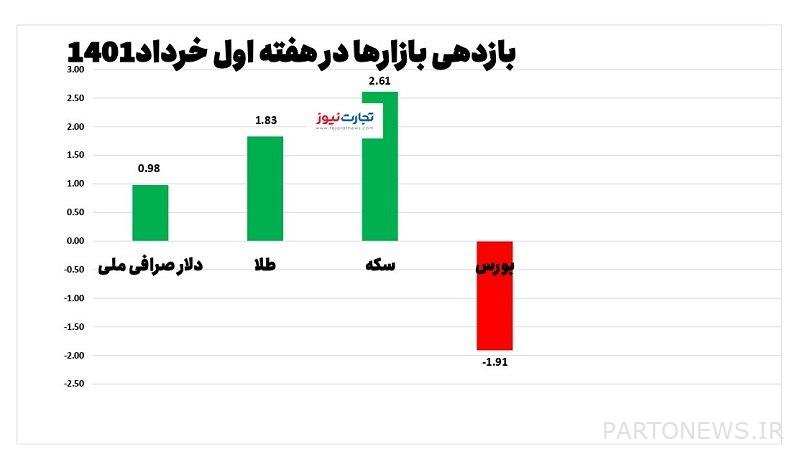

Market returns in the first week of June / 3 markets growth and stock market decline

According to Tejarat News, Market returns in the first week of JuneShows that three markets have grown and one market has fallen.

The price of the dollar

The price of the dollar In the first week of June, it grew by 0.98%. This is the lowest positive return among the financial markets in the last week.

National ExchangeOn Thursday, June 26, 25893, the selling rate of the dollar was announced as Toman. This is while this figure was recorded on Thursday, May 20, 25641 Tomans.

gold price

The return of the gold market in the first week of June 1401 was accompanied by a growth of 1.83 percent.

gold price On Thursday, one million and 386 thousand and 715 Tomans were announced. While the market had reached the price of 1,361,783 tomans on May 19.

Prices for coins

Buyers of the coin market also experienced price growth in the first week of June. During this period, the positive return for the new design coin was 2.61%. This was a higher growth rate among the markets.

Prices for coins The new plan was announced on Thursday, June 26, at 14 million and 520 thousand tomans, but the week before, it had reached 14 million and 150 thousand tomans.

The gold and coin market fluctuated last week. Gold went up to the threshold of entering the channel of one million and 400 thousand tomans, but in the end did not reach this range. The new design coin did not exceed about 14 million and 500 thousand tomans. The old design coin, however, fluctuated between 13 and 14 million tomans in the channel, and finally ended the week with a price of 13 million and 900 thousand tomans.

All three markets of the national exchange dollar, gold and coins were down in the last week of May, but left last week with a positive return.

Exchange

But in another aspect of Market returns in the first week of JuneOverall Index Exchange Fell. The capital market ended the last week at the level of 1,564,487 units.

Meanwhile, the total stock index in the last working day of last week, Wednesday, May 19, had reached about 1,594,977. These figures mean a 1.91 percent drop in the overall index. The stock market was the only financial market that had a negative return last week. While the situation was the opposite the week before; Capital markets grew and other markets fell. Of course, some experts consider the stock market conditions to be normal and its trend to be balanced.

At the same time, Mehdi Sassani, a capital market expert in the stock market’s weekly forecast, said: “The overall index moved a little away from its continuous upward path last week.” This issue will cause us to see fluctuating days with negative and positive emotions in different groups if it can not regain the strength of its trend next week.

But Ehsan Rezapour, another stock market expert, said: “The purchases made in the second half of last week and the arrival of companies’ stocks to support points, can promise better days than last week. The market may be able to have better days. The closer we get to the end of June, the more we can expect from the market to strengthen and improve the existing conditions (Shahrbourse).

Different signals for markets

According to Tejarat News, financial markets have been affected recently Vienna talks Were located.

Nuclear talks stalled in the last month of last year. Both sides emphasize that much of the agreement has been reached, but a few key issues remain. Until recently, various officials in the negotiating countries believed that an agreement was available. But now some officials, especially in the United States, have raised doubts. Also, the news about the seizure of the Greek oil tanker by Iran could affect the markets this week.

But important news affects Market returns in the first week of June What were they?

Mali: The chances of reaching an agreement with Iran are slim

“Efforts to revive the 2015 agreement have run into trouble, but a proposal for a” limited “reduction in sanctions to Tehran could still save the deal,” US Special Representative for Iran Robert Mali told a Senate Foreign Relations Committee meeting on Wednesday. Pave the way for a broader agreement.

He added that more than a year had passed since the talks in Vienna, which seemed to have lost momentum. Time is running out. We have no agreement with Iran and the prospect of achieving it at best is weak (IRNA).

Amir Abdullahian: The United States should make a realistic decision

On the other hand, Foreign Minister Hossein Amir-Abdollahian said about the financial remarks: “Like the US Secretary of State and Robert Mali, I am facing a lot of pressure in front of the parliament of my country.” They are a strong spectrum within the two countries that, for their own reasons, oppose returning to the UN Security Council.

He added: “Of course we receive messages from Robert Mali and US officials to the highest level of Mr Biden that are somewhat different from their media positions.

Amir Abdullahian stated: “Since the beginning of the new round of talks, Iran has put several initiatives on the table to return the parties to the UN Security Council and their commitments.” We recently put another new initiative on the table. But we feel that Mr. Biden is indecisive.

“I hope the American side is realistic,” he said. The most important thing for us is that we should enjoy the economic interests of Borjam in the return of all parties (فارس).

Is the nuclear deal over?

Meanwhile, Republican Sen. Lindsey Graham said the nuclear deal with Iran was over. We must explain the consequences of Iran’s nuclear activities for Tehran.

But IRNA He denied the news, citing informed Iranian and non-Iranian sources involved in the talks.

An informed Iranian source said: “Talks are still underway to reach an agreement.” Any early judgment is either crude or biased and reflects the inner desires of some commentators.

Greek oil tanker seized by IRGC

Another piece of news that could affect the efficiency of the markets is the reciprocal action of Greece and Iran to seize each other’s tankers. Yesterday, following the seizure of an Iranian tanker by the Greek government and the delivery of its oil to the United States, Iran decided to take punitive action against this country.

In this regard, the IRGC navy confiscated two Greek tankers due to violations in the azure waters of the Persian Gulf (October).

After the seizure of two Greek tankers by Iran, the world price of Brent oil fluctuated by 1.57% to $ 2.2 per barrel (immediate economy).

These cases or on Market returns in the first week of June Were influential or likely to influence this week. Experts also consider the upward trend of inflation expectations due to the increase in subsidies and the news of the high prices of basic goods to be effective in this regard.

The latest news of market developments on the page Markets reportRead Business News.