Market situation: Bitcoin falls below $ 54,000 after the discovery of a new strain of the Corona virus

The price of bitcoin fell by about 9% after the news of the discovery of a new strain of the corona virus was published. However, as can be seen from the market data on Bitcoin options and futures contracts, professional traders still expect the price to rise by the end of 2021.

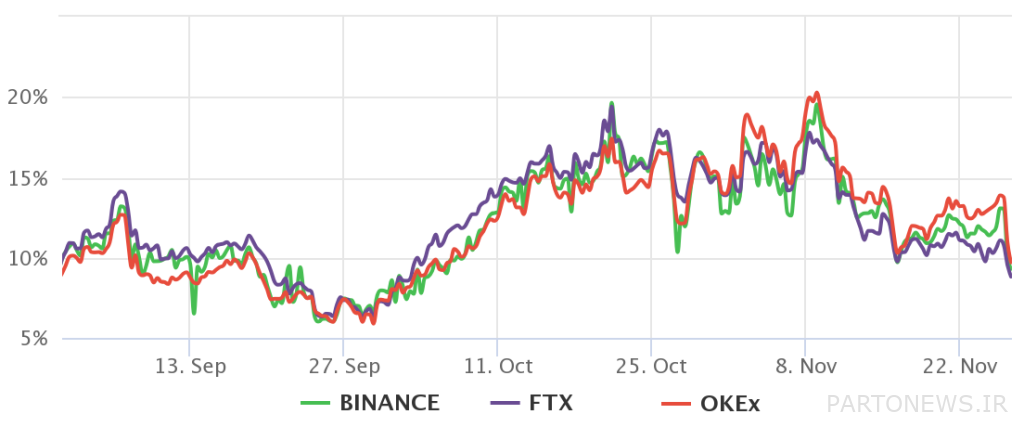

to the Report Kevin Telegraph, Deribit digital currency exchange, one of the most popular markets for bitcoin trading, tweeted last Wednesday, citing traders ‘25% skew index, saying traders’ feelings The profession is declining.

The 25% skew delta index is used to compare trading options. It should be noted that the negative skewness is a sign for the rising market and its positive is a sign for the market to decline.

Dribbit tweeted:

As we have seen, we are getting closer [موقعیتهای معاملاتی اختیار] By the end of November (November), the Delta skew has risen 25 percent from about zero to close to 10 to 15 percent, indicating a decline in market sentiment. The cost of premium downtrends (sales) increases and the maximum expiration level of option contracts is $ 58,000.

Also read: What is an Option Contract?

The price of bitcoin has been fluctuating in a bearish channel since November 9 (November 18), and this could reflect the 22% drop in the price from the historic high of $ 69,000.

As mentioned, the Delta Sloping Index compares 25% of buy and sell options. This index becomes positive when the premium of option contracts is higher than the option contracts with similar risk. That is why the positive of this index indicates a downward trend.

On the other hand, when traders have bullish sentiment, the opposite is true, which is why the Delta skew index enters the negative area at 25%.

Positioning this index between negative 8% to positive 8% is usually considered neutral. Therefore, considering the fact that the slope of the index has changed significantly since November 23 (December 23), it can be said that the analysis of Dribbit exchange was also correct. Yesterday, however, the slope of the index became lighter and reached the level of 8%; A level that can no longer be considered as a sign that traders’ emotions are declining.

What is happening in the future markets?

To answer the question of whether the downward movement of prices in recent days has been limited to the option market or not, we must also look at futures markets.

The futures premium, known as the “base rate”, is a measure of the price difference between long-term futures and the price in the current market. Under natural conditions or Contango, the annual premium is between 5 and 15%.

This price difference is due to the demand for more money from sellers to maintain the position of futures contracts longer. When the index falls or enters a negative range, it is said that the market has “inverted”.

Contrary to the 25% delta index in the option market, which has entered the fear zone, the premium index, which is one of the main criteria for measuring risk in the futures market, is close to a fixed 11% level between November 16 and 25 (November 25 to December 25). have been. Despite the limited decline of this index, being at the level of 9% is completely normal for the market and is not even close to the downtrend.

Traders are more likely to use option contracts

Bitcoin option traders pay too much for sell options, and there can only be one reason for this. Perhaps the reason for this group of fears is one of the US Senate committees on suppliers of stable coins.

On the same day that the news broke, the Federal Reserve Board of Governors announced that it was working on a set of “comprehensive legal policies” to improve the transparency of legislation in the digital currency industry. The executive is likely to be responsible for complying with the rules and enforcing these standards on the new regulations.

However, it is not possible to explain why this feeling of insecurity has not affected the bitcoin futures market. So the other question that arises is whether the Delta skewness index of 25% should be ignored in this case?

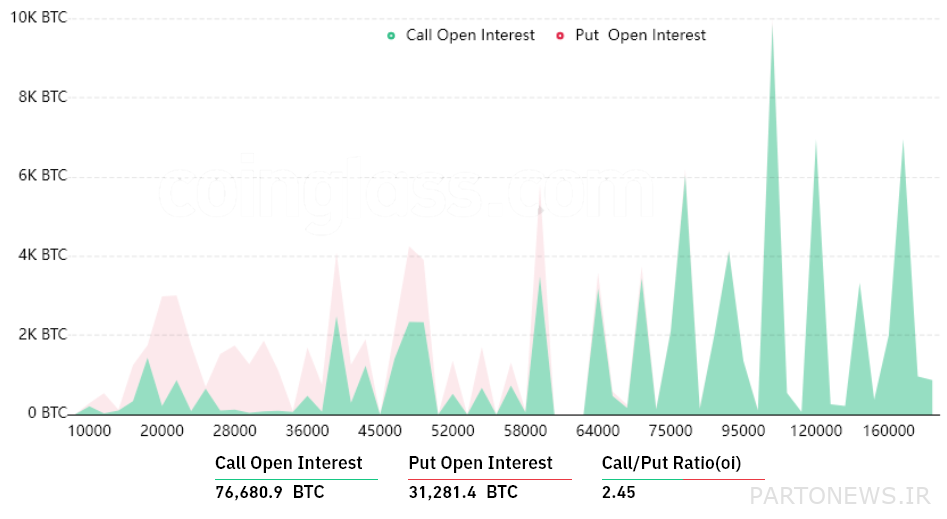

Sixty percent of all Bitcoin open-ended contracts expire on December 31, the end of the year, for a total of $ 13.4 billion. As can be seen in the chart above, there is virtually no option sale above $ 60,000.

Given that the volume of options contracts is 145 percent larger than options contracts as of December 31 (December 10), one should not worry too much about the pricing of traders in the market of options contracts. Therefore, although the Delta skew index is down 25% overall, they are not very important for the market at the moment.