Luna Foundation buys another $ 100 million in bitcoin; Price recovery or further correction?

Many analysts believe that bitcoin has now gained significant support and the fate of the market in this area will be determined. In addition, the Luna Foundation, which recently purchased another $ 100 million in bitcoin, has lost $ 200 million in total bitcoin investment following recent price declines.

To Report Bitcoin Telegraph has kept traders nailed this week; Because its key protections are about to break.

Market data show that after several tests of the $ 40,000 level, the levels below remain almost intact.

The downward trend of bitcoin these days has been partly influenced by macroeconomic conditions, and this decline has caused the level of $ 40,000 to have a lot of collisions during this period. Bitcoin prices fell as technology companies fell, losing almost all of their gains since the second half of March.

Now, the $ 30,000 to $ 40,000 range is once again a short-term target, and Bitcoin may see a repeat of the 2022 first quarter trend.

One of the support levels that has worked so far is the $ 39,600 level, which, despite being broken several times, buyers can still show their strength in that area.

Prominent analyst Scott Melker wrote on Twitter:

The major bitcoin levels are currently $ 45,500, $ 42,000 and $ 39,600.

The analytical website Whalemap on Tuesday pointed out that if the price falls below $ 39,600, the areas where the whales will buy will probably act as support for bitcoin.

Crypto Ed, meanwhile, another popular market analyst, is looking at $ 38,600 as a short-term target and the area where the bitcoin boom begins. This shows the difference of opinion of different people about the rate of bitcoin decline.

As previously reported, Arthur Hayes, former CEO of the BitMEX trading platform, predicts that the world’s largest digital currency will reach $ 30,000 in June.

Kevin Svenson, a digital currency analyst and trader, has also used the 600-day simple moving average (SMA 600 – blue line in the image below) as a key level of support for Bitcoin over long periods of time. The line can mark an important event.

He said:

Bitcoin has not recorded a single daily candle below the simple 600-day moving average since the decline of the Corona epidemic. Also, this index has been a very strong support for Bitcoin since mid-January. The 600-day moving average is currently priced at $ 39,250.

The Luna Foundation’s purchases are accompanied by a loss of $ 96 million

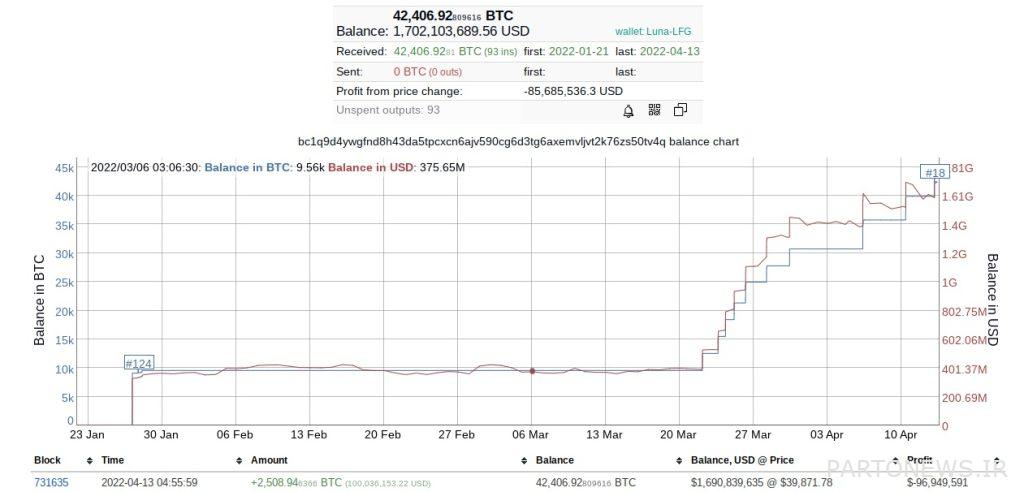

Despite falling prices, the new bitcoin buyer continues to work as before. Wallet data from the Luna Foundation (LFG), a non-governmental organization affiliated with the Terra blockchain, added another 2,500 bitcoins worth about $ 100.4 million to its reserves on Wednesday.

This means that the Luna Foundation now owns 42,400 bitcoins worth approximately $ 1.704 billion, and only 800 bitcoins less than Tesla’s reserves.

However, the Luna Foundation’s purchases have had repercussions for them. Tera, which previously made $ 200 million in profits from its bitcoin reserves, has now lost nearly $ 100 million due to falling digital currency prices.

However, the Luna Foundation’s wallet is now the 18th largest bitcoin whale, and as Ter co-founder Do Kwon has confirmed, their reserves are set to grow steadily to provide the financial backing needed for the Stable’s growing supply. Hold a USTR coin.