Market situation: The price of Bitcoin and Altcoins is likely to jump next week

Concerns about rising inflation and declining economic growth have attracted more investors to the digital currency market. Experts believe that traders’ feelings are generally positive and there is a possibility that the price of bitcoins and coins will jump in the coming days.

to the Report Last week, the digital currency market, Coin Desk, saw record-breaking prices for Atrium and some of its coins, and Bitcoin trading volume continued to decline during this period. Bitcoin prices have fallen 2 percent over the past seven days, while Atrium and Solana have risen 1.5 and 17 percent, respectively.

Alex Kuptsikevich, an analyst at FxPro, said:

Market traders move from one currency to another and seek to take advantage of small fluctuations. If flowing [بازار] It is changing, it is like a game with a positive outcome; This means that the total market value of digital currencies is increasing.

Some analysts expect bitcoin to grow like a penny in the next seven days; An event that could push the price of this digital currency to $ 64,000.

Will Morris, an expert with the British company GlobalBlock, says:

Historical data show that there is a positive correlation, albeit with some delay, between the traditional financial markets and the digital currency market, which could help prices rise in November.

Digital currency traders are waiting for the release of the third quarter earnings report of Kevin Base Exchange, which is scheduled to be released on Tuesday this week. The exchange’s revenue in the second quarter of this year was negative due to the decrease in trading volume. The exchange value of the exchange has increased by 40% in the last 30 days, while the prices of Bitcoin and Atrium have increased by 10% and 25%, respectively.

Bitcoin correlation with the stock market

The correlation between Bitcoin performance and the S & P500 index has also increased over the past month, indicating that investors are still more willing to take risks. On the other hand, the demand for treasury bonds (government bonds), which is known as a safe investment, has been reduced due to growing concerns about rising inflation and declining economic growth.

The chart below shows that the correlation between the bitcoin market and long-term treasury bonds is declining. A similar thing happened in 2019; When the downturn in the digital currency market stabilized and the monetary policy of the US government was effective. This ultimately benefited digital currencies, stocks and other assets in which investing is considered risky.

Investors now seem to be moving away from long-term assets, as these forms of assets are more sensitive to slowing economic growth and, consequently, higher interest rates. Under such circumstances, the correlation between bitcoin, stocks and long-term treasury bonds increases as investors’ risk appetite decreases.

In addition, in times of crisis, such as the Corona epidemic in 2020, the correlation between Bitcoin performance and the S & P500 index could grow significantly.

Positive capitalization rates and upward sentiment of traders

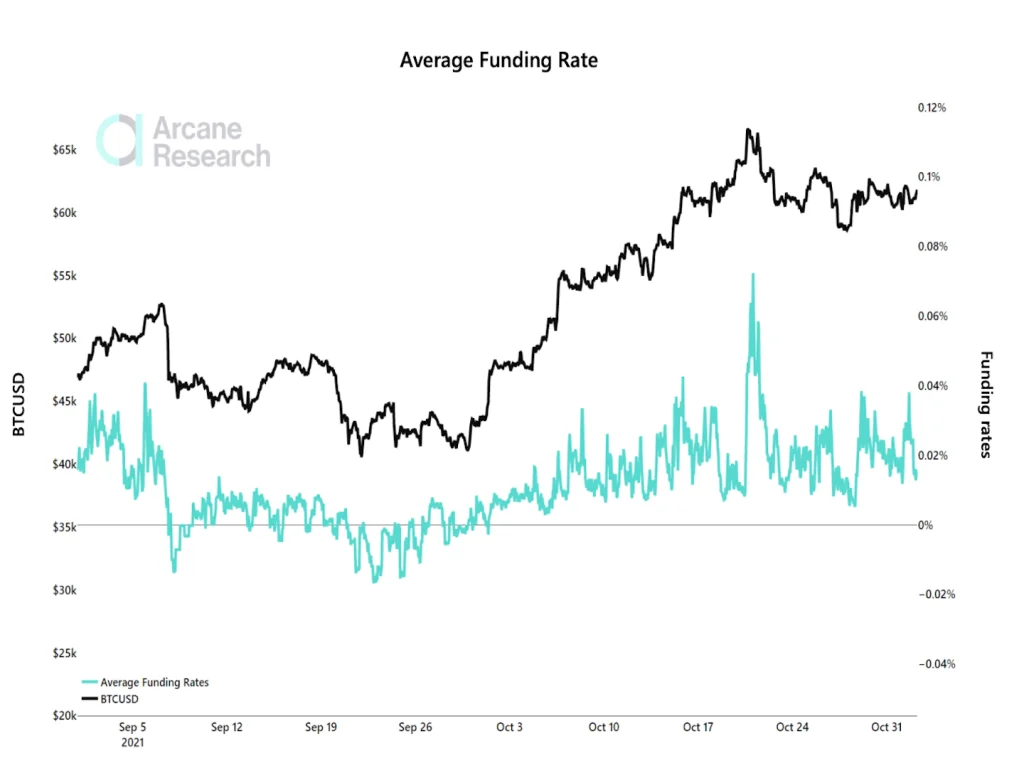

The average bitcoin exchange rate, or the cost of holding long trades in the futures market, has been somewhat positive over the past seven days, reflecting traders’ bullish sentiment.

Arcane Research wrote in a recent report:

Remaining in the positive area indicates that market demand for long trading positions is high, but the relatively small volume of liquidated long positions means that traders compared to the bullish spring market. [سال جاری] They are less reluctant to use trading levers.

Arkan Research experts say that the decline of the digital currency market could be associated with the risk of increasing volatility.

The collapse of Argo Blockchain shares and Solana’s investment in Chinese blockchain games

Shares of the digital currency mining company fell 5 percent on Friday after Argo Blockchain announced that some of its employees had inadvertently leaked some of the company’s confidential information. The leaks included information about a possible increase in the company’s hash rate or processing power and an estimate of the cost of building a new complex in Texas. China’s Argo Block traded on the Nasdaq in September, and the company has risen about 3 percent since then.

Digital exchange offices FTX, software company Lightspeed and Solana Ventures are set to invest $ 100 million in a third-generation web development project for video games. The $ 100 million budget is to be spent on developing new projects, helping Solana collaborate with current games, building an economic system for games based on NFTs, and making Solana wallet payments. Solana, Efteix and LightSpeed have made their first investment with $ 21 million in funding for Faraway Studios.