Market situation: How long will the price of Bitcoin remain stable?

Many analysts believe that if Bitcoin can overcome the resistance of $ 40,000, the conditions will be created for reducing the sales pressure and further price jumps; But why is this level so important for changing market trends in the short term?

To Report Kevin Desk, the digital currency market has been entering a price stabilization phase for some time after the sharp fall in January. Many analysts expect the price of digital currencies to recover somewhat this month; Especially considering that over the past few weeks, some altcoins have performed better than bitcoins.

The bitcoin market has been almost volatile for the past 24 hours. Atrium has experienced similar conditions and the price of Solana has increased by 3.5%. The market for the Decentraland and The SandBox tokens also declined after Monday’s jump, with both tokens falling nearly 5 percent over the past 24 hours.

Yesterday, Indian Finance Minister Nirmala Sitharaman announced for the first time that the government intends to levy a 30% tax on digital currency transaction revenues. “India is finally on the path to legalizing digital currencies,” said Nischal Shetty, CEO of WazirX, one of India’s largest digital currency markets. Of course, this news did not have a significant impact on the market situation.

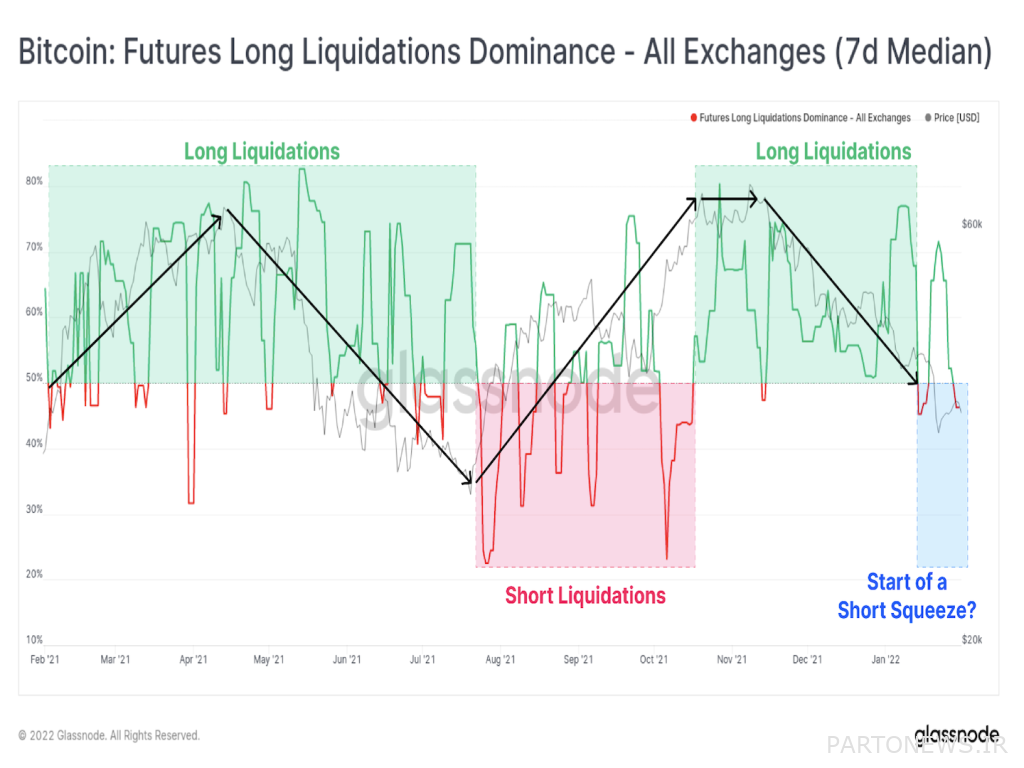

Analysts expect the psychological pressures of digital currency legislation to ease in the short term; An event that can reinforce the feelings of traders. For example, the digital currency market fear and greed index is slowly rising above the “extreme fear” level, which could be a sign of traders’ uptrend. In the Bitcoin futures market, there are also signs of short sale squeeze. Borrowing sell-offs occur when short (traded) traders are forced to exit their trading positions due to a sudden rise in market prices.

At present, some buyers continue to buy with lower prices on the floor. Microstrate software company, which regularly accumulates bitcoins, announced yesterday that it had purchased 660 new bitcoins worth $ 25 million between December 30 and January 31.

Technical indicators indicate that the potential jump in the price of bitcoin between $ 40,000 and $ 45,000 will be stopped; Because the current price acceleration does not seem to be enough to form a long-term move.

Improve the feelings of traders

The digital currency fear and greed index came out of the extreme fear area last week, which shows that the downside sentiment is waning. This index has now reached the levels of July 2020 (July 99); When the process of recovering the digital currency market had not yet begun.

The Arcane Research Institute wrote in its report yesterday:

On Sunday this week, the fear and greed index reached 30% in a short period of time, which is the highest level since the beginning of 2022.

There are some analysts who prefer to wait for trading volume to confirm the change in traders’ feelings from bearish to bullish.

Arkan Research has said:

The bitcoin market is currently struggling with $ 40,000 resistance and is trying to overcome this level. May [با عبور قیمت از این سطح] Witness a sharp increase in trading volume; Just like when Bitcoin fell below $ 40,000. Until then, there will be no noticeable trading activity; This is because momentum traders (those who trade depending on price fluctuations) wait for specific price movements after entering trading positions.

Investigate the possibility of short-term price jumps

In order for significant volumes to be liquidated from short trading positions, Bitcoin must cross the $ 40,000 resistance. As can be seen from the chart below, the volume of liquidated long (buy or bullish) trading positions has recently decreased; This usually happens before the price jumps and as a result of the widespread liquidation of short positions or the formation of debt sales pressure.

Liquidation occurs when a money changer completely closes the trader’s leveraged trading position to prevent the initial amount owed to the trader from being burned. In fact, trading platforms do not allow a trader’s account balance to reach less than his debt. This happens primarily in futures markets.

The Glassnode analytics platform also wrote in its new report:

Given the negative sentiment of traders, the high use of trading leverage and the predominance of short trading positions, the formation of short-term borrowing sales pressure against the current market direction seems logical.