Long-term bitcoin holders are buying at current prices

Despite the fact that some bitcoin investors are at a loss, the available data show that the long-term holders of this digital currency continue to accumulate new units and are not willing to offer their inventory in exchange offices.

To Report Kevin Telegraph In declining markets, there are usually periods when sales pressure is extremely high. In these periods, investors become discouraged and eventually abandon their trading and investment opportunities. Finally, as the inflow or selling pressure decreases, a stabilized price or flooring process begins in the market.

According to recent reports on the analytics website Glassnode, the holders are currently the only ones left in the market, and the group appears to be buying new units with price adjustments below $ 30,000; Hoping that prices will rise again in the future.

To prove the decrease in the number of new buyers, it is enough to examine the number of wallets with non-zero inventory. These wallets started their downward trend after the increase in sales pressure of the digital currency market in May 2021 (May 1400) and last month they also faced a decrease in number.

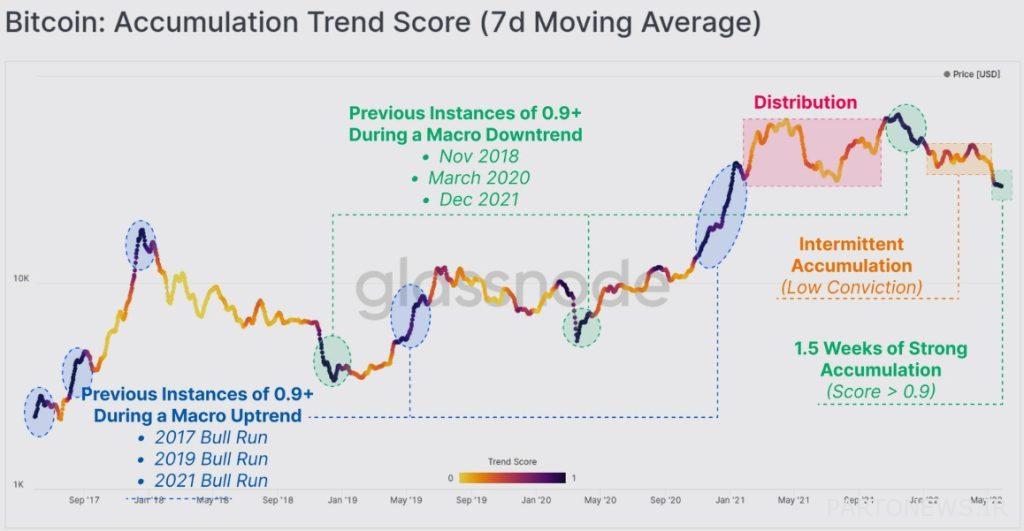

Sales pressure in March 2020 (November 1998) and November 2018 (November 1997) was accompanied by an increase in intra-chain activities. These same activities started the next growth of bitcoin. Contrary to that, the latest wave of bitcoin sales pressure intensification still can not indicate the influx of new users into the market. Golsnood analysts say this indicates that the current activities of the Bitcoin network are mainly related to the holders of this digital currency.

Signs of accumulation in the Bitcoin network

Many investors are disinterested in the bitcoin process due to the lack of volatility; But some investors see this as an opportunity to accumulate. This has led to the bitcoin accumulation trend in the last two weeks reaching a point almost above 0.9.

According to Golsnood, bitcoin will reach high points in the index when it has undergone a very significant correction. Moreover, at this time the psychology of investors shows that they have passed the stage of “distrust” and have reached the stage of “accumulation of value”.

Ki Young Ju, CEO of CryptoQuant, an analytics platform, also noted that the bitcoin market is entering an accumulation phase.

He wrote on Twitter:

The previous bitcoin accumulation period was in the middle of 2022 and lasted 6 months. Now in May 2022 (May 1401), I am personally convinced that Bitcoin is in a period of accumulation. The institutional investors who set the digital currency up in 2021 were buying when Bitcoin was in the $ 25,000 to $ 30,000 range. The main question is why “should not” [در چنین شرایطی] Buy Bitcoin?

Upon closer inspection of the data, it can be seen that the recent accumulation of bitcoins has been done mainly by addresses with less than 100 or more than 10,000 bitcoins in stock.

During the recent fluctuations, the total inventory of addresses with less than 100 bitcoins has increased by 80,724 units. Golsnood emphasizes that this amount is remarkably similar to the 80,081 bitcoins sold by the Luna Foundation.

Holders with more than 10,000 bitcoins, on the other hand, added 46,269 bitcoins to their inventory during the same period. In addition, addresses with between 100 and 10,000 bitcoins were more neutral, and their bitcoin accumulation trend still received an average score of 0.5. As a result, their net assets have not changed much.

Long-term holders are still active

Bitcoin long-term holders seem to be the driving force behind its current trend. Some of these holders are actively accumulating bitcoins, while others have lost an average of 27%.

Despite the sale of some long-term bitcoin holders, the total wallet balance of these investors has recently reached a record high of 13,048 million units.

Golsnood said:

We can expect this index (long-term holder inventory) to increase in the next 3 to 4 months until significant redistribution occurs in the Bitcoin network. This indicates that the holders are gradually accumulating units in circulation and maintaining their inventory.

In general, recent Bitcoin fluctuations may have eroded some of its most committed holders; But the available data show that most stubborn holders of this digital currency are unwilling to sell them, even if they have to hold their inventory at a loss.