Market performance in April 1402 / stock market volatility during the dollar freezing season – Tejaratnews

According to Tejarat News, financial market experts consider 1402 as the year of the stock market. The dominant view among investors is that the gold and coin markets are saturated and currently do not have the capacity to receive new capital.

Meanwhile, as a result of the improvement of international relations and suppression of demand and supply by the central bank, the dollar market is currently frozen and does not offer a clear perspective to investors.

In this way, small capitals are disappointed with these two markets and have taken their money to other markets depending on their investment views and liquidity.

Surprise the stock market

Among the parallel markets, the stock market has been the main destination for investors in the first month of this year due to its high liquidity, acceptance of liquidity in small and large amounts, the value of companies’ shares after a two-year correction and the growth prospects of companies, and it has been able to perform best in April 1402. to register

The stock market started its work on the 5th of April with transactions worth eight thousand and 732 billion tomans. Although the value of small trades on this day was lower than the small trades of the last day of 1401, but the people of the capital market were optimistically preparing to enter the second trading day of the new year. On the first day of this year, the stock market also witnessed the arrival of 179 billion tomans of real money.

The hope of the people of the market for good days kept this market attractive and created an opportunity to continue the upward path that started last year; In this way, not only the total stock market index was able to cross its historic ceiling in April and break this important resistance after more than 2.5 years, but also the stock market managed to regain the experience of its prosperous days in this month and witnessed small daily transactions. with a value of more than 19 thousand billion tomans.

The analysis of the developments of the stock market in April shows that on most days of the month, the stock market has seen small transactions of over 10 thousand billion tomans and the last working day of the first month of the year has ended with transactions worth 16 thousand 677 billion tomans.

At the same time, the balance of inflow and outflow of real money in this month is generally positive and the stock market has been able to be optimistic about the reconciliation of real investors after a 2.5-year-long anger. The arrival of real money in this month also broke records and reached two thousand and 309 billion tomans in just one day (April 26)! A figure that had previously become a dream for the people of the capital market!

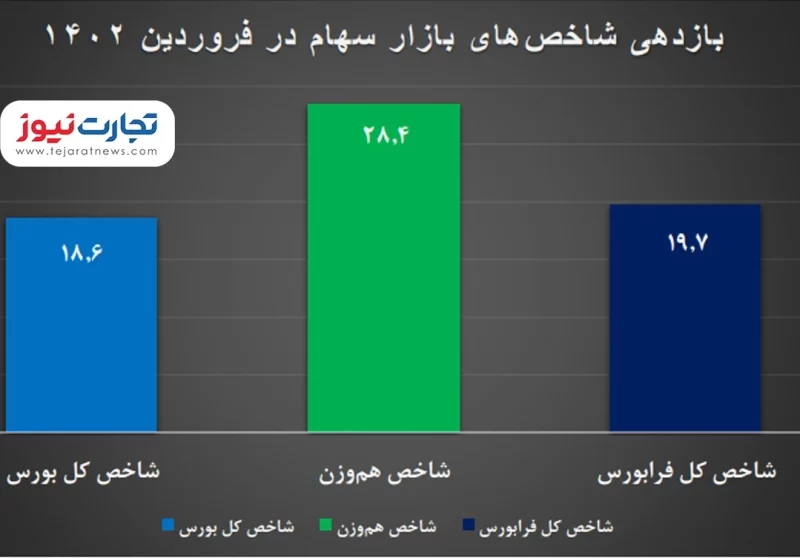

In this way, the stock market ended the first month of the new year while the total stock market index recorded a return of 18.6% and increased from 1,960,000 units at the zero point of the beginning of this year’s trading to a height of 2,324,132 units. It arrived on the last trading day of the month.

The equal weight index experienced new levels and by registering a growth of 28.4%, it reached a height of 760,754,000 units on the last trading day of April, from a level of 592,554 units at the zero point of the year’s trading.

In this month, the overall OTC index rose by 19.7% and reached a level of 29,207 units from the level of 24,394 units.

It should also be noted that in the month of April, among the 694 symbols whose shares were traded, 674 symbols have recorded positive returns in their records! Meanwhile, two symbols have had a zero percent yield and only 18 symbols have experienced backwardation.

Freezing the dollar

The currency market has been in a downward trend since the last days of last year and the price of the dollar had entered the corridor of 40 thousand tomans. However, the unofficial and behind-the-scenes transactions of the dollar during the New Year holiday caused the price of the dollar to open at 51 thousand tomans on the fifth day of April.

The price changes of the holidays had caused some dollarists to be optimistic about the trend of this currency in the future; However, what the dollar experienced until the end of April was only price freezing and wandering between two channels of 50 and 51 thousand tomans!

In this way, the free market dollar experienced a negative return of 0.71% at the end of April and could not appear positive in the competition with other markets.

The inability of gold and coins to continue the upward path

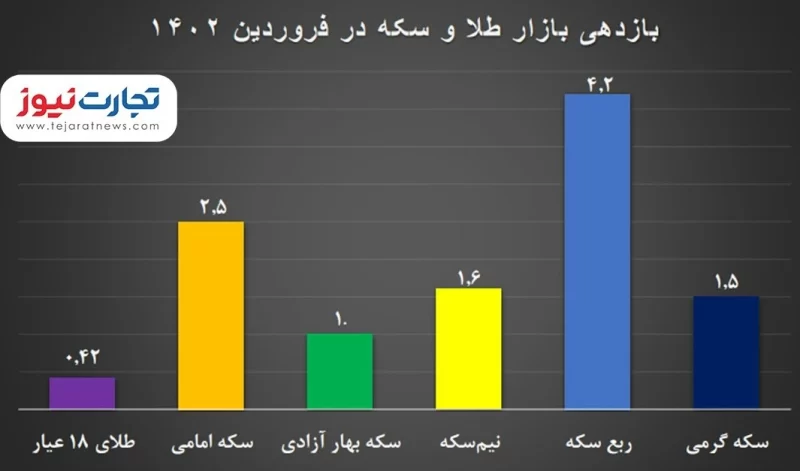

With the freezing of the dollar market, the gold and coin market also went down in April. On the last day of this month, the price of each gram of 18 carat gold reached the level of two million and 605 thousand tomans to record a one-month return of 0.42%.

In this market, Imami coin was able to change the channel; In such a way that from the price of 30 million and 800 thousand tomans (final) on the last day of 1401, it reached the level of 31 million and 586 thousand tomans at the end of April and was able to rise by 2.5%.

The yield of other types of coins was also positive this month, and Bahar Azadi and Nimseke coins recorded a yield of 1 and 1.6 percent, respectively. At the same time, the prices of quarter coins and gram coins increased by 4.2 and 1.5 percent, respectively. In this way, it recorded the best monthly performance in the precious metals market.

Based on this, it can be said that the stock market has been able to surpass its competitors by recording the highest return in April of this year and give the most profit to its investors.

Read more reports on the stock news page.