Market situation: increasing sales of Bitcoin miners and analysts’ disappointment with the rapid return of prices

While we have seen a partial and temporary recovery in cryptocurrency prices over the past few days, analysts say it is too early to expect a market recovery. Meanwhile, Bitcoin miners have been selling their capital during this time and some of them are struggling with serious financial problems.

To Report CoinDesk, on Tuesday Bitcoin, Ethereum and many digital currencies, after falling until around 18:00 (Tehran time), recovered their prices by the end of the night. However, yesterday’s Bitcoin candle closed again in the red (bearish) color.

Bitcoin is currently hovering very close to the $20,000 level and has lost about 1.5% of its value overnight. Over the past month, the digital currency has been struggling to maintain the important support of $20,000, and with a 60% fall in the second quarter of 2022, it has experienced its worst quarterly performance since 2011.

Many altcoins, such as Ethereum, experienced a surge in the closing hours of the previous day and entered a new downtrend at the start of today. The fear and greed index of digital currencies also reached 19 with a jump of 5 points on Tuesday. Although this number still indicates a feeling of “extreme fear” among traders, it is the highest level of the fear and greed index since May 7 (May 17 – before the collapse of the Terra network).

Alex Kuptsikevich, senior analyst at FxPro, attributed the slight jump in cryptocurrency prices these days to retail investors “buying at the bottoms” and says it’s too early to expect a market recovery. .

Koptsikevich said:

At this juncture, with only a few very weak attempts to raise prices, it is too early to talk about a breakout and the end of the downtrend.

The origin of these pessimism about the future of the market is the recent crises of the digital currency industry, including the collapse of the Terra network, the suspension of withdrawals on the Celsius lending platform and the announcement of the bankruptcy of the digital currency investment institution Three Arrows Capital. Now a part of the market is waiting to see what will happen to Bitcoin miners; Those who have sold a significant part of their capital in recent weeks after a long time, and some of them may continue to have problems in paying their loans.

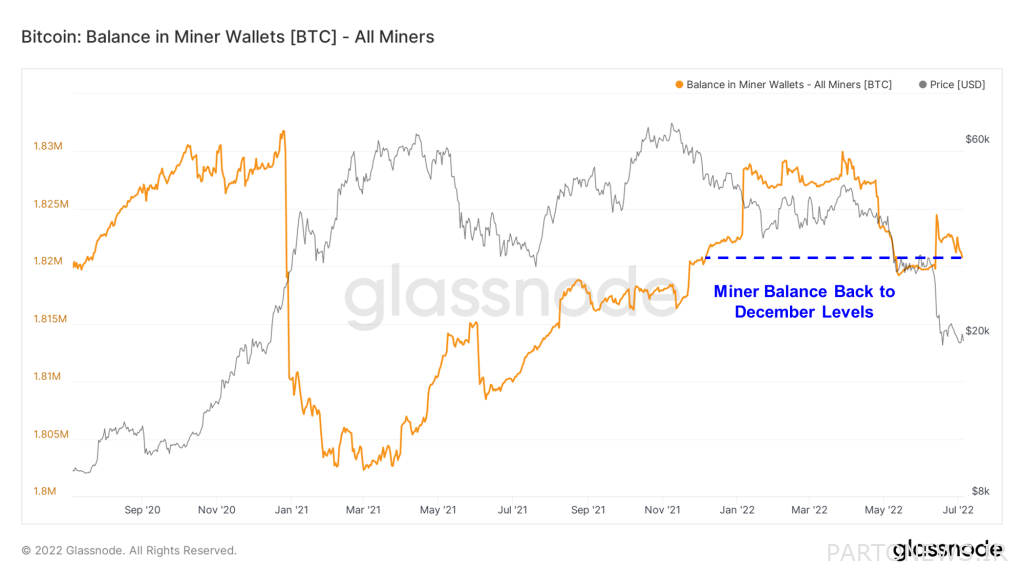

According to data from the Glassnode analytics platform, the inventory of Bitcoin miners has now returned to the levels of December 2021 (Azer 1400). Core Scientific, an IT company, revealed yesterday that it sold 7,000 units of its Bitcoin stock in June in order to manage its expenses and investments. slow These 7,000 bitcoins were sold at an average price of $23,000, bringing in about $167 million to the Cor Scientific collection.

It should be mentioned that many countries around the world may soon put more regulatory pressure on the digital currency mining industry.