown by 3% during this period.

In the past month, however, the lowest loss among active tokens in the defense sector was 22% and the highest loss was related to the Chinese bull with a 51% decrease in price. Among the tokens related to the first layer of corrugated blocks, the price of Solana, Olench and Near Protocol has decreased by more than 34% in these 30 days.

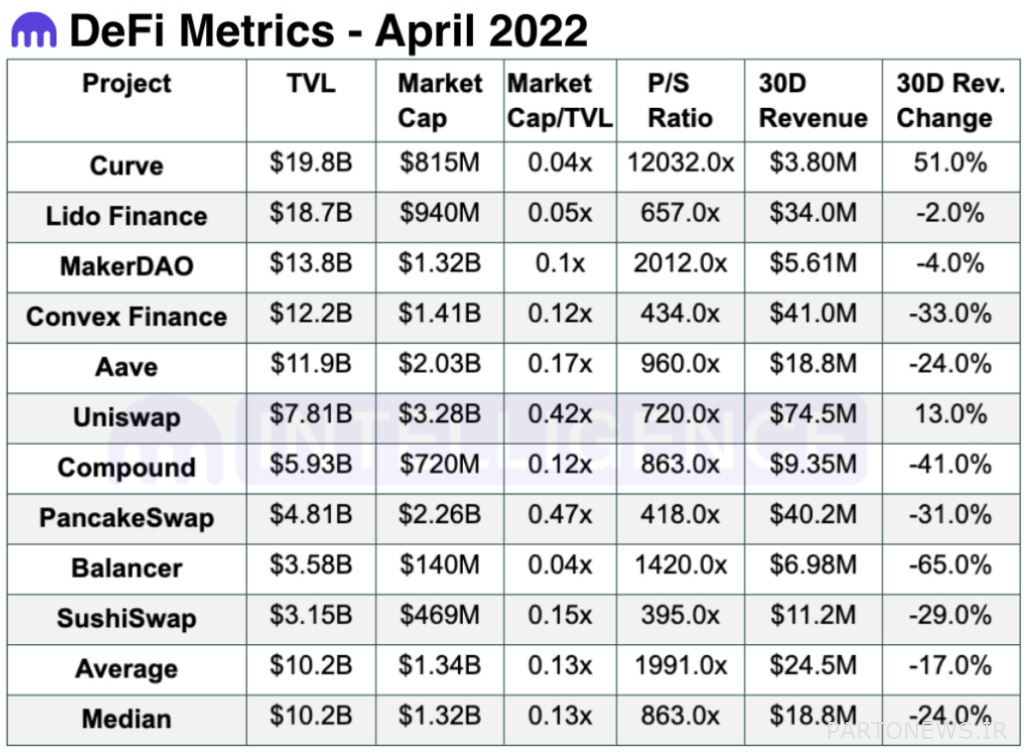

In April, the revenue of the protocols in the defense sector also decreased. The revenue from these protocols comes from users’ financial activities, and traders have to pay a small amount of their trading volume to the protocols as a fee. The reason for this decrease in income was probably the decrease in the price of Defai tokens and as a result, the decrease in investors’ interest in them.

For example, this month the revenues of the SushiSwap platform and the decentralized Balancer exchange fell by 29% and 66%, respectively. CoinGecko data show that swap and balance sushi tokens also lost 45% and 18% of their value last month, respectively.

Crow and Uni Swap were the only Diffie projects whose revenue increased last month. Revenues for these protocols grew by 51% and 13% in April compared to March (March), respectively. However, as it turns out, the positive fundamentals associated with these projects have failed to attract buyers to the market for these digital currencies; Because the price of their tokens has decreased by 15% and 34% in these 30 days, respectively.

Exchange memes and tokens performed relatively better than other digital currency categories. The price of honey coins fell by an average of 19 percent in April and the price of tokens by exchanges such as OKX and FTX fell by only 13 percent. However, the best performance comes from the price of coins like Monroe, which have risen an average of 16 percent in the past month.

In addition, although the number of NFT users in April did not change much from previous months, trading activity in this area increased and the average daily trading volume of these tokens and their average transaction amount was about 40%. Has become more.

Last month, CryptoPunks, a popular Atrium-based NFT suite, lost its popularity among investors, falling to third place in terms of market value of NFT suites. On the other hand, with the increasing popularity of Bored Ape Yacht Club NFTs, this $ 2 billion market value was able to climb to second place.