Major threats to the stock market in 1402 / Are the preparations for the growth of the capital market ready? – Tejarat News

According to Tejarat News, the stock market has started an upward trend these days since last year; With the start of the markets in the new year, this trend was followed more strongly so that finally the total stock market index could break the resistance of 1999. Capital market experts often believe that this year is the year of the stock market, and the most important reason is that the stock market lags behind the parallel markets last year. But is it really so?

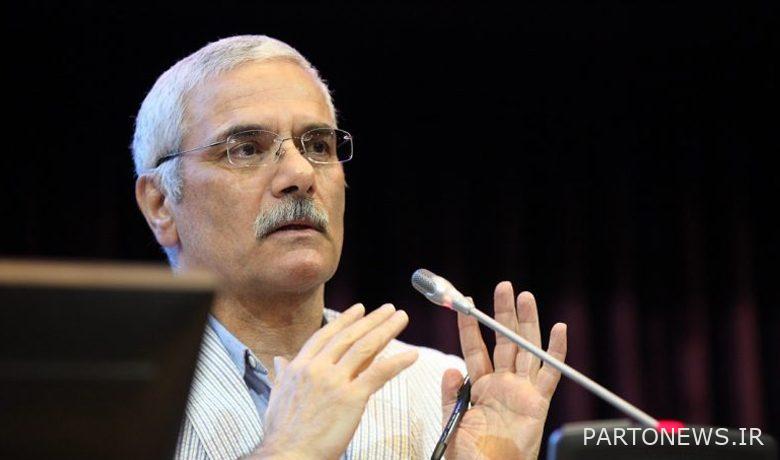

Economist Morteza Imanirad confirms that this year can be considered the year of the stock market, but he also points out two major threats to the market and believes that these threats, which can be identified from a macroeconomic point of view, can increase the optimism of the people of the capital market regarding the steady growth of the market. distort

Achilles heel of the stock market for sustainable growth

Imanirad stated that the three powerful factors of the growth of the dollar price, the increase in inflation and the placement of listed companies below their intrinsic value will push the stock market upwards this year, considering the two threats of the capital market in 1402 and believes that These two threats against these driving factors will affect the stock market and should not be underestimated.

He says: “One of these threats is weak domestic production. In this regard, there is a problem of import, production and investment. The investment problem has been exacerbated especially by international challenges from a social perspective. Therefore, the stock market is threatened from the production area.”

Imanirad adds: “The total production, which is referred to as the gross domestic product, must have a growth rate above 5% in order to have a positive effect on the stock market, which we did not have such a forecast for 1402!”

He states: On the other hand, what is serious is high risks inside the country and high risks at the international level. At the same time, the issue of global economic risk is also discussed, although I do not consider it very strong. But if a crisis occurs in the world economy, it will definitely affect Iran’s oil, budget and economy.

Exchange; The progressive market of 1402

Imanirad continues to emphasize: “Based on the factors that I give weight to, the Iranian stock market is progressing. If you invest 100 Tomans at the beginning of the year, this capital has increased at the end of the year. However, it does matter what your investment portfolio is.”

He adds: “In the meantime, the main point is that if the risks rise and their impact on the economy increases, there is a possibility that the stock market will not grow!”

How does the dollar affect stocks?

Imanirad rejects the hypothesis that the stock market adjusts with the dollar rate. He says that the growth of the dollar price affects all markets, but these markets are affected by the growth of the dollar price with a different time interval. This economist says that the stock market shows the growth effect of the dollar price after gold and coins and before housing.

Imani Rad states: In fact, the stock market has lagged behind the increase in the price of the dollar, so the Iranian stock market has not been able to adjust itself with the increase in the price of the dollar.

Read more reports on the stock news page.